Ethereum

Grayscale Ethereum Mini Trust (ETH): Buy the Big News

Liliya Filakhtova

Thesis summary

Ethereum (ETH-USD) The ETFs have been approved and nine ETFs will be available for purchase starting Tuesday, July 23.

While all of these ETFs track the price of Ethereum, there are differences between these funds that investors should consider before investing.

Fees will, of course, be the most important factor to consider.

So which ETF has the lowest fees? Which ETF will attract the most capital? And what does ETF approval mean for Ethereum and cryptocurrencies?

Ethereum ETF: Who’s in the race?

In total, nine spot Ethereum ETFs will begin trading on Tuesday, July 23.

These include: Grayscale Ethereum Mini Trust (NYSEARCA:ETH), Franklin Ethereum ETF (BATS:EZET), VanEck Ethereum ETF (BATS:ETHV), Bitwise Ethereum ETF (NYSEARCA:ETHW), 21Shares Core Ethereum ETF (BATS:CETH), Fidelity Ethereum Fund (BATS:FETH), iShares Ethereum Trust (NASDAQ:ETHA) and the Invesco Galaxy Ethereum ETF (BATS:QETH), as well as the Grayscale Ethereum Trust (NYSEARCA:ETHÉ) which will be converted into an ETF.

The wide variety of ETFs will undoubtedly pave the way for increased adoption of Ethereum, making it easier for investors to gain exposure to the asset.

However, with nine options to choose from, we need to do our due diligence to find the best option. Since all of these options will essentially track Ethereum’s performance, the main consideration here is fees.

Fees and exemptions

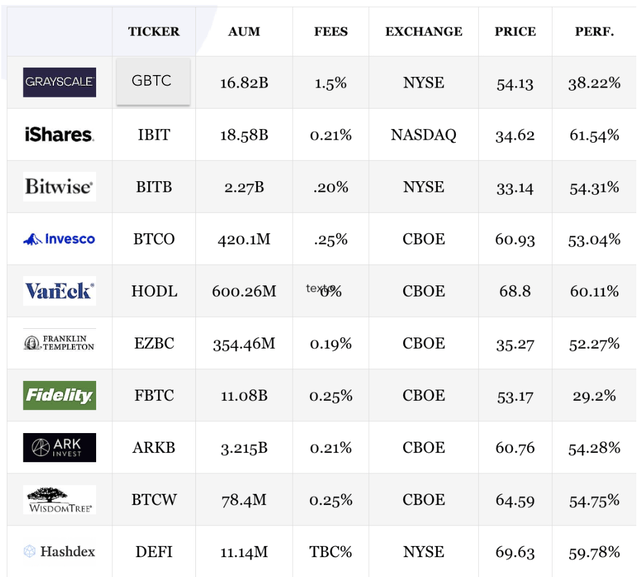

The list below tells us what the fees will be for each fund. Many funds will waive their fees, either completely or partially, so this is something we also need to consider.

Fees and Waivers for ETH ETFs (Fees and Waivers for ETH ETFs (ccn.com))

As we can see, six of the funds will initially charge no fees. However, these waivers are limited in terms of total assets and, most importantly, time. In most cases, fees will start to “return to normal” after 6 to 12 months.

The only two funds not to offer a fee waiver will be QETH and ETHE. ETHE will actually leave its fee level unchanged and, with a 2.5% fee, will become the most expensive ETH ETF.

Grayscale Ethereum Mini Trust: A Well-Chosen Name

Interestingly, while Grayscale will likely see notable outflows from its ETHE fund, which will become the least competitive ETF, the firm could benefit from the launch of its ETH Mini Trust.

This is effectively a “spin-off” of its ETHE fund, and something the company will also do with its Grayscale Bitcoin Trust ETF (GBTC).

But how will this work?

If you own 1,000 shares of ETHE, you will be entitled to 1,000 shares of mini ETH. While this comes from one share point, its value is significantly different.

An individual holding $1,000 of ETHE or GBTC will have $900 remaining in the original fund and $100 allocated to the newly created mini ETFs after the splits.

Source: TokenPost

In other words, when the mini fund is launched, 1/10 of the original/large fund will be converted into a mini fund, which in turn will have a share value of 1/10 of the original/large fund.

The Grayscale Ethereum Mini Trust will have 0% fees for the first $2 billion in assets, second only to iShares Ethereum Trust (ETHA), which will charge 0% fees on the first $2.5 billion in assets.

Subsequently, however, ETH will be the fund with the lowest overall fees, at just 0.15%, along with the Franklin Ethereum ETF (EZET) the next best option at 0.19%

Cheaper is better

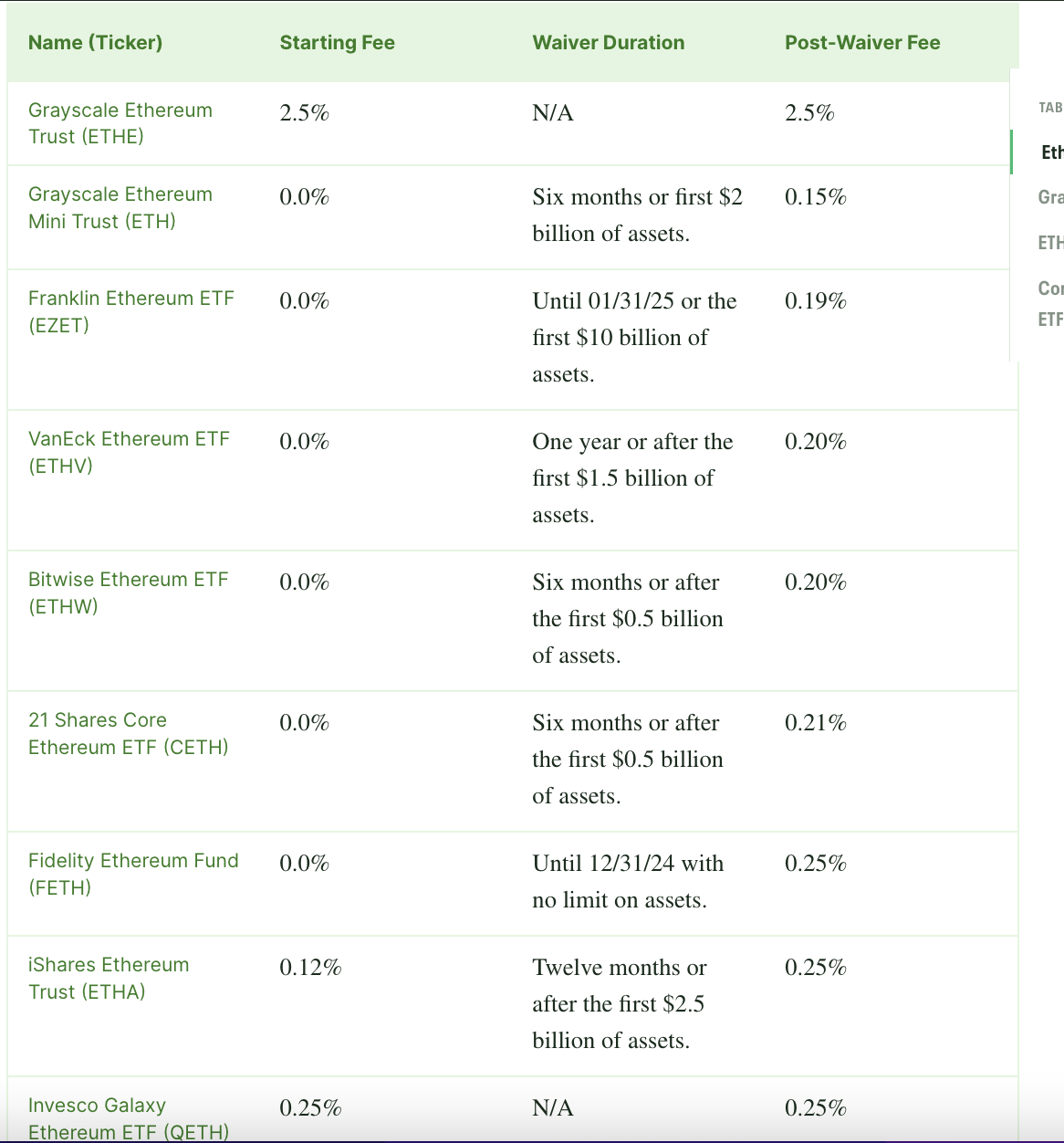

If Ethereum’s launch is anything like the Bitcoin ETF, we should expect the funds with the lowest fees to do much better.

Comparison of BTC ETFs (Mooloo)

As it stands, the VanEck Bitcoin Trust ETF (HODL) has the lowest fees, although they will increase to 0.20% on April 1, 2025. This fund has grown 60% since its launch and has $600 million in assets under management.

The ETF with the most assets and the best performance is the iShares Bitcoin Trust ETF (I BITE), with $18.58 billion in assets under management. There are a few funds with slightly lower fees, but the iShares fund stands out as the best performer.

iShares is a very reputable and popular ETF provider, which probably also helped it secure a spot as the most popular BTC ETF.

Impact of Ethereum ETFs

The Ethereum ETF is a highly anticipated event, although it may pale in comparison to what we saw with the Bitcoin ETF launch.

Crypto market maker Wintermute predicts that the Ethereum ETF will likely attract around $3.2 to $4 billion in assets.

The firm expects Bitcoin ETFs to raise about $32 billion by the end of the year, meaning Ethereum ETFs would only receive about 10% to 12.5% of the amount of assets that Bitcoin ETFs are expected to receive.

Source: DL NewsWintermute Report

The main issue here is that Ethereum ETFs will not have a staking mechanism in place. Following Ethereum’s transition to Proof of Stake, Ethereum holders with sufficient funds can stake their Ethereum and receive a return on their investment (currently yielding 3.2%).

ETFs will not have this functionality and will therefore be less attractive.

Nonetheless, Wintermute expects Ethereum’s price to increase by 18-24% as more capital flows into the asset via ETFs.

Final Thoughts

In conclusion, I believe that the Grayscale Ethereum Mini Trust fund could become the most popular Ethereum ETF. This is based on three main reasons:

-

It will have the lowest fees.

-

The stock price will be low (around $3).

-

Grayscale has a solid reputation in the crypto world.

These three factors should combine to make it a very popular option. Everyone loves low fees, and the low share price will also help attract smaller retail investors. While Grayscale doesn’t have the same reputation as iShares, which should also do very well, I still think it’s the best option for investors.

Finally, while this is a big step in the right direction for crypto, it may not be as big as the Bitcoin ETF.

Editor’s Note: This article discusses one or more securities that are not traded on a major U.S. exchange. Be aware of the risks associated with these securities.

Ethereum

Crypto Token Ether (ETH) Rebounds Following Complaint About SEC Investigation Into Ethereum

The Ether token posted its best gain this week amid speculation that U.S. regulatory oversight of the blockchain ecosystem underlying the second-largest digital asset could ease.

The token climbed as much as 3.6% on Wednesday before paring some of its advance to trade at $3,562 as of 12:53 p.m. in Singapore. The rally was a modest tailwind for market leader Bitcoin and a string of smaller rivals.

Ethereum

Will they capture the same buzz in the market?

The launch of Ethereum spot exchange traded funds Exchange traded funds (ETFs) attracted significant market interest on July 23, with initial inflows surpassing $100 million. This is a notable change from the previous four days of outflows for U.S. spot Ether ETFs, which saw a total of $33.67 million in new investments.

This figure was, however, partly offset by an outflow of $120.28 million from Grayscale’s Ethereum Trust (ETHE). However, many crypto analysts believe that the Ethereum ETF will soon follow bitcoin’s path.

Ethereum ETF to Track Bitcoin

Katalin Tischhauser, head of investment research at Sygnum Bank and a former Goldman Sachs executive, predicted that Spot Ether exchange-traded funds could attract as much as $10 billion in assets under management in their first year.

She also predicted that Bitcoin ETFs could see inflows of $30 billion to $50 billion in their first 12 months, with Ethereum products likely following the same path.

Tischhauser noted that investing in Ethereum offers distinct advantages over Bitcoin. While Bitcoin is primarily viewed as a store of value, Ethereum’s value comes from revenue and cash flow. This makes Ether more relevant to traditional institutional investors compared to the perception of Bitcoin as “digital gold.”

Fee waivers to attract institutional investors

To attract institutional investors, several ETF issuers are waiving fees for their Ethereum spot funds. Franklin Templeton announced a 0.19% sponsorship fee, but will waive it for the first $10 billion in assets for six months. Meanwhile, Bitwise and VanEck will charge a 0.20% fee through 2025.

BlackRock revised its registration statement for its spot Ethereum ETF, ETHA, to include a 0.25% management fee. Grayscale launched its Grayscale Ethereum Mini Trust with the same 0.25% fee.

Ethereum ETFs Exclude Staking

The enthusiasm is, however, tempered by the lack of staking rewards of these ETFs. In May, BlackRock, Grayscale and Bitwise removed staking provisions from their SEC filings after discussions with the SEC.

As traditional investment institutions are limited by regulations and legal constraints, they can only invest through ETFs, without resorting to staking.

Also see: Crypto News Today: Bitcoin, Ethereum Brace for Volatility as Fed Holds Rates

Ethereum

SEC Hints It May Approve Ethereum ETFs at Last Minute, But ‘No Issuers Are Ready’

It sounded like an almost certain rejection from the Securities and Exchange Commissionbut just hours before the May 23 deadline to rule on VanEck’s application to launch an Ethereum spot exchange traded fundIt appears that the SEC may reconsider its decision.

CoinDesk First reported On Monday, the nine potential issuers that had filed to list and trade the ETFs were “abruptly” asked by regulators to update their 19b-4 filings on an expedited basis. A 19b-4 is what an exchange like the NYSE requires for new product introductions — in other words, the applicants and the exchange ask the SEC for permission to add the ETFs to their platforms.

Since rumors began circulating Monday afternoon, the price of Ether has climbed nearly 20%, trading near $3,750 as of 1:30 p.m. ET Tuesday.

It’s hard to believe that the SEC would do us a favor by approving the ETH spot ETF.

But politics is politics, and crypto has been winning the political battle for months.

Perhaps the Biden camp saw how many voters Trump could win over with a single pro-crypto comment and decided to change course.

— Jake Chervinsky (@jchervinsky) May 21, 2024

Since VanEck is the first exchange to file, its approval could hypothetically be a green light for others waiting to hear about their own 19b-4s. While rumors began circulating Monday that applications were being worked on, Bloomberg analysts updated their ratings from 25% to 75% approval.

But the news left issuers scratching their heads. Every issuer Bloomberg ETF analyst James Seyffart spoke to was “caught off guard by the SEC’s 180-degree turn,” he told Fortune. The agency reached out to filers for comment and updates just three days before the deadline, he said.

“This is not standard operating procedure, and everyone from issuers to exchanges to lawyers to market makers and more are scrambling to be ready for eventual approval and to meet SEC requirements,” Seyffart adds. The hasty nature of the pivot suggests it was likely a “political move,” the result of a “top-down decision” by the Biden administration, he speculates. “No issuer is ready,” he wrote on X.

It’s hard to believe that the SEC would do us a favor by approving the ETH spot ETF.

But politics is politics, and crypto has been winning the political battle for months.

Perhaps the Biden camp saw how many voters Trump could win over with a single pro-crypto comment and decided to change course.

— Jake Chervinsky (@jchervinsky) May 21, 2024

So far, Grayscale is the only potential issuer to post an update 19b-4 to the New York Stock Exchange website, for its application to transfer its Ethereum Mini Trust ETF. Meanwhile, Fidelity has abandoned its plan to put Ether in its ETF, according to a S-1 Update The filing was made with the SEC early Tuesday. In previous filings, the company had said it intended to “stake a portion of the trust assets” to “one or more” infrastructure providers, but now it “will not stake Ether” stored with the custodian.

Staking involves committing Ether to secure the network in exchange for a yield, which is currently around 3%, according to data from staking service Lido. Ark and Franklin Templeton have also considered staking in their applications. In today’s 19b-4 update from Grayscale, the company confirmed that it would not participate in staking. The fact that Grayscale highlighted this and Fidelity omitted it suggests that the SEC may have asked that staking be banned. Vance Spencer, co-founder of Business executivestold Fortune he believed the SEC’s last-minute requests included advice on staking.

Staking the underlying Ether in the ETF has been seen as a reason the SEC could reject the applications, with Chairman Gary Gensler expressing concern in March that digital assets using staking protocols could be considered securities under federal law. Staking could be “a significant complication,” Bitwise CIO Matt Hougan said. previously said Fortune.

However, even if the SEC approves VanEck’s 19b-4 on Thursday, it doesn’t guarantee clearance, as exchanges will need S-1 filings from issuers before the products can begin trading. When filing to launch a new security, an S-1 is the form that describes to potential investors and the SEC the structure of the asset, how it will be managed and, in this case, how it plans to mirror the performance of the underlying asset, namely Ether tokens.

But S-1 projects could take “weeks, if not months” to be approved, Seyffart said. written on X“That said, if we are correct and see these theoretical approvals later this week, that should mean that S-1 approvals are a matter of ‘when’ and not ‘if.’”

Recommended newsletter:

CEO Daily provides essential context for the information business leaders need to know. Every weekday morning, more than 125,000 readers trust CEO Daily for insights into leaders and their businesses. Subscribe now.

Fuente

Ethereum

FOMC Holds Interest Rates Steady, Bitcoin and Ethereum Prices Fall

After Federal Reserve Chairman Jerome Powell said a September rate cut “could be on the cards,” stocks soared to session highs. The tech-heavy Nasdaq 100 climbed 3.3% and the S&P 500 climbed 2%. However, the king cryptocurrency Bitcoin (BTC) fell 1.3% to $66,088, and Ethereum (ETH) fell about 1.11% to $3,313. Over the past 24 hours, the global cryptocurrency market cap also fell 0.71% to $2.39 trillion.

However, market analysts believe that this is a short-term decline, as Bitcoin and other cryptocurrencies, despite being in a bearish situation, are showing bullish signals. Although BTC is still struggling to break the $70,000 mark, it will be interesting to see how BTC will react in August before the rate cuts.

Federal Reserve Decision

On July 31, the U.S. Federal Reserve concluded a two-day meeting of the Federal Open Market Committee (FOMC) by choosing to keep benchmark interest rates unchanged at 5.25%-5.50%, in line with Wall Street expectations. The decision marked the eighth consecutive meeting without a rate change.

Towards a market rebound?

According to SantimentThe FOMC’s decision to maintain current interest rates led to an initial decline in cryptocurrency prices. Traders were hoping for a rate cut, which hasn’t happened since March 2020. A future rate cut could signal bullish trends for stocks and cryptocurrencies, potentially boosting markets for the remainder of 2024. Despite the initial sell-off, markets are likely to stabilize unless another major event impacts the cryptocurrency sector.

In the meantime, aggressive accumulation by bulls and increasing negative sentiment among the crowd could set the stage for a substantial market rebound.

Understanding the broader impact

Despite the anticipation surrounding the FOMC meeting, the impact on cryptocurrencies was limited as the pause on rates had already been factored into prices. Previous Fed decisions have shown minimal major impact on Bitcoin prices.

Historically, FOMC actions affect all asset classes. In 2020 and 2021, Bitcoin and other altcoins soared when the Fed cut rates to zero, only to reverse course in 2022 when rates began to rise. Investors moved trillions of dollars into lower-risk assets, with money market funds amassing over $6.1 trillion, earning an average return of 5%.

Furthermore, Bitcoin’s immediate resistance is noted at $66,852, with support at $65,000. The RSI is signaling oversold conditions, suggesting further declines are possible if the price falls below $65,900.

Investors are now closely watching the FOMC meeting for clues about inflation and economic growth, which could influence Bitcoin’s next move.

-

News1 year ago

News1 year agoBitcoin (BTC) price recovery faces test on non-farm payrolls

-

Bitcoin12 months ago

Bitcoin12 months ago1 Top Cryptocurrency That Could Surge Over 4,300%, According to This Wall Street Firm

-

Altcoins12 months ago

Altcoins12 months agoOn-chain data confirms whales are preparing for altcoin surge with increased buy orders

-

Bitcoin12 months ago

Bitcoin12 months agoThe US government may start accumulating Bitcoin, but how and why?

-

News1 year ago

News1 year agoNew ByBit Listings for 2024: 10 Potential Listings

-

News1 year ago

News1 year ago11 Best Crypto TikTok Accounts & Influencers in 2024

-

Altcoins1 year ago

Altcoins1 year agoMarket giants have taken action!

-

News1 year ago

News1 year ago11 Best Shitcoins to Buy in 2024: The Full List

-

Ethereum1 year ago

Ethereum1 year agoTop Meme Coins by Market Capitalization in 2024

-

News1 year ago

News1 year ago1.08 Trillion SHIBs Dumped on Major Crypto Exchange, What’s Going On?

-

News1 year ago

News1 year ago19 Best Crypto Games to Play in 2024

-

Altcoins1 year ago

Altcoins1 year agoAltcoin Recommended by Crypto Expert for Today’s Portfolio