Ethereum

Is Ethereum a Good Investment in 2024?

Last updated:

May 7, 2024 18:57 EDT

| 16 min read

With the release of smart contracts, new consensus mechanisms, and improvements to network efficiency, the cryptocurrency market has grown exponentially in recent years, leading many investors to ask, is Ethereum a good investment? Throughout this guide, we’ll be taking an in-depth look at Ethereum, analyzing its utility and potential for growth in the future. Let’s get started.

Is Ethereum a Good Investment? Our Verdict

Yes, our verdict is that Ethereum is a good investment. As the crypto market expands, there will likely be a sharp increase in the number of applications built upon the Ethereum network. This will naturally result in significantly boosted demand for the ETH token, in turn pumping the token’s price.

Ethereum is one of the most proactive blockchains in developing and upgrading its network and following the Merge in 2022, which cut energy usage by an estimated 99.95%. Other upgrades are in the pipeline, only helping to further boost its performance.

Ethereum remains, by far, the most popular network for decentralized app (dApp) builders and developers, with almost 1,000 major protocols built on its network as well as thousands of meme tokens and NFT collections. In fact, Ethereum’s TVL, (total value locked, the combined value of projects built on its network) is over $50 billion, more than five times nearest rival Tron ($9.8bn TVL).

That is unlikely to change any time soon making Ethereum, by far, the most useful cryptocurrency and giving it a huge network of reliant projects – even if that isn’t always reflected in the current price of ETH. With this in mind, we’ve reached a positive verdict on whether Ethereum is a good investment. While the coming months are likely to be rather rocky, over the long-term Ethereum should perform quite well.

How Ethereum Has Performed Since Launch & in 2024

Ethereum has been performing well since its official launch in 2014, when the price of ETH was just $0.31 during its initial coin offering (ICO). Based on the asset’s past performance, it will have likely provided great returns to investors that gave it enough time to grow. Regardless of when an investor picked up ETH, historically, it’s been possible to turn a profit simply by waiting, making ETH a great long-term crypto investment.

Investors that bought into the asset during its 2018 highs, would’ve had to wait until at least 2021 just to break even. However, given that ETH was held to the bull run’s peak, investors could’ve netted themselves returns of around 275% or an annualized rate of 91.66%.

Furthermore, anyone that invested during the 2017 high would’ve secured 482% in returns. With this in mind, while it’s true that anyone that bought ETH at the peak of the 2021 bull would be down roughly 65% at today’s prices, given enough time they could end up securing huge returns, especially given the continued improvements to the Ethereum network, that have massively boosted efficiency, scalability and transaction price.

The same is true for investors that got involved during the January 2022 dip, while they would currently be down around 53%, given a few years in the market, it’s possible that ETH could yield annualized returns similar to its last run. As such, ETH could be the best crypto to buy in the crash right now.

- Since its launch, Ethereum has increased in value by millions of percent.

- Investors that stocked up on ETH during the 2017 run would be enjoying 482% returns.

- Anyone that purchased ETH in 2018 would have earned an annualized return of 91.66%.

- After hitting a new all-time high in 2021. ETH has been on a steady decline.

- Throughout 2022, the price of ETH fell alongside the wider market.

- 2023 brought better performance with the coin reaching a yearly high of $2,120 in April.

- In September 2023, ETH is around 40% up from its price in January.

- 2024 has been a strong year for Ethereum so far, and in March it came close to beating its ATH when it hit $4,067.

- Ethereum is currently trading at $2,921.11.

Ethereum Price History

Launched back in 2014, Ethereum has grown from a humble initial coin offering (ICO) into a titan of industry and the second-largest cryptocurrency on the market. The asset, now boasting a price tag of around $1,600 was originally sold for just $0.311 during its ICO, a discount of 99.97% compared to today’s figure.

As Ethereum’s smart contract ecosystem grew and began to attract attention from developers, the price of ETH exploded, rising from a 2017 low of just $8.17 to a high of $820.24, an increase of nearly 10,000%. Naturally, this fast growth led many investors to wonder is investing in Ethereum a good idea.

This trend continued into 2018, with Ethereum growing massively. Likely helped along by the fact that the world’s largest blockchain game (at the time), CryptoKitties was built on the Ethereum network, leading many other developers to follow suit. At its peak price in 2018, the price of ETH soared, hitting $1,270.47.

However, what goes up must come down. Over the next couple of years the price of Ethereum, one of the fastest-growing cryptocurrencies on the market at the time, slowly declined. Throughout 2018 ETH fell as low as $90.60 and traded between $150 and $200 during 2019.

Over this same period, the price of Bitcoin fell from $19,118 to a low of $3,460.55. The ETH price stayed within this range until late 2020 promoting crypto enthusiasts everywhere to wonder will Ethereum go up.

While things were looking bleak, the cryptocurrency market picked up significantly as thousands of investors entered the market, pushing ETH to new heights, first taking the asset to $4,174, then even further to an all-time high of $4,878.26 on November 10, 2021.

Like the rest of the market, Ethereum has suffered through a prolonged bear market since those highs, with macroeconomic factors such as the Russia-Ukraine War, inflation, plus the collapse of various crypto companies, including FTX, seeing the price dip below $1,000 in mid-2022.

ETH rose steadily in 2023 – and was up as much as 77% between January and June to a high of $2,100. It surpassed that high in 2024, and its present-day valuation stands at $2,921.11.

Ethereum Highs and Lows

Below, we’ve summarized the highs and lows of Ethereum since its launch, putting the asset’s growth in perspective, and making it simpler to determine is Ethereum a good investment.

- Early 2014 – Ethereum was released as an ICO with ETH available for around $0.311

- Mid-2017 – Ethereum slowly grew, then exploded in 2017, rising from $8.17 to $820.

- Throughout 2018 – More investors piled into the market, pushing the price of ETH to $1270.47.

- During 2019 – After hitting a new high in 2018, ETH incrementally declined, falling to $175.

- Late 2020 to 2021 – The crypto market rapidly grew, causing ETH to surge to $4,733.

- Throughout 2022 – Ongoing bear market that saw collapse to a low of $990 in June 2022.

- January 2023 to June 2023 – Started the year at $1,100 and rose to $2,100 in June.

- July 2023 – March 2024 – After a dip, it started the path towards recovery, coming close to a new all-time high.

- Present Day – Currently trading at around $2,921.11

Ethereum Price Forecast

To ensure that our forecast is as accurate as possible, we’ve taken a huge variety of different factors into account. A few of these include the economy as a whole, the crypto market, potential competitors, and even Ethereum’s utility as well as any planned updates to the network. Let’s dive into our prediction.

- End of 2024 – Moving onwards, as long as nothing unexpected occurs, we’ll likely see the economy begin its path to recovery, something likely to have a very positive impact on the crypto and stock market. The next Bitcoin halving is also approaching, which has sparked all previous bull runs. This will likely lead to Ethereum trading for an average of $3,000, an increase of around 75% over today’s prices.

- End of 2025 – With more time to build positive traction, continued updates and widespread crypto adoption, we could see some impressive moves from the price of ETH during 2025. It seems likely that a retest of the asset’s prior high will be required. This would place the value of ETH at approximately $4,900.

- End of 2030 – The Ethereum team will have had plenty of time to work on developing new features and any improvements to the network currently in the pipeline may have rolled out. Combined with the expected growth of the crypto market (11.1% annually), we could see ETH hit $7,985 with a high of $10,000 also possible.

Ethereum Utility – What Does the Future Hold?

When it comes time for an investor to answer the question, should I buy Ethereum now, it’s crucial to consider the project’s long-term utility – which is among the very best in the crypto space. It’s impossible to predict the market’s movements with 100% accuracy, but investing in utility-centric projects drastically increases the chances of an investment paying off over the long term.

To make it more simple for investors to determine whether Ethereum holds enough utility to be considered a worthwhile investment, we’ve outlined a few of its top uses below.

Smart Contracts

Perhaps the most widely used feature of the Ethereum network is its smart contract capabilities. Developers can build their own decentralized applications known as dApps, directly on the Ethereum network.

This helps to facilitate interoperability between applications and allows new projects to take advantage of the various benefits offered by an established network like Ethereum. Numerous high-profile and highly important protocols are based on Ethereum, including the likes of Lido, Maker, Aave and Uniswap.

A number of the largest meme coins in the space are also ERC-20 tokens, powered and secured by Ethereum, including Shiba Inu, Pepe and Floki. As applications created on the Ethereum network boost demand for the ETH, this could be phenomenal for the long-term growth of this innovative proof-of-stake crypto.

Network Upgrades

The recent update to the Ethereum network, known as the Merge, switched Ethereum from the proof-of-work consensus mechanism to proof-of-stake. This has created a new economy on the network, with ETH holders able to earn rewards for validating transactions and adding to the network’s security.

This incentivizes long-term holds and rewards the project’s top supporters. On top of introducing staking to the network, the Merge has paved the way for sharding to be introduced to the network. This will allow transaction data to be split among the network, sharply increasing throughput and reducing congestion during periods of load. Ethereum is one of the most active networks for consistently trying to improve and upgrade its network.

Security

One of the greatest benefits of the Ethereum network is its security. Achieved through decentralization, Ethereum is considered to be one of the most secure networks on the planet. As a result, it’s commonly used for sensitive applications, like Aave which is a crypto lender and Lido, which offers liquid staking. With the rate at which crypto hacks are increasing, developers will aim to build on secure networks, boosting the demand for Ethereum.

NFTs

The NFT sector has struggled badly since the 2021 boom – much more so than crypto investment – but it remains one of the most rapidly evolving areas in cryptocurrency. A large portion of the best NFTs are built on the Ethereum network, including the likes of Crypto Punks and the Bored Ape Yacht Club. Naturally, this has drastically increased the number of transactions taking place on the network, booting its dominance. With NFTs quickly being picked up by mainstream companies this is very promising for Ethereum.

Is Ethereum a Good Long-Term Investment or Short-Term Investment?

For investors considering is now a good time to buy Ethereum, it’s important to have an investing plan in place. This means determining which prices to buy and sell at and also deciding whether you want to hold Ethereum as a long or short-term investment. We’ll be discussing the merit of ETH with both strategies, making it simple for investors to choose the one right for them.

If you’re wondering should I invest in Ethereum over the short term, it’s important to take the performance of the wider economy into consideration. With assets across the board taking a beating and mass uncertainty being present in the crypto market, it’s probably best to avoid a shorter-term investment in ETH, until the market gets a clear directional bias.

On the other hand, as a long-term investment, Ethereum has excellent merit – the project boasts a wide array of utilities, a strong use case and is consistently attempting to improve. Furthermore, a number of the world’s largest crypto-assets are built upon the Ethereum network, a clear indicator of longevity. As it stands today, anyone holding ETH for at least 2 years would be in profit, so ETH could work well as a long-term hold.

What Experts Say on Whether You Should Invest in Ethereum

Many experts have strong feelings on the topic is Ethereum still a good investment. While hundreds of prominent figures have shared their opinions regarding this top trending crypto.

- Capital.com, a popular broker discussed the potential of Ethereum saying that the improvements to the network’s scalability and throughput are likely to offer a sizable long-term boost to the asset. The broker summarized predictions from various outlets, almost all of which offered a positive outlook over a 6+ month period.

- Time, a well-known media outlet shared the thoughts of Mike McGlone, an intelligence analyst for Bloomberg. McGlone predicted that Ethereum could end 2022 trading for roughly $4,000 to $4,500. However, another market analyst, Wendy O expects ETH will drop to around $750, providing a mixed answer to the question is Ethereum a good investment.

- WalletInvestor a prominent price prediction platform, shared its rating for Ethereum giving the smart contract network an A+. The predictions platform also stated that according to their forecasts, an increase in the price of Ethereum is expected over the coming years making it a solid long-term pick.

Where to Buy Ethereum

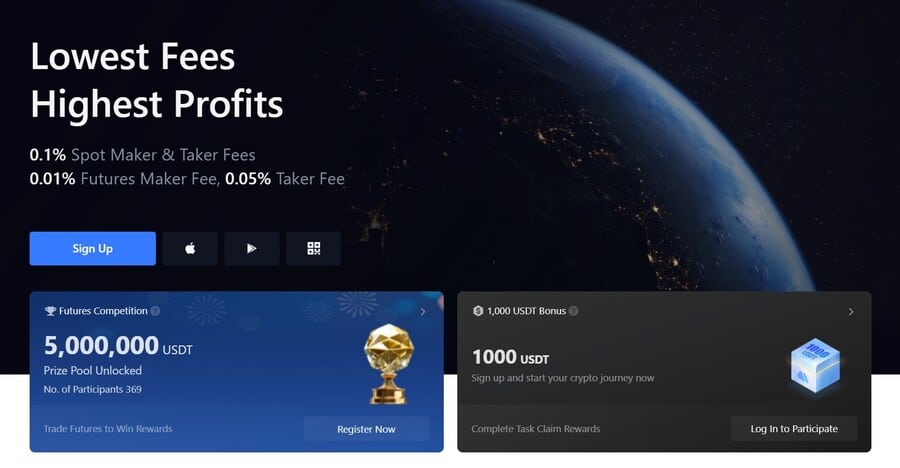

Investors trying to determine is it a good time to buy Ethereum will also likely be wondering where they can pick up the digital asset. We’ve included a review of MEXC, a leading crypto exchange and our top pick for the best exchange to buy ETH.

MEXC – Popular Crypto Exchange With 0.1% Spot Trading Fees

MEXC is a crypto exchange that offers over 1,700 tokens to trade with low spot fees of 0.1% and futures fees from 0.01%. This means that not only is MEXC an excellent choice to buy ETH, but also to trade it on the spot market or the futures market with leverage.

If you’re looking to simply buy ETH, you can do so quickly when you deposit funds via bank transfer or via third-party providers such as Mercuryo, Banxa, Moonpay and Simplex. These providers let you buy ETH with a card, with Apple Pay or Google Pay.

Note, these come with a slightly higher fees than if you made a bank deposit and purchased ETH on the spot market. But sometimes, buying ETH faster, even if it comes with higher fees, could be a better option, especially if the price of ETH soars. Once you have your ETH, you can withdraw it to your wallet, such as MetaMask, or you can keep some of it on the exchange and stake it with MEXC Savings where you can get up to 4.80% annual percentage yield.

Keeping it on the platform can also be useful if you need instant liquidity. With MEXC Loans you can use your ETH as collateral to borrow funds. MEXC offers additional features such as copy trading, where you can copy popular traders, you can get new tokens from the MEXC Launchpad, or learn to trade with demo accounts.

Should I Buy Ethereum Now? Our Verdict

Now that we’ve covered the factors influencing our verdict, it’s time to answer the question, is it still a good time to buy Ethereum? While the short-term outlook of just about every financial market leaves a lot to be desired right now, Ethereum seems to be very strong in a macro sense.

Just about every long-term (2+ years) ETH holder would currently be in profit, with the only exception being those that invested during the 2021 bull run. As such, it’s clear that Ethereum provides a great long-term opportunity.

With Ethereum boasting strong utility and a clear plan for future developments, our Ethereum price predictions look rather promising. 2024 could see a bull run for Ethereum, and we expect that ETH could reach between $7,500 to $10,000 during 2030, an increase of 350% on the low end. While the experts seemed mostly divided on how Ethereum might perform over the short term, one thing was clear, long-term growth was expected by most.

It seems as though most people believe Ethereum will play a crucial role in the crypto space over the next few years, so it’s not an asset to overlook. All in all, while its short-term potential is murky, Ethereum seems like a strong long-term investment. As such, it could be a good time to buy Ethereum, for investors focused on the macro perspective.

Coins to Consider Alongside Ethereum

Now that we’ve answered the question as to whether Ethereum is a good investment, it seems fitting to discuss a couple of smaller projects built on the Ethereum network, that could provide even greater returns than ETH.

Bitcoin Minetrix – Stake-to-Mine Project Offering Huge 6,000% APY During Presale

Bitcoin Minetrix ($BTCMTX) is a new ERC-20 token launched on Ethereum that is the world’s first stake-to-mine crypto project. The project has seen incredible interest from investors and has already raised more than $12 million.

As well as offering incredible staking rewards – with the current APY sitting at over 6,000% – Bitcoin Minetrix token holders can also mine Bitcoin. This works by staking tokens which then generate cloud mining credits. They can be burnt to earn allocated mining time, with mined BTC sent back to the user.

The whole process is managed via a dedicated mobile app and takes all the risk out of cloud mining – which has been a hotbed for scammers – by tokenizing the process. That means there are no upfront fees or long fixed-term contracts to agree, with Bitcoin Minetrix holders able to stake as much or as little as they like and unstake at any time and sell their tokens on an exchange.

The project is still in presale. Tokens currently cost $0.014 but will steadily keep on increasing until the final stage. There is a max supply of 4 billion tokens, with 2.8 billion available during the presale. More information and the latest news can be found in the whitepaper or on Telegram.

| Presale Started | 26 Sept 2023 |

| Purchase Methods | ETH, USDT, BNB |

| Chain | Ethereum |

| Min Investment | $10 |

| Max Investment | None |

Is Ethereum a Good Investment FAQs

Is Ethereum a good investment in 2024?

Every investor will have a different opinion of what constitutes a good investment. However, with Ethereum constantly working on developing new features and with most people expecting ETH to slowly increase in value, Ethereum could be a good investment in 2024.

What Ethereum be worth in five years?

It’s difficult to predict the value of an asset in the future, but based on the growth of the crypto market and the planned improvements to the Ethereum network, we could see the value of ETH at around $5,000 by 2025 and around $7,500 in five years times.

Is it worth buying Ethereum now?

Is Ethereum a good investment? This is the question on the minds of thousands of investors. Right now, ETH can be purchased for around $2,921.11. If you were debating buying ETH at $4,000+ it’s most probably worth buying today.

Is Ethereum a safe investment?

While every investment has its own risks, the general consensus among professional investors and traders seems to be that Ethereum will grow steadily over the coming years.

References

About the Author

Jay, a UK-based cryptocurrency expert, specializes in fundamental analysis and focuses on medium to long-term investments in the crypto market. With considerable hands-on experience in financial market analysis and technical analysis, Jay is currently concentrated on exploring the institutional adoption of cryptocurrency and its implications for the future of the asset class. His insights have been featured in several high-profile publications, including Finance Illustrated, EconomyWatch, and Business2Community.

About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.

Ethereum

Crypto Token Ether (ETH) Rebounds Following Complaint About SEC Investigation Into Ethereum

The Ether token posted its best gain this week amid speculation that U.S. regulatory oversight of the blockchain ecosystem underlying the second-largest digital asset could ease.

The token climbed as much as 3.6% on Wednesday before paring some of its advance to trade at $3,562 as of 12:53 p.m. in Singapore. The rally was a modest tailwind for market leader Bitcoin and a string of smaller rivals.

Ethereum

Will they capture the same buzz in the market?

The launch of Ethereum spot exchange traded funds Exchange traded funds (ETFs) attracted significant market interest on July 23, with initial inflows surpassing $100 million. This is a notable change from the previous four days of outflows for U.S. spot Ether ETFs, which saw a total of $33.67 million in new investments.

This figure was, however, partly offset by an outflow of $120.28 million from Grayscale’s Ethereum Trust (ETHE). However, many crypto analysts believe that the Ethereum ETF will soon follow bitcoin’s path.

Ethereum ETF to Track Bitcoin

Katalin Tischhauser, head of investment research at Sygnum Bank and a former Goldman Sachs executive, predicted that Spot Ether exchange-traded funds could attract as much as $10 billion in assets under management in their first year.

She also predicted that Bitcoin ETFs could see inflows of $30 billion to $50 billion in their first 12 months, with Ethereum products likely following the same path.

Tischhauser noted that investing in Ethereum offers distinct advantages over Bitcoin. While Bitcoin is primarily viewed as a store of value, Ethereum’s value comes from revenue and cash flow. This makes Ether more relevant to traditional institutional investors compared to the perception of Bitcoin as “digital gold.”

Fee waivers to attract institutional investors

To attract institutional investors, several ETF issuers are waiving fees for their Ethereum spot funds. Franklin Templeton announced a 0.19% sponsorship fee, but will waive it for the first $10 billion in assets for six months. Meanwhile, Bitwise and VanEck will charge a 0.20% fee through 2025.

BlackRock revised its registration statement for its spot Ethereum ETF, ETHA, to include a 0.25% management fee. Grayscale launched its Grayscale Ethereum Mini Trust with the same 0.25% fee.

Ethereum ETFs Exclude Staking

The enthusiasm is, however, tempered by the lack of staking rewards of these ETFs. In May, BlackRock, Grayscale and Bitwise removed staking provisions from their SEC filings after discussions with the SEC.

As traditional investment institutions are limited by regulations and legal constraints, they can only invest through ETFs, without resorting to staking.

Also see: Crypto News Today: Bitcoin, Ethereum Brace for Volatility as Fed Holds Rates

Ethereum

SEC Hints It May Approve Ethereum ETFs at Last Minute, But ‘No Issuers Are Ready’

It sounded like an almost certain rejection from the Securities and Exchange Commissionbut just hours before the May 23 deadline to rule on VanEck’s application to launch an Ethereum spot exchange traded fundIt appears that the SEC may reconsider its decision.

CoinDesk First reported On Monday, the nine potential issuers that had filed to list and trade the ETFs were “abruptly” asked by regulators to update their 19b-4 filings on an expedited basis. A 19b-4 is what an exchange like the NYSE requires for new product introductions — in other words, the applicants and the exchange ask the SEC for permission to add the ETFs to their platforms.

Since rumors began circulating Monday afternoon, the price of Ether has climbed nearly 20%, trading near $3,750 as of 1:30 p.m. ET Tuesday.

It’s hard to believe that the SEC would do us a favor by approving the ETH spot ETF.

But politics is politics, and crypto has been winning the political battle for months.

Perhaps the Biden camp saw how many voters Trump could win over with a single pro-crypto comment and decided to change course.

— Jake Chervinsky (@jchervinsky) May 21, 2024

Since VanEck is the first exchange to file, its approval could hypothetically be a green light for others waiting to hear about their own 19b-4s. While rumors began circulating Monday that applications were being worked on, Bloomberg analysts updated their ratings from 25% to 75% approval.

But the news left issuers scratching their heads. Every issuer Bloomberg ETF analyst James Seyffart spoke to was “caught off guard by the SEC’s 180-degree turn,” he told Fortune. The agency reached out to filers for comment and updates just three days before the deadline, he said.

“This is not standard operating procedure, and everyone from issuers to exchanges to lawyers to market makers and more are scrambling to be ready for eventual approval and to meet SEC requirements,” Seyffart adds. The hasty nature of the pivot suggests it was likely a “political move,” the result of a “top-down decision” by the Biden administration, he speculates. “No issuer is ready,” he wrote on X.

It’s hard to believe that the SEC would do us a favor by approving the ETH spot ETF.

But politics is politics, and crypto has been winning the political battle for months.

Perhaps the Biden camp saw how many voters Trump could win over with a single pro-crypto comment and decided to change course.

— Jake Chervinsky (@jchervinsky) May 21, 2024

So far, Grayscale is the only potential issuer to post an update 19b-4 to the New York Stock Exchange website, for its application to transfer its Ethereum Mini Trust ETF. Meanwhile, Fidelity has abandoned its plan to put Ether in its ETF, according to a S-1 Update The filing was made with the SEC early Tuesday. In previous filings, the company had said it intended to “stake a portion of the trust assets” to “one or more” infrastructure providers, but now it “will not stake Ether” stored with the custodian.

Staking involves committing Ether to secure the network in exchange for a yield, which is currently around 3%, according to data from staking service Lido. Ark and Franklin Templeton have also considered staking in their applications. In today’s 19b-4 update from Grayscale, the company confirmed that it would not participate in staking. The fact that Grayscale highlighted this and Fidelity omitted it suggests that the SEC may have asked that staking be banned. Vance Spencer, co-founder of Business executivestold Fortune he believed the SEC’s last-minute requests included advice on staking.

Staking the underlying Ether in the ETF has been seen as a reason the SEC could reject the applications, with Chairman Gary Gensler expressing concern in March that digital assets using staking protocols could be considered securities under federal law. Staking could be “a significant complication,” Bitwise CIO Matt Hougan said. previously said Fortune.

However, even if the SEC approves VanEck’s 19b-4 on Thursday, it doesn’t guarantee clearance, as exchanges will need S-1 filings from issuers before the products can begin trading. When filing to launch a new security, an S-1 is the form that describes to potential investors and the SEC the structure of the asset, how it will be managed and, in this case, how it plans to mirror the performance of the underlying asset, namely Ether tokens.

But S-1 projects could take “weeks, if not months” to be approved, Seyffart said. written on X“That said, if we are correct and see these theoretical approvals later this week, that should mean that S-1 approvals are a matter of ‘when’ and not ‘if.’”

Recommended newsletter:

CEO Daily provides essential context for the information business leaders need to know. Every weekday morning, more than 125,000 readers trust CEO Daily for insights into leaders and their businesses. Subscribe now.

Fuente

Ethereum

FOMC Holds Interest Rates Steady, Bitcoin and Ethereum Prices Fall

After Federal Reserve Chairman Jerome Powell said a September rate cut “could be on the cards,” stocks soared to session highs. The tech-heavy Nasdaq 100 climbed 3.3% and the S&P 500 climbed 2%. However, the king cryptocurrency Bitcoin (BTC) fell 1.3% to $66,088, and Ethereum (ETH) fell about 1.11% to $3,313. Over the past 24 hours, the global cryptocurrency market cap also fell 0.71% to $2.39 trillion.

However, market analysts believe that this is a short-term decline, as Bitcoin and other cryptocurrencies, despite being in a bearish situation, are showing bullish signals. Although BTC is still struggling to break the $70,000 mark, it will be interesting to see how BTC will react in August before the rate cuts.

Federal Reserve Decision

On July 31, the U.S. Federal Reserve concluded a two-day meeting of the Federal Open Market Committee (FOMC) by choosing to keep benchmark interest rates unchanged at 5.25%-5.50%, in line with Wall Street expectations. The decision marked the eighth consecutive meeting without a rate change.

Towards a market rebound?

According to SantimentThe FOMC’s decision to maintain current interest rates led to an initial decline in cryptocurrency prices. Traders were hoping for a rate cut, which hasn’t happened since March 2020. A future rate cut could signal bullish trends for stocks and cryptocurrencies, potentially boosting markets for the remainder of 2024. Despite the initial sell-off, markets are likely to stabilize unless another major event impacts the cryptocurrency sector.

In the meantime, aggressive accumulation by bulls and increasing negative sentiment among the crowd could set the stage for a substantial market rebound.

Understanding the broader impact

Despite the anticipation surrounding the FOMC meeting, the impact on cryptocurrencies was limited as the pause on rates had already been factored into prices. Previous Fed decisions have shown minimal major impact on Bitcoin prices.

Historically, FOMC actions affect all asset classes. In 2020 and 2021, Bitcoin and other altcoins soared when the Fed cut rates to zero, only to reverse course in 2022 when rates began to rise. Investors moved trillions of dollars into lower-risk assets, with money market funds amassing over $6.1 trillion, earning an average return of 5%.

Furthermore, Bitcoin’s immediate resistance is noted at $66,852, with support at $65,000. The RSI is signaling oversold conditions, suggesting further declines are possible if the price falls below $65,900.

Investors are now closely watching the FOMC meeting for clues about inflation and economic growth, which could influence Bitcoin’s next move.

-

News1 year ago

News1 year agoBitcoin (BTC) price recovery faces test on non-farm payrolls

-

Bitcoin12 months ago

Bitcoin12 months ago1 Top Cryptocurrency That Could Surge Over 4,300%, According to This Wall Street Firm

-

Altcoins12 months ago

Altcoins12 months agoOn-chain data confirms whales are preparing for altcoin surge with increased buy orders

-

Bitcoin12 months ago

Bitcoin12 months agoThe US government may start accumulating Bitcoin, but how and why?

-

News1 year ago

News1 year agoNew ByBit Listings for 2024: 10 Potential Listings

-

News1 year ago

News1 year ago11 Best Crypto TikTok Accounts & Influencers in 2024

-

Altcoins1 year ago

Altcoins1 year agoMarket giants have taken action!

-

News1 year ago

News1 year ago11 Best Shitcoins to Buy in 2024: The Full List

-

Ethereum1 year ago

Ethereum1 year agoTop Meme Coins by Market Capitalization in 2024

-

News1 year ago

News1 year ago1.08 Trillion SHIBs Dumped on Major Crypto Exchange, What’s Going On?

-

News1 year ago

News1 year ago19 Best Crypto Games to Play in 2024

-

Altcoins1 year ago

Altcoins1 year agoAltcoin Recommended by Crypto Expert for Today’s Portfolio