Altcoins

Are The Glory Days Over? Why Analysts See Big Risks In Coming 2024

The cryptocurrency market has experienced a whirlwind ride in recent years. Bitcoin, the undisputed king of crypto, has captured headlines with its soaring valuations. However, alongside Bitcoin surged a wave of alternative cryptocurrencies, often referred to as “altcoins.” These altcoins promised revolutionary functionalities and the potential for even greater returns. But with the cryptocurrency market evolving, analysts are raising a critical question: Are altcoins a “relatively huge” risk for investors, and are the days of big returns a thing of the past?

A More Crowded Playing Field:

One of the primary concerns surrounding altcoins is the sheer number of them in existence. The market is flooded with new altcoins emerging constantly, all vying for investor attention. This saturation makes it increasingly difficult for any individual altcoin to break through the noise and achieve significant price gains. Unlike the early days of crypto, where a handful of altcoins stood out, today’s investors have a vast array of choices, making it harder for altcoins to establish themselves.

Market Maturation and Investor Caution for Altcoins: A Delicate Dance

The cryptocurrency market, particularly the realm of altcoins (alternative coins to Bitcoin), has experienced a rollercoaster ride in recent years. While early adopters witnessed explosive growth, recent times have seen a shift towards market maturation and a more cautious approach from investors. Let’s delve deeper into this dynamic:

Market Maturation: A sign of a Healthy Ecosystem?

- Increased Scrutiny: The Wild West days of the crypto market, where hype and speculation fueled rapid price increases, are slowly fading. Regulatory bodies are taking a closer look at the industry, and investors are demanding more transparency and accountability. This scrutiny, while posing challenges, can ultimately lead to a more stable and trustworthy ecosystem.

- Focus on Utility: Investors are increasingly seeking altcoins that offer real-world utility and solve specific problems. Projects with innovative use cases in areas like decentralized finance (DeFi), non-fungible tokens (NFTs), and supply chain management are gaining traction. This shift in focus indicates a maturing market where value is tied to tangible applications.

- Institutional Adoption: The entry of institutional investors, such as hedge funds and investment banks, signifies a growing recognition of the potential of blockchain technology and altcoins. While this can bring much-needed stability, it also introduces a new breed of investors with a more risk-averse approach.

Investor Caution: A Prudent Response or Stifled Innovation?

- Volatility Concerns: The inherent volatility of the cryptocurrency market, particularly for altcoins, continues to be a major deterrent for some investors. Recent market corrections have served as a stark reminder of the risks involved, leading some to adopt a wait-and-see approach.

- Regulation Uncertainty: The regulatory landscape surrounding cryptocurrencies remains somewhat murky. This uncertainty can create hesitation among investors, who may be wary of entering a market with unclear regulations.

- Project Hype vs. Project Substance: The emergence of numerous altcoin projects, some with questionable value propositions, has led to investor fatigue. Savvy investors are now prioritizing projects with strong teams, well-defined roadmaps, and a clear path to adoption.

The Delicate Dance: Balancing Innovation with Investor Confidence

The future of altcoins hinges on striking a delicate balance between fostering innovation and attracting long-term investors. Here’s how this dance might unfold:

- Focus on Building Sustainable Projects: Altcoin projects that prioritize building robust technology, fostering active communities, and demonstrating real-world use cases are more likely to attract and retain investors.

- Transparency and Compliance: Embracing transparency and proactively adhering to evolving regulations will be key to building trust with investors and regulators alike.

- Investor Education: Educating the public about the potential and risks associated with altcoins is crucial for fostering wider adoption and responsible investment.

While investor caution is a natural consequence of market maturation, it doesn’t negate the potential of altcoins. For innovative projects that can navigate this evolving landscape by building trust, utility, and a sustainable ecosystem, the future remains bright. As the market matures, altcoins have the potential to become a more prominent asset class, attracting a wider range of investors and shaping the future of finance and technology.

Also, read – Top 10 Intriguing Reasons Reduced Bitcoin Supply Spark Altcoins: Halving as a Catalyst

Uncertain Applications and the “So What?” Factor for Altcoin Investments: A Hurdle to Overcome

The world of altcoins presents a compelling proposition – a diverse landscape of blockchain-powered projects brimming with potential. However, a significant hurdle for altcoin investments lies in the uncertainty surrounding their applications and the ever-present question: “So what?” Let’s dissect this challenge and explore potential solutions:

The “So What?” Factor: Why Investors Hesitate

- Unproven Use Cases: Many altcoin projects boast innovative ideas, but translating those ideas into tangible, real-world applications remains a challenge. Investors are hesitant to put their money behind projects with unclear use cases or limited adoption potential. This “So what?” factor creates a barrier to entry for many altcoins.

- Technological Immaturity: The underlying blockchain technology powering altcoins is still evolving. Scalability issues, transaction fees, and security vulnerabilities can hinder widespread adoption. Investors are wary of investing in projects built on immature technology with uncertain long-term viability.

- Competition within the Crypto Space: The altcoin market is crowded, with numerous projects vying for investor attention. Standing out from the crowd requires a clear and compelling value proposition that solves a specific problem or offers a unique advantage over existing solutions.

Navigating the Uncertainty: Building Trust and Demonstrating Value

For altcoin projects to overcome the “So what?” factor and attract investors, a proactive approach is necessary:

- Focus on Building Functional Applications: The core tenet should be developing functional applications that address real-world needs. This could involve creating a more efficient payment system, streamlining supply chain management, or facilitating secure identity verification. By demonstrating tangible utility, altcoin projects can move beyond mere speculation and attract investors seeking solutions.

- Building Strong Communities: Fostering a vibrant and engaged community is crucial for any altcoin project. Active communities provide valuable feedback, help identify potential use cases, and drive project adoption. Engaging with the community fosters trust and transparency, addressing the uncertainty surrounding the project’s long-term vision.

- Collaboration and Ecosystem Building: No single altcoin project exists in a vacuum. Collaboration with established players in the industry and building a strong ecosystem around the project can enhance its value proposition. Partnerships with other blockchain projects, traditional financial institutions, or relevant businesses demonstrate the project’s potential for real-world integration.

The future of altcoin investments will likely be shaped by projects that can bridge the gap between theoretical potential and practical application. By prioritizing utility, building strong communities, and fostering a collaborative ecosystem, altcoin projects can overcome the “So what?” factor and attract investors seeking value beyond mere speculation. As the altcoin market matures, success will hinge on demonstrating a clear path towards real-world adoption and solving problems that matter in the evolving digital landscape.

The Bitcoin Tugboat: When the Tide Goes Out, Altcoins Feel the Squeeze

The cryptocurrency market, for all its innovative potential, exhibits a fascinating dynamic – the influence of Bitcoin on altcoins. Often likened to a tugboat, Bitcoin’s price movements tend to have a ripple effect, impacting the prices of altcoins. This phenomenon, known as the “Bitcoin Tugboat” effect, presents a significant risk factor for altcoin investments.

Understanding the Tugboat Effect:

- Market Dominance: Bitcoin, as the first and most established cryptocurrency, holds a dominant position in the market. Investors often view Bitcoin as a relatively safe haven within the volatile crypto landscape. When Bitcoin’s price fluctuates, it can trigger a domino effect, influencing investor sentiment and trading behavior in the altcoin market.

- Investor Risk Aversion: During periods of market correction or heightened volatility, investors often flock to Bitcoin, perceived as a less risky asset. This capital flight from altcoins can lead to significant price drops, even for projects with strong fundamentals. The Bitcoin Tugboat effect highlights the interconnectedness of the cryptocurrency market, where altcoin fortunes are often tied to the whims of Bitcoin.

Navigating the Tugboat’s Wake: Strategies for Altcoin Investors

While the Bitcoin Tugboat effect poses a challenge, there are strategies altcoin investors can employ to mitigate risk:

- Diversification: Spreading investments across a basket of altcoins with varying risk profiles and functionalities can help hedge against market fluctuations. By not being overly reliant on the performance of a single altcoin, investors can achieve a more balanced portfolio.

- Focus on Project Fundamentals: While Bitcoin’s price movements can be unpredictable, meticulously researching altcoin projects with strong teams, innovative technology, and a clear path to adoption can help identify projects with long-term potential. Investing in altcoins that offer unique value propositions can provide some insulation from the Bitcoin Tugboat effect.

- Understanding Risk Tolerance: Investors should have a clear understanding of their risk tolerance and investment goals. Altcoins are inherently more volatile than Bitcoin, and investors should be prepared for price swings. Investing with a long-term perspective and avoiding panic selling during market downturns can help navigate the choppy waters caused by the Bitcoin Tugboat.

The Evolving Cryptocurrency Market: Uncoupling the Fate of Altcoins?

As the cryptocurrency market matures, the relationship between Bitcoin and altcoins might evolve. Here are some potential future scenarios:

- Increased Altcoin Adoption and Utility: If altcoins successfully carve out distinct niches and demonstrate real-world utility, their price movements might become less tethered to Bitcoin. A more robust and diverse cryptocurrency ecosystem could lead to a decoupling of fortunes.

- Rise of Stablecoins: Stablecoins, cryptocurrencies pegged to a stable asset like the US dollar, offer more price stability. The wider adoption of stablecoins could provide investors with an alternative to Bitcoin during periods of market volatility, potentially weakening the Tugboat effect.

By employing sound investment strategies, focusing on project fundamentals, and understanding the evolving market dynamics, altcoin investors can navigate the challenges posed by the Tugboat and position themselves for success in the ever-changing world of cryptocurrency.

Pump-and-Dump Schemes: A Shadow Over the Market – Why Investor Beware is Crucial in Altcoins

The exciting world of altcoins, brimming with innovation and potential, also harbors a dark side: pump-and-dump schemes. These manipulative tactics exploit the unregulated nature of some altcoin markets, casting a shadow over investor confidence. Understanding these schemes and how to protect yourself is paramount for anyone venturing into the altcoin space.

The Devious Mechanics of Pump-and-Dump Schemes:

- Coordinated Hype: Fraudulent actors behind pump-and-dump schemes often operate in online communities or social media channels. They create a false sense of excitement and potential around a specific altcoin, driving up its price through coordinated buying and positive endorsements. This fabricated hype attracts unsuspecting investors who jump on the bandwagon, further inflating the price.

- The Dumping Act: Once the price reaches a pre-determined point, the orchestrators behind the scheme quickly sell their holdings, profiting handsomely from the artificially inflated price. This sudden sell-off triggers a dramatic price drop, leaving unsuspecting investors holding significantly devalued altcoins.

Investor Beware: Protecting Yourself from Pump-and-Dump Schemes

The decentralized and unregulated nature of some altcoin markets makes them fertile ground for pump-and-dump schemes. Here’s how investors can protect themselves:

- Scrutinize the Hype: Be wary of any altcoin experiencing a sudden and unexplained surge in price or online buzz. Research the project thoroughly, understand its technology, and assess its long-term viability. Don’t get swept away by online hype or FOMO (fear of missing out).

- Investigate the Project Team: Look for altcoin projects with a transparent and reputable team. Research the team’s background, experience, and track record. A project with a team lacking credibility or a history of involvement in suspicious activities should raise red flags.

- Beware of Unrealistic Promises: If an altcoin project seems too good to be true, it probably is. Be skeptical of claims of guaranteed returns or exponential growth. Legitimate altcoin projects focus on building a strong foundation and achieving sustainable growth.

- Invest Only What You Can Afford to Lose: The altcoin market is inherently volatile. Only invest what you can afford to lose, and avoid putting all your eggs in one basket. Diversify your portfolio across different altcoins (with strong fundamentals) and established asset classes.

Regulation and a Call for Transparency: A Brighter Future for Altcoins?

The prevalence of pump-and-dump schemes underscores the need for increased regulation and transparency in the altcoin market. Regulatory bodies are starting to take a closer look at these manipulative practices, and stricter regulations could help weed out bad actors and protect investors. Additionally, altcoin projects themselves can play a role in fostering a more transparent environment by:

- Clearly Disclosing Tokenomics: Providing clear information about the token distribution, lockup periods, and team allocations fosters trust with investors.

- Engaging with the Community: Open and honest communication with the community helps build trust and combats misinformation.

A Regulatory Sword Hanging Low:

As the cryptocurrency market continues to evolve, regulatory bodies around the world are taking a closer look. Increased regulatory scrutiny could potentially stifle the growth of certain altcoins, particularly those deemed non-compliant with emerging regulations. Investors entering the altcoin market should be mindful of the potential regulatory landscape and how it might impact their chosen investments.

The Analyst’s Takeaway:

The world of altcoins presents a captivating blend of innovation, potential disruption, and inherent risk. While analysts acknowledge significant challenges in the altcoin market, their outlook is not one of complete pessimism. Here’s a breakdown of the key takeaways for investors:

Acknowledging the Risks: A Prudent Approach

- Market Volatility: The altcoin market is known for its wild price swings. Investors should be prepared for significant fluctuations and have a well-defined risk tolerance strategy in place.

- Uncertain Applications: Many altcoin projects are struggling to define clear and compelling use cases. Investors should prioritize altcoins that demonstrate real-world utility and a path towards adoption.

- The Bitcoin Tugboat: The price movements of Bitcoin can have a significant ripple effect on altcoins. Investors should be aware of this dynamic and not blindly follow Bitcoin’s price movements.

- Pump-and-Dump Schemes: Fraudulent actors can manipulate the prices of altcoins. Investors should be wary of sudden surges in price or online hype, and conduct thorough research before investing.

Reasons for Measured Optimism: A Future of Innovation

Despite the acknowledged risks, analysts see reasons for measured optimism in the altcoin market:

- Technological Innovation: Blockchain technology holds immense potential for innovation across various industries. Altcoin projects at the forefront of this technological advancement hold significant promise.

- Evolving Regulatory Landscape: Regulatory bodies are starting to take a closer look at the cryptocurrency market. Clearer regulations could create a more stable and trustworthy environment for altcoin investments.

- Increased Institutional Adoption: The entry of institutional investors into the cryptocurrency space signifies growing recognition of the potential of altcoins. This could bring much-needed stability and legitimacy to the market.

The Road Ahead: Building a Sustainable Altcoin Future

For altcoins to thrive in the long run, the focus needs to shift towards:

- Building Sustainable Projects: Altcoin projects that prioritize building robust technology, fostering active communities, and demonstrating real-world use cases are more likely to succeed.

- Transparency and Compliance: Embracing transparency and proactively adhering to evolving regulations will be key to building trust with investors and regulators alike.

- Investor Education: Educating the public about the potential and risks associated with altcoins is crucial for fostering wider adoption and responsible investment.

Conclusion: The altcoin market presents a complex landscape with both risks and opportunities. By carefully considering the analyst’s takeaways, investors can approach the altcoin market with a measured approach, focusing on projects with strong fundamentals and a clear path towards long-term success. The future of altcoins hinges on building trust, fostering innovation, and navigating the challenges to create a sustainable and impactful presence in the evolving financial landscape.

Altcoins

On-chain data confirms whales are preparing for altcoin surge with increased buy orders

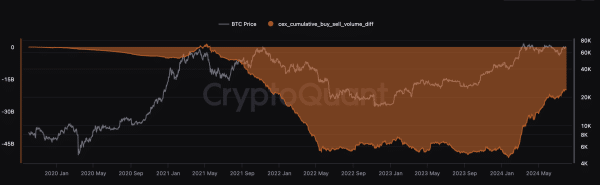

Ki Young Ju, CEO of analytics platform CryptoQuant, believes whales are preparing for an upcoming surge in altcoins.

In a recent revelation about X, Ju underlines that the volume of limit buy orders for altcoins, excluding Bitcoin and Ethereum, is increasing. This pattern suggests the formation of substantial buy walls, highlighting significant buying pressure from large-scale investors.

Ju’s chart identifies two main phases in limit order volume for altcoins: the limit sell phase and the limit buy phase. The limit sell phase saw a notable increase in cumulative sell orders in 2022, demonstrating strong selling pressure from whales and other market participants. This phase coincided with a period of falling altcoin prices due to unfavorable market conditions.

Then, the limit buying phase began, marked by a significant increase in cumulative buy orders. This indicates a period of strategic accumulation where whales establish substantial buy walls.

According to Ju, the increase in buying volume suggests confidence in the future conditions of the altcoin market. This buying pressure creates strong support levels, indicating that whales are preparing for a positive change in the market.

Buying pressure on specific altcoins

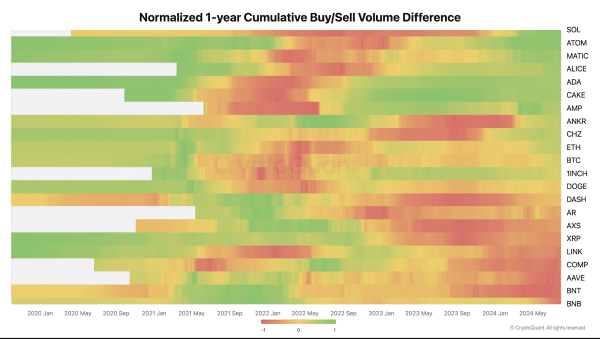

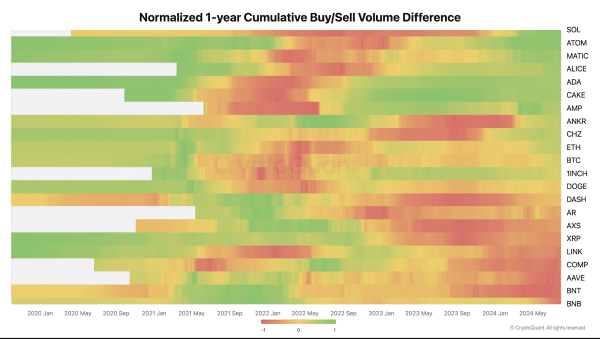

Ju also provided a heatmap of the 1-year normalized cumulative buy/sell volume difference for various altcoins, showing the buying and selling pressure over time. Solana (SOL) has seen alternating strong buying and selling phases, with recent activity showing increased buying interest. Cosmos (ATOM) and Polygon (MATIC) have also shown increased buying pressure despite mixed activity trends.

Cardano (ADA) and PancakeSwap (CAKE) have shown balanced buying and selling phases, with recent trends proving increased buying pressure. Coins like AMP and ANKR have also demonstrated increased buying activity. The heatmap reveals that most altcoins are seeing increased buying pressure as whales and large investors accumulate altcoins in anticipation of a rally.

Meanwhile, coins experiencing selling pressure, as indicated by the predominantly red areas on the heatmap, include DOGE, DASH, AXS, XRP, COMP, and AAVE, BNT.

Bitcoin whales are also buying

It is important to note that while whales are accumulating altcoins, Bitcoin whales are also active. Crypto Basic note an increase in buyer activity on Binance, which aligns with an increase in the buy/sell ratio of takers and whale movements. Analyst Ali Martinez highlighted the ratio fluctuations from below 0.8 to above 1.7 between July 27 and 31. Ratios above 1.0 indicate aggressive buying, often preceding price rallies.

From July 27 to July 28, the ratio remained mostly above 1.0, corresponding to the rise in Bitcoin price from around $66,500 to over $67,000. A spike to around 1.5 led to a sharp increase in price to around $68,500. However, on July 30 and 31, the ratio fell below 1.0 several times, corresponding to a drop in price to around $66,000, before a final spike to 1.7 indicated another slight increase in price.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinion of The Crypto Basic. Readers are encouraged to conduct thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Advertisement-

Altcoins

How to buy a car with cryptocurrency

The automotive and cryptocurrency industries have been merging for the past few years. As digital currencies become more prevalent in everyday activities, it is increasingly likely that they will be integrated into everyday transactions, such as when buying a car. The article unpacks the dynamic relationship between cryptocurrency and car buying today, explaining how digital currencies can be used to buy a vehicle today. It includes elements such as some of the benefits and challenges of buying a car using cryptocurrency and what lies ahead in the future.

Understanding Cryptocurrency Payments in the Automotive Industry

Cryptocurrency is not just a digital asset; it represents a revolutionary approach to decentralized financial transactions. The automotive industry, known for its adaptability, has begun to accept cryptocurrencies as a legitimate form of payment in various markets. For example, luxury car dealerships and online platforms offering car auctions in new york increasingly allow buyers to purchase cars using cryptocurrencies.

There are several factors that determine how much cryptocurrency you need to buy a car. Among them, the most influential will be the current value of the cryptocurrency you want to use at that moment. Unlike traditional currencies, cryptocurrencies can be very volatile. Their value can change drastically in an instant, which affects the amount needed at the time of purchase.

Benefits of Buying Cars with Cryptocurrency

Buying cars with cryptocurrencies offers several advantages:

– Reduced transaction fees: Cryptocurrencies can reduce the fees involved in large financial transactions typical of car purchases.

– Enhanced Privacy: Buyers who value their privacy can benefit from anonymity through blockchain-based transactions.

– Speed and convenience: transactions are faster than those carried out by banks, especially when the operation has an international scope.

Challenges and considerations

Although the benefits are compelling, several challenges must be considered:

– Volatility: At one moment, the price of any cryptocurrency can collapse, or the next minute it can skyrocket, and the price needed to buy a car can double or triple from one day to the next.

– Limited acceptance: Not all dealers accept cryptocurrency, which in turn may limit its use for making purchases.

– Tax implications: This may create different tax implications on purchases via cryptocurrency, depending on your jurisdiction.

Practical steps to buy a car with cryptocurrency

If you want to use cryptocurrency to buy a car, follow these steps:

- Ensure Acceptance: Check if the dealer or auction accepts the use of cryptocurrency.

- Check the conversion rate: You need to know how much your cryptocurrency is currently trading at compared to the price of the car in fiat currency.

- Secure your funds Make sure your digital wallet is secure and funded.

- Know the terms: Be informed and be clear about return policies as well as any additional fees incurred.

- Complete the transaction: Continue the payment via the digital wallet.

Future prospects

There is a good chance that many car dealerships will start accepting digital currencies, especially when blockchain technology pushes the boundaries and cryptocurrencies become stable. This trend is expected to be propelled forward due to the increasing demand for transparency, security, and efficiency in transactions.

Conclusion

The potential for cryptocurrencies to have a real impact on the car buying process is enormous. Of course, there are a few issues that emerge when considering the current market, including volatility and limited acceptance. However, the benefits of using digital currency to execute such transactions can easily outweigh the drawbacks for many buyers. As both sectors continue to grow, buying cars with cryptocurrencies shows a promising future and therefore creates a more connected and developed technological automotive market.

This means that buying a car, whether in cryptocurrency or in another form, is not just about following technological trends; it is rather about enjoying greater freedom and efficiency in financial transactions. Indeed, the closer the digital and automotive worlds become, the more buyers should expect simpler, much safer and also very innovative ways of purchasing.

Disclaimer: This press release article is provided by the client. The client is solely responsible for the content, quality, accuracy, products, advertising or other materials on this page. Readers should conduct their own research before taking any action related to the material available on this page. Crypto Basic is not responsible for the accuracy of the information or for any damage or loss caused or alleged to be caused by the use of or reliance on any content, goods or services mentioned in this press release article.

Please note that The Crypto Basic does not endorse or support any content or products on this page. We strongly advise readers to conduct their own research before acting on the information presented here and to take full responsibility for their decisions. This article should not be considered investment advice.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinion of The Crypto Basic. Readers are encouraged to conduct thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Advertisement-

Altcoins

Introducing Bit-Chess. The World’s First Fully Decentralized Chess Platform

Bit-Chess announces the pre-sale of the world’s first fully decentralized chess platform, combining the classic strategy game with the innovative world of cryptocurrencies. This platform will change the way millions of people interact with chess online, providing a digital space where players can enjoy their favorite game, compete in global tournaments, and earn rewards through play-to-win mechanics.

Bit-Chess is an entry point for both experienced players and newcomers to the crypto space. It provides tools and guides to help even inexperienced users get started with cryptocurrencies by creating in-game wallets upon first login. It is the first chess game to use Web3 technology, and all participants can earn money while playing.

During the presale, 500 of the 2,000 special NFTs will be available, with the rest distributed through tournaments and auctions. Unless NFT holders agree otherwise, the team will manage 1,500 NFTs, preserving their rarity with a cap of 2,000 pieces. More information about the NFT marketplace will be released after the token’s official launch.

The platform aims to become the world’s leading online chess center, offering:

Play to win features.

Global tournaments with cash or NFT prizes.

Player versus player challenges

Special NFTs and more

Bit-Chess invites players from all over the world to join its unique ecosystem, where playing chess is more than just entertainment: it’s an opportunity to earn and learn in the world of crypto.

For more information and to participate in the presale, Visit the Bit-Chess website.

Disclaimer: This press release article is provided by the client. The client is solely responsible for the content, quality, accuracy, products, advertising or other materials on this page. Readers should conduct their own research before taking any action related to the material available on this page. The Crypto Basic is not responsible for the accuracy of the information or for any damage or loss caused or alleged to be caused by the use of or reliance on any content, goods or services mentioned in this press release article.

Please note that The Crypto Basic does not endorse or support any content or products on this page. We strongly advise readers to conduct their own research before acting on the information presented here and to take full responsibility for their decisions. This article should not be considered investment advice.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinion of The Crypto Basic. Readers are encouraged to conduct thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Advertisement-

Altcoins

Here’s the price of XRP if it handles 10% of SWIFT transactions

Popular community figure Amélie predicts a massive increase in the price of XRP if its underlying network, XRPL, is used to process 10% of all SWIFT transactions.

In a recent article on X, Amélie took on SWIFT (Society for Worldwide Interbank Financial Telecommunication), suggesting that XRP is a better alternative for cross-border settlements.

Ripple claims Swift is not fast enough

In a recent post on X, the community personality called attention to a Ripple ad claiming that “Swift isn’t fast enough.” The remark was a subtle criticism of Ripple’s transaction processing speeds for the global financial messaging giant.

Interestingly, Ripple has recommended financial institutions to adopt its solution to instantly transfer value across borders.

Amelie compared the processing speed of SWIFT and XRP transactions. According to community figures, cross-border transactions on SWIFT typically take between three and five business days. Conversely, Amelie claimed that XRP transactions can be completed in four seconds.

After the analysis, Amélie echoed Ripple’s sentiments, pointing out that SWIFT is not fast enough compared to XRP.

XRP to Surpass $1,000 if it handles 10% of SWIFT transactions

Therefore, enthusiasts have speculated that all SWIFT transactions will eventually be processed through the XRP Ledger (XRPL), the underlying blockchain of the XRP token.

Interestingly, she suggested that the price of XRP could surpass $1,000 per token if 10% of all SWIFT network transactions were processed through XRPL. However, Amelie did not provide details on how XRP could reach this milestone.

SWIFT VS XRP:

SWIFT: 3 to 5 business days

XRP: Cross-border payments in 4 seconds

SWIFT IS NOT FAST ENOUGH!

I think all Swift transactions will soon be processed via #XRPL 💵💱💴

10% of SWIFT network = $1,000+ per XRP! pic.twitter.com/Jt6mumQHfb

— 𝓐𝓶𝓮𝓵𝓲𝓮 (@_Crypto_Barbie) July 20, 2024

Can XRP replace SWIFT?

Several cryptocurrency enthusiasts have compared XRP to SWIFT in recent years. In particular, the famous crypto asset manager Grayscale characterized XRP as an alternative to SWIFT. Notably, some users have taken this comparison further by projecting that XRP could eventually replace SWIFT because of its inefficiencies, including slow transaction processing.

The potential replacement of XRP with an established system like SWIFT would require more than just community support. Factors such as the final resolution of the SEC lawsuit, increased institutional adoption of XRP, and large-scale commercial partnerships leveraging Ripple’s payment solution could play a critical role in XRP’s potential replacement or integration with SWIFT.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinion of The Crypto Basic. Readers are encouraged to conduct thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Advertisement-

-

News1 year ago

News1 year agoBitcoin (BTC) price recovery faces test on non-farm payrolls

-

Bitcoin12 months ago

Bitcoin12 months ago1 Top Cryptocurrency That Could Surge Over 4,300%, According to This Wall Street Firm

-

Altcoins12 months ago

Altcoins12 months agoOn-chain data confirms whales are preparing for altcoin surge with increased buy orders

-

Bitcoin12 months ago

Bitcoin12 months agoThe US government may start accumulating Bitcoin, but how and why?

-

News1 year ago

News1 year agoNew ByBit Listings for 2024: 10 Potential Listings

-

News1 year ago

News1 year ago11 Best Crypto TikTok Accounts & Influencers in 2024

-

Altcoins1 year ago

Altcoins1 year agoMarket giants have taken action!

-

News1 year ago

News1 year ago11 Best Shitcoins to Buy in 2024: The Full List

-

Ethereum1 year ago

Ethereum1 year agoTop Meme Coins by Market Capitalization in 2024

-

News1 year ago

News1 year ago1.08 Trillion SHIBs Dumped on Major Crypto Exchange, What’s Going On?

-

News1 year ago

News1 year ago19 Best Crypto Games to Play in 2024

-

Altcoins1 year ago

Altcoins1 year agoAltcoin Recommended by Crypto Expert for Today’s Portfolio