Altcoins

6 Altcoins to Buy, Turning Ordinary Investors Into Crypto Millionaires After BTC Halving

The altcoin market suffered greatly following the Bitcoin halving, which was largely a failure unlike previous cycles. However, if investors look closely, they can identify unique altcoins to buy that have the potential to help ordinary investors reach millionaire status by the end of 2024.

Bitcoin’s retracement from the weekly high of $67,000 leaves many cryptocurrencies vulnerable. To make the most of these declines, investors should focus on adopting the best dollar-cost averaging strategies. This involves buying when prices fall to increase exposure at different levels. Average purchase cost guarantees maximum profits without spending too much money.

While Bitcoin achieved a commendable 132% increase in value last year, gold only managed an average return of 7.98%, compared to 10.7% for US stocks, 8.01% for commodities raw materials and 6.39% for emerging stocks. Statist market data.

Annual returns of gold and other assets | Statist

Building an Altcoin Purchasing Portfolio Based on the Bitcoin Halving

Most cryptocurrency investors are looking to the consequences of Bitcoin halved in less than two weeks. The halving process is important to minimize inflation by reducing the rewards miners receive for processing blocks.

After the April halving, miner rewards will be halved from 6.25 BTC to 3.125. This will gradually reduce the circulating supply of Bitcoin and, if demand remains stable or increases, investors expect the price to rise significantly.

Based on previous bull markets, the price of Bitcoin triggered a major rise in its price and altcoin prices to buy across the board a few months after the halving.

Although the price increase is affected by many factors, including the regulatory environment, a well-diversified portfolio including Bitcoin and a selection of altcoins to buy could potentially push ordinary investors towards the million dollar club of here the end of the year.

1.XRP

XRP observed a notable decrease in its price action, falling below the critical threshold of $0.6 amid a prevailing bearish backdrop. THE XRP Price is trading at $0.5867, reflecting a 2.36% decline over the past day. Despite a slight market adjustment, investor sentiment towards XRP remains cautious.

The digital asset’s valuation is now around $32 billion, affirming its rank as the 7th largest cryptocurrency, according to CoinMarketCap data. A significant increase in trading volume was seen, with an increase of over 37% in the last 24 hours, totaling $2.18 billion. This surge highlights increased investor interest in XRP.

XRP Price Chart

The impending pre-trial conference between Ripple and the SEC in April could significantly influence future regulation of cryptocurrencies. The SEC is seeking a substantial fine from Ripple Labs for the alleged sale of unregistered securities. Both sides have engaged in settlement discussions and requested deadline extensions.

XRP has shown notable resilience, consistently staying above the pivotal $0.58 mark. If a positive trend reappears, XRP could potentially break above the previous resistance level of $0.65. With an increase in bullish momentum, it could cross the $0.9 barrier and reach $1 in a short period.

2. Dogecoin (DOGE)

Amid the recent market downturn, Dogecoin saw significant selling pressure at $0.22, leading to a 20% price drop to now trade at $0.18. On the 4-hour chart, this spike formed a double top pattern, intensifying the bearish sentiment among traders. With the Bitcoin Ahead of the ongoing halving correction, there is speculation whether this trend will prolong the downward movement of altcoins.

Unlike other major cryptocurrencies, Dogecoin, the popular dog-themed meme coin, displayed an aggressive uptrend in March. The asset saw a notable inflow during the fourth week of the month, which propelled its value from $0.122 to $0.228 to record a growth of 86.8%.

3. Dog Hat (WIF)

Over the past day, cryptocurrency what price for my dog experienced a significant decline in value, falling 11.60% to $3.85. The digital currency’s market capitalization now stands at around $3.85 billion, ranking it 30th among its peers. Despite the slowdown, 24-hour trading volume saw a sharp increase of 32.45%, signaling increased investor attention.

Dogwifhat Price Prediction Chart | Commercial view

Dogwifhat appears to be gearing up for a major breakout. After consistently trading above the $4 mark with a bullish posture, it reached an all-time high on March 31, 2024, climbing over 194% during the month. However, WIF has since fallen below $4, indicating a consolidation phase as it looks to establish new support levels.

4. Shiba Inu (SHIB)

Shiba Inu (SHIB) is originally a meme token, often considered a competitor to Dogecoin. It has become a decentralized ecosystem with its decentralized exchange, ShibaSwap, and plans to expand into NFTs and game development.

Amid the recent market consolidation, SHIB price recovery has seen a notable slowdown from the $0.0000328 resistance in late March. The bearish reversal caused the coin’s value to drop by 21.5% over the past six days.

As of press time, Shiba Inu’s market cap stands at $15.29 billion, while trading volume is around $15.92 as of yesterday. According to recent data from Shibburn, the meme coin saw a dramatic increase in its burn rate, climbing to 2307.19% in the last 24 hours. During this period, a massive total of 110,384,799 SHIB tokens were removed from circulation.

However, if supply pressure in broader markets persists, the Shiba Inu Price will retest the 61.8% FIB level at $0.00002368.

5. Solana (SOL)

Solana (SOL), a cutting-edge open source initiative, leverages the permissionless nature of blockchain technology to deliver decentralized finance (DeFi) solutions. The Solana protocol is ingeniously designed to support the development of decentralized applications (DApps), aiming for improved scalability through a unique Proof of History (PoH) consensus, which works in tandem with Proof of Stake (PoS) inherent to the blockchain. consensus mechanism.

Solana Price Chart

SOL Coin’s value has seen an extraordinary rise, indicating strong market performance with an increase of over 500% since October, signaling a bullish trend. Despite a slight drop of 8% in the last 24 hours, which saw Solana Price Adjusting to $189, the outlook for the altcoin remains optimistic, with expectations of continued bullish momentum, albeit with potential minor retracements.

6. Cardano (ADA)

Cardano (ADA) is a third-generation cryptocurrency distinguished by a research-driven design and development approach. The project aims to address scalability, interoperability, and sustainability issues faced by legacy blockchain platforms.

THE Cardano Price entered the current correction trend in mid-March as the price moved back from the psychological resistance of $0.8. In three weeks, the altcoin has lost 22.4% of its value from the current trade at $0.628.

ADA Price Chart

With a market capitalization of $22.4 billion, Cardano coin maintains its position as the 9th largest cryptocurrency. Today’s price drop is supported by $502 billion in trading volume, up 48% since yesterday. If the downward momentum persists, the ADA Price is likely to challenge support at $0.57.

However, the confluence of technical levels at this support could prompt buyers into a further recovery trend targeting a high of $0.678 and $0.8.

Conclusion

Top altcoins to buy, including unprecedented returns of over $1 million by the end of 2024. Ahead of the halving in 2024, DCA strategies will ensure that investors get the inflows while maximizing long-term profits.

Related Articles

Altcoins

On-chain data confirms whales are preparing for altcoin surge with increased buy orders

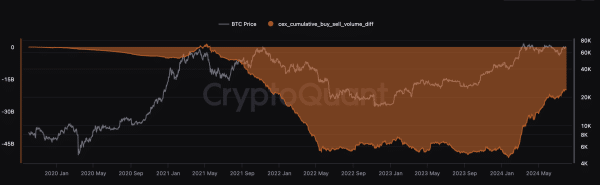

Ki Young Ju, CEO of analytics platform CryptoQuant, believes whales are preparing for an upcoming surge in altcoins.

In a recent revelation about X, Ju underlines that the volume of limit buy orders for altcoins, excluding Bitcoin and Ethereum, is increasing. This pattern suggests the formation of substantial buy walls, highlighting significant buying pressure from large-scale investors.

Ju’s chart identifies two main phases in limit order volume for altcoins: the limit sell phase and the limit buy phase. The limit sell phase saw a notable increase in cumulative sell orders in 2022, demonstrating strong selling pressure from whales and other market participants. This phase coincided with a period of falling altcoin prices due to unfavorable market conditions.

Then, the limit buying phase began, marked by a significant increase in cumulative buy orders. This indicates a period of strategic accumulation where whales establish substantial buy walls.

According to Ju, the increase in buying volume suggests confidence in the future conditions of the altcoin market. This buying pressure creates strong support levels, indicating that whales are preparing for a positive change in the market.

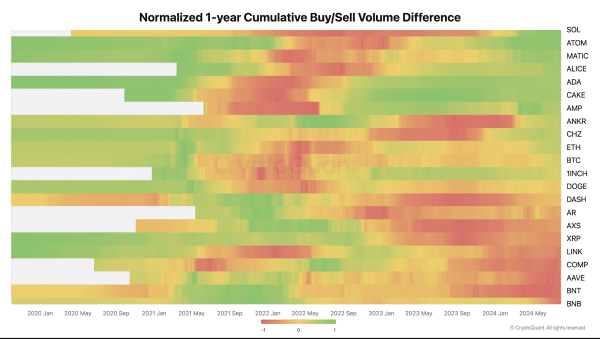

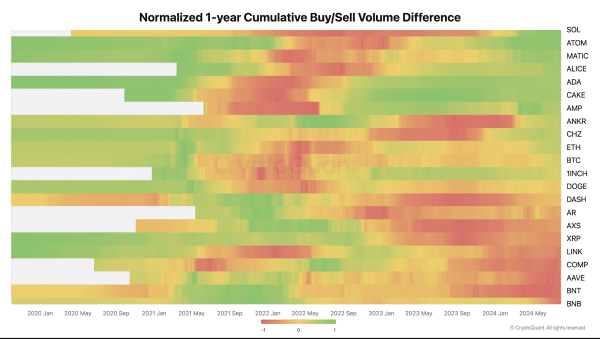

Buying pressure on specific altcoins

Ju also provided a heatmap of the 1-year normalized cumulative buy/sell volume difference for various altcoins, showing the buying and selling pressure over time. Solana (SOL) has seen alternating strong buying and selling phases, with recent activity showing increased buying interest. Cosmos (ATOM) and Polygon (MATIC) have also shown increased buying pressure despite mixed activity trends.

Cardano (ADA) and PancakeSwap (CAKE) have shown balanced buying and selling phases, with recent trends proving increased buying pressure. Coins like AMP and ANKR have also demonstrated increased buying activity. The heatmap reveals that most altcoins are seeing increased buying pressure as whales and large investors accumulate altcoins in anticipation of a rally.

Meanwhile, coins experiencing selling pressure, as indicated by the predominantly red areas on the heatmap, include DOGE, DASH, AXS, XRP, COMP, and AAVE, BNT.

Bitcoin whales are also buying

It is important to note that while whales are accumulating altcoins, Bitcoin whales are also active. Crypto Basic note an increase in buyer activity on Binance, which aligns with an increase in the buy/sell ratio of takers and whale movements. Analyst Ali Martinez highlighted the ratio fluctuations from below 0.8 to above 1.7 between July 27 and 31. Ratios above 1.0 indicate aggressive buying, often preceding price rallies.

From July 27 to July 28, the ratio remained mostly above 1.0, corresponding to the rise in Bitcoin price from around $66,500 to over $67,000. A spike to around 1.5 led to a sharp increase in price to around $68,500. However, on July 30 and 31, the ratio fell below 1.0 several times, corresponding to a drop in price to around $66,000, before a final spike to 1.7 indicated another slight increase in price.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinion of The Crypto Basic. Readers are encouraged to conduct thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Advertisement-

Altcoins

How to buy a car with cryptocurrency

The automotive and cryptocurrency industries have been merging for the past few years. As digital currencies become more prevalent in everyday activities, it is increasingly likely that they will be integrated into everyday transactions, such as when buying a car. The article unpacks the dynamic relationship between cryptocurrency and car buying today, explaining how digital currencies can be used to buy a vehicle today. It includes elements such as some of the benefits and challenges of buying a car using cryptocurrency and what lies ahead in the future.

Understanding Cryptocurrency Payments in the Automotive Industry

Cryptocurrency is not just a digital asset; it represents a revolutionary approach to decentralized financial transactions. The automotive industry, known for its adaptability, has begun to accept cryptocurrencies as a legitimate form of payment in various markets. For example, luxury car dealerships and online platforms offering car auctions in new york increasingly allow buyers to purchase cars using cryptocurrencies.

There are several factors that determine how much cryptocurrency you need to buy a car. Among them, the most influential will be the current value of the cryptocurrency you want to use at that moment. Unlike traditional currencies, cryptocurrencies can be very volatile. Their value can change drastically in an instant, which affects the amount needed at the time of purchase.

Benefits of Buying Cars with Cryptocurrency

Buying cars with cryptocurrencies offers several advantages:

– Reduced transaction fees: Cryptocurrencies can reduce the fees involved in large financial transactions typical of car purchases.

– Enhanced Privacy: Buyers who value their privacy can benefit from anonymity through blockchain-based transactions.

– Speed and convenience: transactions are faster than those carried out by banks, especially when the operation has an international scope.

Challenges and considerations

Although the benefits are compelling, several challenges must be considered:

– Volatility: At one moment, the price of any cryptocurrency can collapse, or the next minute it can skyrocket, and the price needed to buy a car can double or triple from one day to the next.

– Limited acceptance: Not all dealers accept cryptocurrency, which in turn may limit its use for making purchases.

– Tax implications: This may create different tax implications on purchases via cryptocurrency, depending on your jurisdiction.

Practical steps to buy a car with cryptocurrency

If you want to use cryptocurrency to buy a car, follow these steps:

- Ensure Acceptance: Check if the dealer or auction accepts the use of cryptocurrency.

- Check the conversion rate: You need to know how much your cryptocurrency is currently trading at compared to the price of the car in fiat currency.

- Secure your funds Make sure your digital wallet is secure and funded.

- Know the terms: Be informed and be clear about return policies as well as any additional fees incurred.

- Complete the transaction: Continue the payment via the digital wallet.

Future prospects

There is a good chance that many car dealerships will start accepting digital currencies, especially when blockchain technology pushes the boundaries and cryptocurrencies become stable. This trend is expected to be propelled forward due to the increasing demand for transparency, security, and efficiency in transactions.

Conclusion

The potential for cryptocurrencies to have a real impact on the car buying process is enormous. Of course, there are a few issues that emerge when considering the current market, including volatility and limited acceptance. However, the benefits of using digital currency to execute such transactions can easily outweigh the drawbacks for many buyers. As both sectors continue to grow, buying cars with cryptocurrencies shows a promising future and therefore creates a more connected and developed technological automotive market.

This means that buying a car, whether in cryptocurrency or in another form, is not just about following technological trends; it is rather about enjoying greater freedom and efficiency in financial transactions. Indeed, the closer the digital and automotive worlds become, the more buyers should expect simpler, much safer and also very innovative ways of purchasing.

Disclaimer: This press release article is provided by the client. The client is solely responsible for the content, quality, accuracy, products, advertising or other materials on this page. Readers should conduct their own research before taking any action related to the material available on this page. Crypto Basic is not responsible for the accuracy of the information or for any damage or loss caused or alleged to be caused by the use of or reliance on any content, goods or services mentioned in this press release article.

Please note that The Crypto Basic does not endorse or support any content or products on this page. We strongly advise readers to conduct their own research before acting on the information presented here and to take full responsibility for their decisions. This article should not be considered investment advice.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinion of The Crypto Basic. Readers are encouraged to conduct thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Advertisement-

Altcoins

Introducing Bit-Chess. The World’s First Fully Decentralized Chess Platform

Bit-Chess announces the pre-sale of the world’s first fully decentralized chess platform, combining the classic strategy game with the innovative world of cryptocurrencies. This platform will change the way millions of people interact with chess online, providing a digital space where players can enjoy their favorite game, compete in global tournaments, and earn rewards through play-to-win mechanics.

Bit-Chess is an entry point for both experienced players and newcomers to the crypto space. It provides tools and guides to help even inexperienced users get started with cryptocurrencies by creating in-game wallets upon first login. It is the first chess game to use Web3 technology, and all participants can earn money while playing.

During the presale, 500 of the 2,000 special NFTs will be available, with the rest distributed through tournaments and auctions. Unless NFT holders agree otherwise, the team will manage 1,500 NFTs, preserving their rarity with a cap of 2,000 pieces. More information about the NFT marketplace will be released after the token’s official launch.

The platform aims to become the world’s leading online chess center, offering:

Play to win features.

Global tournaments with cash or NFT prizes.

Player versus player challenges

Special NFTs and more

Bit-Chess invites players from all over the world to join its unique ecosystem, where playing chess is more than just entertainment: it’s an opportunity to earn and learn in the world of crypto.

For more information and to participate in the presale, Visit the Bit-Chess website.

Disclaimer: This press release article is provided by the client. The client is solely responsible for the content, quality, accuracy, products, advertising or other materials on this page. Readers should conduct their own research before taking any action related to the material available on this page. The Crypto Basic is not responsible for the accuracy of the information or for any damage or loss caused or alleged to be caused by the use of or reliance on any content, goods or services mentioned in this press release article.

Please note that The Crypto Basic does not endorse or support any content or products on this page. We strongly advise readers to conduct their own research before acting on the information presented here and to take full responsibility for their decisions. This article should not be considered investment advice.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinion of The Crypto Basic. Readers are encouraged to conduct thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Advertisement-

Altcoins

Here’s the price of XRP if it handles 10% of SWIFT transactions

Popular community figure Amélie predicts a massive increase in the price of XRP if its underlying network, XRPL, is used to process 10% of all SWIFT transactions.

In a recent article on X, Amélie took on SWIFT (Society for Worldwide Interbank Financial Telecommunication), suggesting that XRP is a better alternative for cross-border settlements.

Ripple claims Swift is not fast enough

In a recent post on X, the community personality called attention to a Ripple ad claiming that “Swift isn’t fast enough.” The remark was a subtle criticism of Ripple’s transaction processing speeds for the global financial messaging giant.

Interestingly, Ripple has recommended financial institutions to adopt its solution to instantly transfer value across borders.

Amelie compared the processing speed of SWIFT and XRP transactions. According to community figures, cross-border transactions on SWIFT typically take between three and five business days. Conversely, Amelie claimed that XRP transactions can be completed in four seconds.

After the analysis, Amélie echoed Ripple’s sentiments, pointing out that SWIFT is not fast enough compared to XRP.

XRP to Surpass $1,000 if it handles 10% of SWIFT transactions

Therefore, enthusiasts have speculated that all SWIFT transactions will eventually be processed through the XRP Ledger (XRPL), the underlying blockchain of the XRP token.

Interestingly, she suggested that the price of XRP could surpass $1,000 per token if 10% of all SWIFT network transactions were processed through XRPL. However, Amelie did not provide details on how XRP could reach this milestone.

SWIFT VS XRP:

SWIFT: 3 to 5 business days

XRP: Cross-border payments in 4 seconds

SWIFT IS NOT FAST ENOUGH!

I think all Swift transactions will soon be processed via #XRPL 💵💱💴

10% of SWIFT network = $1,000+ per XRP! pic.twitter.com/Jt6mumQHfb

— 𝓐𝓶𝓮𝓵𝓲𝓮 (@_Crypto_Barbie) July 20, 2024

Can XRP replace SWIFT?

Several cryptocurrency enthusiasts have compared XRP to SWIFT in recent years. In particular, the famous crypto asset manager Grayscale characterized XRP as an alternative to SWIFT. Notably, some users have taken this comparison further by projecting that XRP could eventually replace SWIFT because of its inefficiencies, including slow transaction processing.

The potential replacement of XRP with an established system like SWIFT would require more than just community support. Factors such as the final resolution of the SEC lawsuit, increased institutional adoption of XRP, and large-scale commercial partnerships leveraging Ripple’s payment solution could play a critical role in XRP’s potential replacement or integration with SWIFT.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinion of The Crypto Basic. Readers are encouraged to conduct thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Advertisement-

-

News1 year ago

News1 year agoBitcoin (BTC) price recovery faces test on non-farm payrolls

-

Bitcoin12 months ago

Bitcoin12 months ago1 Top Cryptocurrency That Could Surge Over 4,300%, According to This Wall Street Firm

-

Altcoins12 months ago

Altcoins12 months agoOn-chain data confirms whales are preparing for altcoin surge with increased buy orders

-

Bitcoin12 months ago

Bitcoin12 months agoThe US government may start accumulating Bitcoin, but how and why?

-

News1 year ago

News1 year agoNew ByBit Listings for 2024: 10 Potential Listings

-

News1 year ago

News1 year ago11 Best Crypto TikTok Accounts & Influencers in 2024

-

Altcoins1 year ago

Altcoins1 year agoMarket giants have taken action!

-

News1 year ago

News1 year ago11 Best Shitcoins to Buy in 2024: The Full List

-

Ethereum1 year ago

Ethereum1 year agoTop Meme Coins by Market Capitalization in 2024

-

News1 year ago

News1 year ago1.08 Trillion SHIBs Dumped on Major Crypto Exchange, What’s Going On?

-

News1 year ago

News1 year ago19 Best Crypto Games to Play in 2024

-

Altcoins1 year ago

Altcoins1 year agoAltcoin Recommended by Crypto Expert for Today’s Portfolio