News

Bitcoin in a Bull Market says new Grayscale Report

On Tuesday night Bitcoin achieved its highest price level in nearly two weeks, briefly hitting $71,722 before a sudden drop back to the $68,500 level. The bulls will have to fight to keep the previous all-time high of $69,000 steady as a support level before Bitcoin can make a fresh attempt to push higher. If the Bulls do manage to hold the line, history could be made. In four days’ time, if Bitcoin stays at its current level, Bitcoin will complete seven green monthly candles in a row, something that hasn’t happened previously.

Source: Brave New Coin Bitcoin Liquid Index

As we approach the end of March, Bitcoin finds itself on the cusp of fresh all-time highs. The resurgence of Bitcoin starkly contrasts with the somber atmosphere of the previous week, characterized by significant losses. The retracement from the recent peak near $73,000, reached 17% at one point, induced anxiety among traders. Although this correction remains relatively modest by bull market standards, it triggered apprehension across the market.

However, Monday’s rally hinted at a potential conclusion to the recent downturn in the cryptocurrency market. Last week, Bitcoin experienced a dip below $61,000 from its record highs above $73,000. Additionally, there was subdued interest in new U.S.-listed spot bitcoin ETFs, coupled with increased selling of Grayscale’s GBTC fund. Nonetheless, the robust surge on Monday suggested a shift in sentiment, potentially marking the end of the correction phase.

Grayscale’s Bitcoin Bull Market Report

In a new report released by Grayscale, historical indicators of the Bitcoin market cycle signal that the cryptocurrency market is currently in the midst of a bullish trend, propelled by a combination of robust fundamental and technical factors. The report highlights that previous crypto bull markets have often commenced with a surge in Bitcoin’s dominance, underscoring its pivotal role as a leading indicator for the broader cryptocurrency market. Typically, a rally in altcoins follows an uptick in BTC price, as investors seek higher returns by venturing into riskier cryptocurrencies, buoyed by profits from Bitcoin investments. While the outcome of the ongoing bull run remains uncertain, Grayscale maintains a cautiously optimistic stance, citing potential catalysts such as increased retail and institutional participation that could sustain the momentum of the cycle.

However, the report also expresses caution regarding the behavior of new spot Bitcoin ETF buyers. Historically, Bitcoin experiences drawdowns in every bull cycle, and it remains uncertain how these new buyers will react when faced with such downturns. Nonetheless, the current cycle has witnessed relatively minor drawdowns compared to previous cycles, providing some reassurance.

Contrasting sentiments are observed in retail investor interest, as reflected in cryptocurrency-related YouTube channel subscription rates. Although lower than the fervor seen during the 2020-2021 bull market, recent upticks in subscriber growth rates suggest a gradual resurgence of interest among retail investors.

Spot Bitcoin ETF flows and macroeconomic indicators emerge as the primary drivers shaping the near-term trajectory of Bitcoin’s bull cycle. Grayscale likens these forces to the two sides of a seesaw, with their influence fluctuating over time. Consequently, the report emphasizes the importance of monitoring these factors, which are likely to continue dictating Bitcoin’s market behavior.

Grayscale maintains unwavering confidence in Bitcoin’s performance as an asset class, supported by favorable market conditions and its established roles as a store of value and hard money. By maintaining a long-term perspective, Bitcoin is viewed as being in a strong position for sustained success.

$1 Million BTC

Cathie Wood, the CEO of Ark Invest, has hailed Bitcoin as a “financial superhighway,” highlighting its pivotal role in emerging markets. Speaking at the Bitcoin Investor Day conference in New York, Wood emphasized the significant use cases of the cryptocurrency, particularly in regions facing economic uncertainties.

Wood, whose firm recently launched a spot bitcoin exchange-traded fund (ETF) called ARKB, underscored Ark Invest’s focus on emerging markets and the global macroeconomic landscape. She noted the impact of the U.S. Federal Reserve’s interest rate hikes on the worldwide macro environment, describing it as a shock to the system.

Addressing the challenges faced by countries like Nigeria, where Bitcoin adoption is high due to currency depreciation, Wood characterized Bitcoin as both a risk-off and a risk-on asset. She highlighted Bitcoin’s appeal as a safe haven in times of economic turmoil while also acknowledging its potential for growth in risk-seeking environments.

Ark’s spot bitcoin ETF has emerged as one of the top performers among the ten funds launched in January. Wood expressed optimism about the future of Bitcoin, suggesting that with increasing institutional participation, the cryptocurrency’s price could soar above $3.5 million. However, she refrained from providing a specific price target, emphasizing instead the long-term potential of Bitcoin.

“Bitcoin has miles to go,” Wood remarked, referencing her previous price target of $1.5 million. Her comments reflect the growing confidence in Bitcoin’s trajectory and its ability to navigate the evolving landscape of global finance.

Earlier this month in an interview with the New Zealand Herald, Wood unveiled updated expectations for institutional involvement in Bitcoin’s price growth. She highlighted the transformative impact of the United States’ first spot ETFs on Bitcoin, emphasizing that even ARK Invest has adjusted its bullish stance on the cryptocurrency. The recent regulatory approval from the U.S. Securities and Exchange Commission (SEC) for ETFs has accelerated the timeline for Bitcoin’s price appreciation, according to Wood.

Ark’s price forecast has been $1 million per BTC by 2030. The forecast has been brought forward. “That target was before the SEC gave us the green light, and I think that was a major milestone, and it has pulled forward the timeline,” Wood explained. “Our target is now above that; it’s well above that, and with our new expectations for institutional involvement, the incremental price that we assume for institutions has more than doubled,” she revealed.

Wood’s sentiments were echoed by MicroStrategy’s Executive Chairman Michael Saylor, who emphasized to CNBC, Bitcoin’s potential to surpass gold as a store of value. Saylor announced his company’s purchase of an additional 9,245 bitcoins, bringing MicroStrategy’s total holdings to 214,246 BTC, more than 1% of the total supply.

Source: X

With the price increase, Bitcoin’s market cap surged above $1.3 trillion, making it the world’s ninth most valuable asset and equal to silver in market capitalization. However, it still has a considerable gap to bridge before catching up to gold, which boasts a market cap of $14.7 trillion.

In other Bitcoin news ETFs Continue To Drive BTC Price

Bitcoin’s strength should be matched by new ETF inflows this week, after a quiet week last week, marked by steady outflows. These were driven by record outflows from the Grayscale Bitcoin Trust (GBTC), due to selling by bankrupt crypto lender Genesis. Now, commentators are hoping for a return to “business as usual.”

After last week saw a net outflow each day from the US Spot Bitcoin ETFs, the data for this week is more positive. Monday was an excellent day with net inflows of more than $400 million. Leading the charge was the Fidelity Bitcoin ETF with its largest day of gains in 14 days, a healthy $279.1 million in daily inflows. With $73 million in inflows, Ark 21Shares Bitcoin ETF fund had its best day since March 12, while Invesco Galaxy, Franklin Templeton and Valkyrie all saw more than $26 million worth of inflows across their ETFs. Grayscale’s Bitcoin Trust (GBTC), however, continued a consistent run of outflows, with a Monday outflow of $212 million.

Bitcoin’s record price run completes an impressive comeback after a brutal bear market and an unfortunate string of bankruptcies, and fraud cases during the past two years. Most other cryptocurrencies, including memecoins have also benefited from the rally across the crypto market.

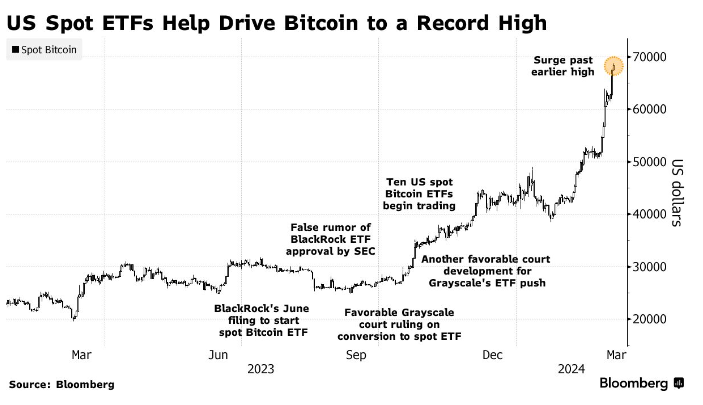

The run back to new all-time highs was triggered by the approval of a number of Bitcoin Spot ETFs in the U.S. offered by big financial names such as Fidelity and BlackRock. Eric Balchunas, Bloomberg ETF analyst said, “Today is a big moment for Bitcoin but I’d argue just as big a moment for ETFs. The move from 25k to 69k was all or close to all due to ETF approval hopes and/or flows and arguably warranted IMO, ETFs (and its ecosystem) so damn good at taking something and making it liquid, cheap, convenient and standardized. Both the ETFs and Bitcoin mutually benefit one another.”

Hashdex Enters Bitcoin ETF Market

Asset manager Hashdex has officially entered the spot Bitcoin exchange-traded fund (ETF) market in the United States by completing the conversion of its futures ETF to hold spot Bitcoin. In an announcement, Hashdex revealed that it has renamed and converted its Hashdex Bitcoin Futures ETF to the Hashdex Bitcoin ETF, which will be traded under the ticker “DEFI.” This conversion aligns with the Fund’s revised investment strategy, allowing it to hold spot Bitcoin and track a new benchmark index effective March 27, 2024. The newly converted fund will allocate at least 95% of its assets to spot Bitcoin, with the remaining 5% designated for CME-traded Bitcoin futures contracts and cash equivalents, as stated by the firm.

Marcelo Sampaio, co-founder and CEO of Hashdex, expressed the firm’s belief in Bitcoin as a generational opportunity. He emphasized the excitement of inviting investors, regardless of their level of conviction in Bitcoin, to join Hashdex in its long-term journey of making digital assets accessible. Samir Kerbage, Hashdex’s chief investment officer, echoed Sampaio’s sentiment, encouraging investors to consider an allocation to Bitcoin and participate in Hashdex’s mission of democratizing access to digital assets.

Source: Bloomberg

Also of note, is that this is the first time that Bitcoin has achieved a new all-time high before the Bitcoin halving event. Popular Technical analyst Rekt Capital said, “In previous cycles, BTC/USD took around 500 days to hit new all-time highs after a halving. Something to consider as we enter a new era for Bitcoin’s price action — we’ve never really seen price action like this before.”

Trump and Ackman Soften Stance

In a surprising turn of events, former U.S. President Donald Trump voiced support for Bitcoin during a CNBC appearance, acknowledging it as an “additional form of currency.” He said, “There has been a lot of use of that [bitcoin] and I’m not sure that I would want to take it away at this point.”

Trump’s remarks mark a notable shift from his previous characterization of Bitcoin as a “scam” that threatened the U.S. Dollar. He also hinted at the need for regulation to address Bitcoin’s growing influence.

Meanwhile, Bill Ackman, founder and CEO of Pershing Square Capital Management, offered a speculative take on Bitcoin’s future, envisioning a scenario where its price could skyrocket indefinitely. Ackman’s comments sparked a lively debate within the Bitcoin community, with Michael Saylor inviting him for a direct discussion on the topic.

As Bitcoin continues its upward trajectory, fueled by institutional interest and changing perceptions, the cryptocurrency landscape remains dynamic and ripe with potential. Investors eagerly await further developments as Bitcoin aims to solidify its position as a mainstream asset class.

Google Search Trends Are Up

Google Search Trends for Bitcoin have increased sharply this month after Bitcoin reached new all-time highs. However, Data shows that worldwide searches for Bitcoin are yet to hit the highs seen in the 2021 bull market.

In previous bull markets, Google Search Trends have increased sharply while the Coinbase app has made it to the number 1 spot in the Apple App Store at the peak of the market, a good indicator of a potential top. Coinbase is currently ranked at 222, up from 230 last week.

A Word of Caution

Finally, a note of caution from BlockTower’s CEO Ari Paul. Paul wrote on X last week, “Every crypto cycle, I turn pessimistic Cassandra around here (in public warnings). My best guess is that today equates not to October 2021, but more like January 2021. Still think we have 4 innings left in the 9 inning bull market, but… time to start steeling the backbone and psychologically preparing to do a really hard thing – to turn bearish when (almost) everyone is losing their minds as max bullish and the news is purely positive. And also worth noting… we’re *already* in a bubble by many metrics. Plenty of risks already, particularly in more speculative plays. For clarity – I’m just starting to *prepare* psychologically to be bearish. The right time might be 2 years away, but I find game-planning and ‘practicing’ contrarian thinking to be critical to making the right contrarian call in real-time.”

News

Ether Drops Further After ETF Launch

Key points

- Spot ether ETFs began trading in the U.S. today, with the funds initially having more than $10 billion in collective assets under management.

- Analysts expect the launch of spot ether ETFs to have a net negative impact on the underlying price of ether in the near term, due to expected outflows from the pre-existing Grayscale Ethereum Trust.

- Spot Bitcoin ETFs continue to see strong inflows, with BlackRock’s IBIT alone seeing more than $500 million in inflows on Monday.

- Franklin Templeton, a spot ETF issuer on bitcoin and ether, has invested in a project that intends to bring Ethereum technology to Bitcoin.

Nine-point ether exchange-traded funds (ETFs)) started trading on the stock market on Tuesday, but all the optimism ahead of their approval did not translate into gains for the cryptocurrency markets.

Ether (ETH), the native cryptocurrency of the Ethereum blockchain, dropped less than 1% around the $3,400 level as of 1:30 PM ET, while Bitcoin (BTC) fell more than 2% to around $66,000.

Ether ETFs’ Debut Isn’t as Flashy as Bitcoin ETFs’

Spot ether ETFs began trading at just over $10 billion assets under management (AUM)), according to Bloomberg Intelligence analyst James Seyffart, most of that money is in the current Grayscale Ethereum Trust (ETHE) which has now been converted into an ETF.

“In the long term, Grayscale will simultaneously have the highest and lowest fees in the market. The asset manager’s decision to keep its ETHE fee at 2.5% could lead to outflows from the fund,” Kaiko Research said in a note on Monday.

Outflows from ETHE, if they occur, would be similar to those faced by Grayscale’s Bitcoin Trust (GBTC) after spot bitcoin ETFs began trading in January of this year, most likely due to high fees for the two original funds. Grayscale’s existing fund charges 2.5% fees, while a new “mini” ether ETF will charge 0.15% and commissions for other ETFs are set at 0.25% or less.

Such outflows could impact the price of ether and market sentiment.

“There could be a pullback shortly after the launch of Ethereum spot ETFs, i.e. outflows from Grayscale Ether Trust could dampen market sentiment in the short term,” Jupiter Zheng, a partner at Hashkey Capital’s liquid fund, told The Block.

But Grayscale remains optimistic.

“Compared to the splashy debut of spot bitcoin ETPs in January, the launch of ethereum ETPs has been relatively muted,” said Zach Pandl, Grayscale’s head of research, adding that investors may be “undervaluing” ether ETFs that are “coming to the U.S. market in tandem with a shift in U.S. cryptocurrency policy and the adoption of tokenization by major financial institutions.”

Bitcoin ETF Inflows Continue to Rise

As for bitcoin, there is clearly no lack of demand for spot ETFs, such as BlackRock’s iShares Bitcoin Trust (IBITS) recorded its sixth-largest day of inflows in its short history on Monday, at $526.7 million, according to data from Farside Investors. Daily inflows for the overall spot bitcoin ETF market also hit their highest level since June 5.

In particular, asset manager Franklin Templeton, which has issued both bitcoin and ether ETFs, appears to have decided to cover its back when it comes to Ethereum by investing in Bitlayer, a way to implement Ethereum technology on a second-layer Bitcoin network, according to CoinDesk.

News

Spot Ether ETFs Start Trading Today: Here’s What You Need to Know

Key points

- Spot ether ETFs will begin trading on U.S. exchanges on Tuesday. Nine ETFs will trade on Cboe BZX, Nasdaq and NYSE Arca.

- Ether ETFs offer investors exposure to the price of their underlying assets.

- Commissions on these new ETFs generally range from 0.15% to 0.25%.

- These ETFs do not provide exposure to Ethereum staking.

The U.S. Securities and Exchange Commission (SEC) has officially approved nine ether spots (ETH)exchange-traded funds (ETFs) for trading on U.S. exchanges. Trading for these new cryptocurrency investment vehicles begins today. Here’s everything you need to know.

What new ether ETFs are starting to trade today?

Spot ether ETFs starting trading today can be found at Quotation, NYSE Arkand Cboe BZX. Here’s a breakdown of each ETF you can find on these three exchanges, along with the fund tickers:

Cboe BZX will list the Invesco Galaxy Ethereum ETF (QETH), the 21Shares Core Ethereum ETF (CETH), the Fidelity Ethereum Fund (FETH), the Franklin Ethereum ETF (EZET) and the VanEck Ethereum ETF (ETHV).

Nasdaq will have the iShares Ethereum Trust ETF (ETHA) created by BlackRock, which also operates the largest spot bitcoin ETF under the ticker IBIT.

NYSE Arca will list the Bitwise Ethereum ETF (ETHW) and the Grayscale Ethereum Trust (ETHE). The Grayscale Ethereum Mini Trust (ETH), which will begin trading on the same exchange.

How does an ether ETF work?

Spot ether ETFs are intended to offer exposure to the price of ether held by the funds. Ether is the underlying cryptocurrency of the Ethereal network, the second largest crypto network by market capitalization.

ETF buyers are buying shares of funds that hold ether on behalf of their shareholders. Different spot ether ETFs use different data sources when it comes to setting the price of ether. Grayscale Ethereum Trust, for example, uses the CoinDesk Ether Price Index.

None of the ETFs launching today include pointed etherwhich represents a potential opportunity cost associated with choosing an ETF over other options such as self-custody or a traditional cryptocurrency exchange.

Ether staking currently has an annual return of 3.32%, according to the Compass Staking Yield Reference Index Ethereum. However, it is possible that the SEC will eventually approve Ether staking held by ETFs.

How can I trade Ether ETFs?

ETFs can simplify the trading process for investors. In the case of cryptocurrencies, instead of taking full custody of the ether and taking care of your own private keysSpot ether ETFs allow investors to purchase the cryptocurrency underlying the Ethereum network through traditional brokerage accounts.

Today, not all brokers may offer their clients spot ETFs on cryptocurrencies.

What are the fees for ether ETFs?

The fees associated with each individual spot ether ETF were previously revealed In the S-1 OR S-3 (depending on the specific ETF) deposit associated with the offerings. These fees are 0.25% or less for all but one.

The Grayscale Ethereum Trust, which converts to an ETF, has a fee of 2.5%. The Grayscale Mini Ethereum Trust has the lowest fee at 0.15%. These fees are charged on an annual basis for the provider’s management of the fund and are in line with what was previously seen with spot bitcoin ETFs.

Brokers may also charge their own fees for cryptocurrency trading.

News

Kamala Harris Odds Surge Amid $81M Fundraise. What Does It Mean for Bitcoin and Cryptocurrencies?

Market odds and memecoins related to US Vice President Kamala Harris have soared as the latest round of donations tied to the Democratic campaign raised $81 million in 24 hours, bolstering sentiment among some traders.

The odds of Harris being declared the Democratic nominee have risen further to 90% on cryptocurrency betting app Polymarket, up from 80% on Monday and setting a new high.

Previously, in early July, bettors were only betting on 8%, but that changed on Saturday when incumbent President Joe Biden announced he would no longer run in the November election. Biden then approved Harris as a candidate.

Polymarket traders placed $28.6 million in bets in favor of Harris, the data showsThe second favorite is Michelle Obama.

Somewhere else, Memecoin KAMA based on Solanaa political meme token modeled after Harris, has jumped 62% to set a new all-time high of 2 cents at a market cap of $27 million. The token is up a whopping 4,000% from its June 18 low of $0.00061, buoyed primarily by the possibility of Harris becoming president.

As such, Harris has yet to publicly comment on cryptocurrencies or her strategy for the growing market. On the other hand, Republican candidate Donald Trump has expressed support for the cryptocurrency market and is expected to appear at the Bitcoin 2024 conference on Saturday.

However, some expect Harris or the Democratic Party to mention the sector in the coming weeks, which could impact price action.

“While he has not yet received the official nomination, there is consensus that last night’s development is in line with current Democratic strategy,” cryptocurrency trading firm Wintermute said in a Monday note emailed to CoinDesk. “Keep an eye on Democrats’ comments on this issue in the coming days.

“The prevailing assumption is that Harris will win the nomination and any deviation from this expectation could cause market volatility,” the firm added.

News

Top 30x Cryptocurrency and Coin Presales Today: Artemis Coin at #1, Others Are: BlockDAG, 99Bitcoin, eTukTuk, and WienerAI

The cryptocurrency market has seen a lot of growth and imagination lately, with new ventures popping up regularly. A critical pattern in this space is the rise of crypto pre-sales, which give backers the opportunity to get involved with promising projects early on. Artemis is a standout option for crypto investors looking to expand their portfolios amid the many pre-sales currently underway.

Cryptocurrency presales, commonly referred to as initial coin offerings (ICOs), allow blockchain ventures to raise capital by offering their local tokens to early backers before they become available on open exchanges. Investors can take advantage of these presales by purchasing tokens at a lower price. If the project is successful and the token’s value increases, investors stand to receive significant returns.

>>> Explore the best cryptocurrency pre-sales to buy now <<

The Ultimate List of the Top 5 Cryptocurrency Pre-Sales to Invest In

- Artemis: The aim of Artemis (ARTMS) will become the cryptocurrency equivalent of eBay or Amazon. The upcoming Phase 4 will see the launch of the Artemis Framework, which will serve as a stage for digital money exchanges where buyers, sellers, specialized organizations and those seeking administration can participate in coherent exchanges.

- DAG Block: uses Directed Acyclic Graph technology to increase blockchain scalability.

- 99bitcoin: operates as a crypto learning platform

- WienerAI uses AI-powered trading bots for precise market analysis.

- eTukTuk focuses on environmentally sustainable transportation options, such as electric vehicle charging infrastructure.

We have determined that Artemis is the best new cryptocurrency presale for investment after conducting extensive research. It presents itself as the unrivaled cryptocurrency presale choice currently open.

>> Visit the best cryptocurrency pre-sale to invest in now <<

Top 5 Crypto Pre-Sales and Best Cryptocurrencies for Investment Today

Artemis (ARTMS) is attempting to establish itself as the cryptocurrency version of eBay or Amazon. The Artemis Crypto System, which will act as a platform for cryptocurrency transactions, will be launched in Phase 4. Buyers, sellers, service providers, and requesters will all benefit from seamless trading with this system. Customers will be able to purchase things, such as mobile phones using digital money, as well as sell products such as involved bicycles and get paid in cryptocurrency. Additionally, crypto money can be used to pay for administrations such as clinical consultations, legitimate care, and freelance work. Artemis Coin will act as the main currency of the ecosystem, with Bitcoin and other well-known cryptocurrencies from various blockchain networks backing it.

Artemis Coin has increased in price from 0.00055 to 0.00101 from 0.00094. Artemis may be attractive to individuals looking to recoup losses in Bitcoin, as predicted by cryptocurrency analysts. At this point, it seems to present an interesting presale opportunity.

>>> Visit the best cryptocurrency pre-sale to invest in now <<

The world of digital currency pre-sales is an exciting and exciting opportunity that could open the door to game-changing blockchain projects. Projects in this article, like Artemis Coin, offer the opportunity to shape the future of various industries and the potential for significant returns as the industry develops.

However, it is imperative to approach these investments with caution, thorough research, portfolio diversification, and awareness of the risks. You can explore the digital currency pre-sale scene with greater certainty and increase your chances of identifying and profiting from the most promising venture opportunities by following the advice and methods in this article.

>>> Join the best cryptocurrency pre-sale to invest in now <<

-

News1 year ago

News1 year agoBitcoin (BTC) price recovery faces test on non-farm payrolls

-

Bitcoin12 months ago

Bitcoin12 months ago1 Top Cryptocurrency That Could Surge Over 4,300%, According to This Wall Street Firm

-

Altcoins12 months ago

Altcoins12 months agoOn-chain data confirms whales are preparing for altcoin surge with increased buy orders

-

Bitcoin12 months ago

Bitcoin12 months agoThe US government may start accumulating Bitcoin, but how and why?

-

News1 year ago

News1 year agoNew ByBit Listings for 2024: 10 Potential Listings

-

News1 year ago

News1 year ago11 Best Crypto TikTok Accounts & Influencers in 2024

-

News1 year ago

News1 year ago11 Best Shitcoins to Buy in 2024: The Full List

-

Altcoins1 year ago

Altcoins1 year agoMarket giants have taken action!

-

Ethereum1 year ago

Ethereum1 year agoTop Meme Coins by Market Capitalization in 2024

-

News1 year ago

News1 year ago1.08 Trillion SHIBs Dumped on Major Crypto Exchange, What’s Going On?

-

News1 year ago

News1 year ago19 Best Crypto Games to Play in 2024

-

Altcoins1 year ago

Altcoins1 year agoAltcoin Recommended by Crypto Expert for Today’s Portfolio