News

Why is the cryptocurrency market declining in 2024? – Forbes INDIA Consultant

The cryptocurrency market has recently suffered a downturn, with the total market capitalization falling by approximately 7.68% to $2.27 trillion the previous day. Bitcoin, the largest cryptocurrency, is currently trading at $67,279, down 7.69% over the past seven days but reflecting a rise of 4.98% over the past 24 hours. Ethereum, the second largest cryptocurrency, is trading at $3,527, down 10.25% over the past seven days.

Cryptocurrency market capitalization has fallen from $2.73 trillion to $2.53 trillion over the past seven days, while 24-hour trading volume stands at $148.02 billion. The month was marked by significant cryptocurrency price fluctuations, most notably with Bitcoin reaching a new all-time high of $73,750 before subsequently collapsing to the $62,000 level in a matter of weeks. It remains uncertain whether the second half of the month will bring slower growth or whether cryptocurrencies will reach new all-time highs again.

Featured partners

Inheritance

Over 1 million investors trust Mudrex for their cryptocurrency investments

Safety

Mudrex is the Indian government. Recognized platform with 100% insured deposits stored in encrypted wallets

Commissions

Enjoy zero cryptocurrency deposit fees and the best rates in the industry.

Award-winning broker

Listed in Deloitte Fast 50 Index, Best Global FX Broker of 2022 – ForexExpo Dubai October 2022 & more

Best-in-Class for investment offerings

Trade over 26,000 assets with no minimum deposit

Customer care

Dedicated 24/7 support and easy registration

Welcome bonus on first deposit:

Get $30 in your verified trading account on your first deposit.

Variety:

Trade CFDs on cryptocurrencies, forex, stocks, metals, commodities and more!

Intuitive and economical:

Designed for traders of all levels, from beginners to professionals.

We invite you to invest carefully, your capital is at risk

How is the cryptocurrency market doing?

The cryptocurrency market is showing significant volatility, with prices fluctuating unpredictably. Currently, there is a decline after Bitcoin surpassed its all-time high several times this month. According to the latest update, the Fear and Greed index is equal to 82.34, indicating a state of extreme greed.

CoinMarketCap

The decline in cryptocurrency market capitalization coincides with the largest single-day outflow ever seen from Spot Bitcoin ETFs. Bitmex Research Reports that the Grayscale Bitcoin ETF saw its largest outflows of $642.5 million on March 18, 2024. Meanwhile, the Fidelity Bitcoin ETF saw its lowest inflows at $5.9 million . As a result, Spot Bitcoin ETFs experienced a net outflow of $154.3 million. The decrease in capital flow into Bitcoin ETFs occurred in anticipation of the Federal Open Market Committee meeting scheduled for yesterday.

On Wednesday, the Federal Reserve held interest rates stable as expected, but signaled its plan to implement several rate cuts before the end of the year. After the two-day political meeting, the Federal Open Market Committee (FOMC) announced its decision to keep its benchmark overnight borrowing rate in the range of 5.25% to 5.5%, which has remained unchanged since July 2023. In addition to this announcement, Fed officials predicted rate cuts rates by three-quarters of a point by the end of the year, representing the first reductions since the start of the Covid pandemic in March 2020.

The decline is part of a broader correction that began on March 14, coinciding with a local peak of around $2.72 trillion. First, signs of bearish divergence appeared before the correction, evident in the growing market capitalization along with the decline in the daily Relative Strength Index (RSI), suggesting a weakening of the underlying strength in price growth. Second, the market’s daily RSI reached excessively high levels prior to the correction, signaling overvaluation and causing traders to reduce demand due to the perception of inflated prices.

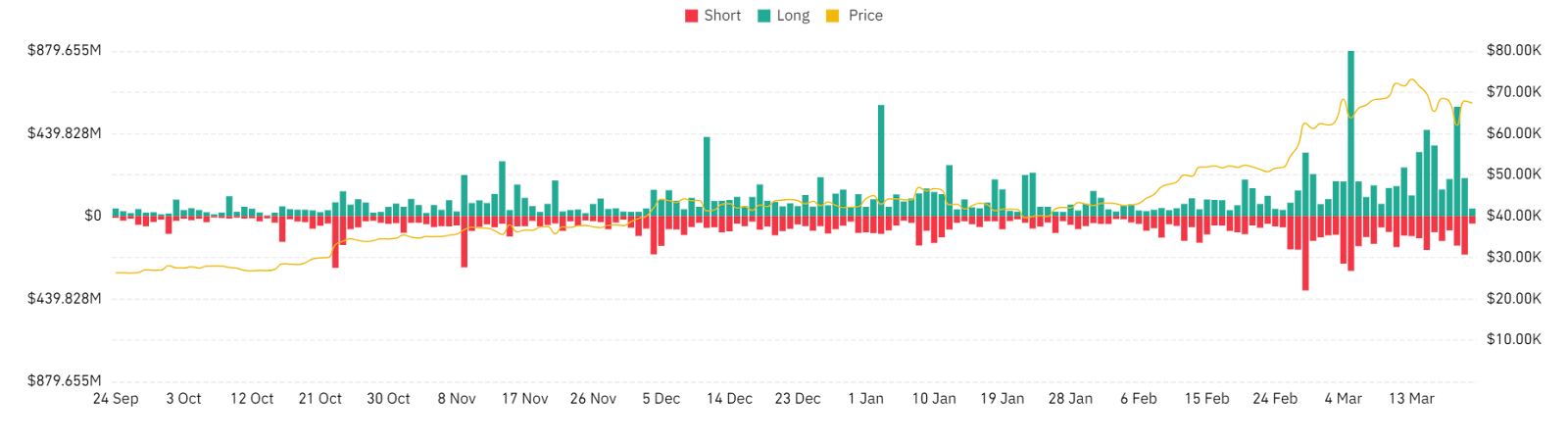

The significant drop in prices of major cryptocurrencies has triggered numerous liquidations in the derivatives market, surprising bullish traders and causing a wave of liquidations of long positions. According to Coinglass data, the cryptocurrency market has seen more than $161.52 million in positions liquidated, with long positions accounting for around $70 million of the total in the past 24 hours.

Coinglass: Total Liquidations Chart

Coinglass: Total Liquidations Chart

Liquidation of long derivatives positions can put downward pressure on asset prices, especially in the absence of sufficient buying momentum indicated by trading volumes.

As of March 21, 2024, BTC is trading at $67,261, approximately 8.95% from its all-time high, while ETH is trading at $3,544, or approximately 27.61% from its all-time high.

However, market sentiments have transformed from extreme greed, greed, extreme greed. This is the nature of the cryptocurrency market which is highly volatile and unpredictable. The current volume in the digital cryptocurrency market amounts to $147.82 billion.

The cryptocurrency market has undoubtedly responded positively to global financial uncertainty thus far and is still holding strong amid a tightening credit situation with shaky bond market volatility. Cryptocurrencies cannot navigate alone, for a balanced climate all other financial assets must follow the same sentiments.

Is investing in cryptocurrencies safe?

The cryptocurrency market has seen the good and the bad side of the market, whether it is the post-Russia-Ukraine effects, the collapse of Earth-Moon, the collapse of FTX or the tightening of fiscal regulation, it has witnessed the most storms violent in recent years.

The year 2023 gave a new beginning to the world of cryptocurrencies, showing positive signs of recovery. Cryptocurrency investors believe that in situations like this, investing in stable digital currencies like Bitcoin and Ethereum in SIP format is a safe choice. Cryptocurrency experts believe that in the overall portfolio, investors should look to invest only 5% exposure to cryptocurrencies. The most important part is to invest only a tiny amount and not your entire life savings as the market is highly volatile and there are chances of you losing everything.

Steps on how to invest in the Indian cryptocurrency market

Step 1: Select a Cryptocurrency: Choose a cryptocurrency you want to invest in. Like any other asset class, cryptocurrency has its fundamentals and different blockchain networks that support them, intrinsic value, and mining techniques. Be sure to research and analyze before investing as the cryptocurrency market is highly volatile.

Step 2: Select a Cryptocurrency Exchange: After you have decided on a cryptocurrency, it is time for you to find a cryptocurrency exchange platform that is perfect for you. It is a necessity to have a functional account in a cryptocurrency exchange that will help you buy and sell cryptocurrencies. Check out our article on best cryptocurrency exchanges in India.

Step 3: KYC: Once you have selected a cryptocurrency exchange you need to register by providing personal details like name and address and complete all the KYC formalities. After setting up your account you are ready to invest in cryptocurrency.

Step 4: Choose your payment method: To purchase a cryptocurrency you need to select a payment option that you find convenient. You can choose peer-to-peer, bank transfer, online payment methods or a crypto wallet.

Step 5: Buy Cryptocurrency: After adding funds to your account you can easily purchase the selected cryptocurrency. All you have to do is press on the “buy” tab and you can easily purchase the cryptocurrency of your choice.

Step 6: Storage: After purchasing cryptocurrencies, don’t forget to store your currencies safely because they are unregulated and you need to keep them safe as there is always a risk of hacking or theft. you can control crypto storage options from here.

Step 7: Selling cryptocurrency: This is as important as buying as it helps you earn money by investing. You can sell cryptocurrency the same way you bought it, just click on the “sell” tab in your wallet. You can fully or partially sell your cryptocurrency investment based on your choice, but don’t forget to book your profits timely.

Featured partners

Inheritance

Over 1 million investors trust Mudrex for their cryptocurrency investments

Safety

Mudrex is the Indian government. Recognized platform with 100% insured deposits stored in encrypted wallets

Commissions

Enjoy zero cryptocurrency deposit fees and the best rates in the industry.

Award-winning broker

Listed in Deloitte Fast 50 Index, Best Global FX Broker of 2022 – ForexExpo Dubai October 2022 & more

Best-in-Class for investment offerings

Trade over 26,000 assets with no minimum deposit

Customer care

Dedicated 24/7 support and easy registration

Welcome bonus on first deposit:

Get $30 in your verified trading account on your first deposit.

Variety:

Trade CFDs on cryptocurrencies, forex, stocks, metals, commodities and more!

Intuitive and economical:

Designed for traders of all levels, from beginners to professionals.

We invite you to invest carefully, your capital is at risk

Bottom line

It is a wise choice to cautiously observe the cryptocurrency market with the uncertain environment and slow recovery of macroeconomic situations in the world. Don’t make rash decisions because it is a good time to closely observe the market and analyze it.

We may never know, but the observation will ultimately help investors make smart decisions and they may have a preferred digital asset at a fair value, once the chaos situation has fully resolved.

News

Ether Drops Further After ETF Launch

Key points

- Spot ether ETFs began trading in the U.S. today, with the funds initially having more than $10 billion in collective assets under management.

- Analysts expect the launch of spot ether ETFs to have a net negative impact on the underlying price of ether in the near term, due to expected outflows from the pre-existing Grayscale Ethereum Trust.

- Spot Bitcoin ETFs continue to see strong inflows, with BlackRock’s IBIT alone seeing more than $500 million in inflows on Monday.

- Franklin Templeton, a spot ETF issuer on bitcoin and ether, has invested in a project that intends to bring Ethereum technology to Bitcoin.

Nine-point ether exchange-traded funds (ETFs)) started trading on the stock market on Tuesday, but all the optimism ahead of their approval did not translate into gains for the cryptocurrency markets.

Ether (ETH), the native cryptocurrency of the Ethereum blockchain, dropped less than 1% around the $3,400 level as of 1:30 PM ET, while Bitcoin (BTC) fell more than 2% to around $66,000.

Ether ETFs’ Debut Isn’t as Flashy as Bitcoin ETFs’

Spot ether ETFs began trading at just over $10 billion assets under management (AUM)), according to Bloomberg Intelligence analyst James Seyffart, most of that money is in the current Grayscale Ethereum Trust (ETHE) which has now been converted into an ETF.

“In the long term, Grayscale will simultaneously have the highest and lowest fees in the market. The asset manager’s decision to keep its ETHE fee at 2.5% could lead to outflows from the fund,” Kaiko Research said in a note on Monday.

Outflows from ETHE, if they occur, would be similar to those faced by Grayscale’s Bitcoin Trust (GBTC) after spot bitcoin ETFs began trading in January of this year, most likely due to high fees for the two original funds. Grayscale’s existing fund charges 2.5% fees, while a new “mini” ether ETF will charge 0.15% and commissions for other ETFs are set at 0.25% or less.

Such outflows could impact the price of ether and market sentiment.

“There could be a pullback shortly after the launch of Ethereum spot ETFs, i.e. outflows from Grayscale Ether Trust could dampen market sentiment in the short term,” Jupiter Zheng, a partner at Hashkey Capital’s liquid fund, told The Block.

But Grayscale remains optimistic.

“Compared to the splashy debut of spot bitcoin ETPs in January, the launch of ethereum ETPs has been relatively muted,” said Zach Pandl, Grayscale’s head of research, adding that investors may be “undervaluing” ether ETFs that are “coming to the U.S. market in tandem with a shift in U.S. cryptocurrency policy and the adoption of tokenization by major financial institutions.”

Bitcoin ETF Inflows Continue to Rise

As for bitcoin, there is clearly no lack of demand for spot ETFs, such as BlackRock’s iShares Bitcoin Trust (IBITS) recorded its sixth-largest day of inflows in its short history on Monday, at $526.7 million, according to data from Farside Investors. Daily inflows for the overall spot bitcoin ETF market also hit their highest level since June 5.

In particular, asset manager Franklin Templeton, which has issued both bitcoin and ether ETFs, appears to have decided to cover its back when it comes to Ethereum by investing in Bitlayer, a way to implement Ethereum technology on a second-layer Bitcoin network, according to CoinDesk.

News

Spot Ether ETFs Start Trading Today: Here’s What You Need to Know

Key points

- Spot ether ETFs will begin trading on U.S. exchanges on Tuesday. Nine ETFs will trade on Cboe BZX, Nasdaq and NYSE Arca.

- Ether ETFs offer investors exposure to the price of their underlying assets.

- Commissions on these new ETFs generally range from 0.15% to 0.25%.

- These ETFs do not provide exposure to Ethereum staking.

The U.S. Securities and Exchange Commission (SEC) has officially approved nine ether spots (ETH)exchange-traded funds (ETFs) for trading on U.S. exchanges. Trading for these new cryptocurrency investment vehicles begins today. Here’s everything you need to know.

What new ether ETFs are starting to trade today?

Spot ether ETFs starting trading today can be found at Quotation, NYSE Arkand Cboe BZX. Here’s a breakdown of each ETF you can find on these three exchanges, along with the fund tickers:

Cboe BZX will list the Invesco Galaxy Ethereum ETF (QETH), the 21Shares Core Ethereum ETF (CETH), the Fidelity Ethereum Fund (FETH), the Franklin Ethereum ETF (EZET) and the VanEck Ethereum ETF (ETHV).

Nasdaq will have the iShares Ethereum Trust ETF (ETHA) created by BlackRock, which also operates the largest spot bitcoin ETF under the ticker IBIT.

NYSE Arca will list the Bitwise Ethereum ETF (ETHW) and the Grayscale Ethereum Trust (ETHE). The Grayscale Ethereum Mini Trust (ETH), which will begin trading on the same exchange.

How does an ether ETF work?

Spot ether ETFs are intended to offer exposure to the price of ether held by the funds. Ether is the underlying cryptocurrency of the Ethereal network, the second largest crypto network by market capitalization.

ETF buyers are buying shares of funds that hold ether on behalf of their shareholders. Different spot ether ETFs use different data sources when it comes to setting the price of ether. Grayscale Ethereum Trust, for example, uses the CoinDesk Ether Price Index.

None of the ETFs launching today include pointed etherwhich represents a potential opportunity cost associated with choosing an ETF over other options such as self-custody or a traditional cryptocurrency exchange.

Ether staking currently has an annual return of 3.32%, according to the Compass Staking Yield Reference Index Ethereum. However, it is possible that the SEC will eventually approve Ether staking held by ETFs.

How can I trade Ether ETFs?

ETFs can simplify the trading process for investors. In the case of cryptocurrencies, instead of taking full custody of the ether and taking care of your own private keysSpot ether ETFs allow investors to purchase the cryptocurrency underlying the Ethereum network through traditional brokerage accounts.

Today, not all brokers may offer their clients spot ETFs on cryptocurrencies.

What are the fees for ether ETFs?

The fees associated with each individual spot ether ETF were previously revealed In the S-1 OR S-3 (depending on the specific ETF) deposit associated with the offerings. These fees are 0.25% or less for all but one.

The Grayscale Ethereum Trust, which converts to an ETF, has a fee of 2.5%. The Grayscale Mini Ethereum Trust has the lowest fee at 0.15%. These fees are charged on an annual basis for the provider’s management of the fund and are in line with what was previously seen with spot bitcoin ETFs.

Brokers may also charge their own fees for cryptocurrency trading.

News

Kamala Harris Odds Surge Amid $81M Fundraise. What Does It Mean for Bitcoin and Cryptocurrencies?

Market odds and memecoins related to US Vice President Kamala Harris have soared as the latest round of donations tied to the Democratic campaign raised $81 million in 24 hours, bolstering sentiment among some traders.

The odds of Harris being declared the Democratic nominee have risen further to 90% on cryptocurrency betting app Polymarket, up from 80% on Monday and setting a new high.

Previously, in early July, bettors were only betting on 8%, but that changed on Saturday when incumbent President Joe Biden announced he would no longer run in the November election. Biden then approved Harris as a candidate.

Polymarket traders placed $28.6 million in bets in favor of Harris, the data showsThe second favorite is Michelle Obama.

Somewhere else, Memecoin KAMA based on Solanaa political meme token modeled after Harris, has jumped 62% to set a new all-time high of 2 cents at a market cap of $27 million. The token is up a whopping 4,000% from its June 18 low of $0.00061, buoyed primarily by the possibility of Harris becoming president.

As such, Harris has yet to publicly comment on cryptocurrencies or her strategy for the growing market. On the other hand, Republican candidate Donald Trump has expressed support for the cryptocurrency market and is expected to appear at the Bitcoin 2024 conference on Saturday.

However, some expect Harris or the Democratic Party to mention the sector in the coming weeks, which could impact price action.

“While he has not yet received the official nomination, there is consensus that last night’s development is in line with current Democratic strategy,” cryptocurrency trading firm Wintermute said in a Monday note emailed to CoinDesk. “Keep an eye on Democrats’ comments on this issue in the coming days.

“The prevailing assumption is that Harris will win the nomination and any deviation from this expectation could cause market volatility,” the firm added.

News

Top 30x Cryptocurrency and Coin Presales Today: Artemis Coin at #1, Others Are: BlockDAG, 99Bitcoin, eTukTuk, and WienerAI

The cryptocurrency market has seen a lot of growth and imagination lately, with new ventures popping up regularly. A critical pattern in this space is the rise of crypto pre-sales, which give backers the opportunity to get involved with promising projects early on. Artemis is a standout option for crypto investors looking to expand their portfolios amid the many pre-sales currently underway.

Cryptocurrency presales, commonly referred to as initial coin offerings (ICOs), allow blockchain ventures to raise capital by offering their local tokens to early backers before they become available on open exchanges. Investors can take advantage of these presales by purchasing tokens at a lower price. If the project is successful and the token’s value increases, investors stand to receive significant returns.

>>> Explore the best cryptocurrency pre-sales to buy now <<

The Ultimate List of the Top 5 Cryptocurrency Pre-Sales to Invest In

- Artemis: The aim of Artemis (ARTMS) will become the cryptocurrency equivalent of eBay or Amazon. The upcoming Phase 4 will see the launch of the Artemis Framework, which will serve as a stage for digital money exchanges where buyers, sellers, specialized organizations and those seeking administration can participate in coherent exchanges.

- DAG Block: uses Directed Acyclic Graph technology to increase blockchain scalability.

- 99bitcoin: operates as a crypto learning platform

- WienerAI uses AI-powered trading bots for precise market analysis.

- eTukTuk focuses on environmentally sustainable transportation options, such as electric vehicle charging infrastructure.

We have determined that Artemis is the best new cryptocurrency presale for investment after conducting extensive research. It presents itself as the unrivaled cryptocurrency presale choice currently open.

>> Visit the best cryptocurrency pre-sale to invest in now <<

Top 5 Crypto Pre-Sales and Best Cryptocurrencies for Investment Today

Artemis (ARTMS) is attempting to establish itself as the cryptocurrency version of eBay or Amazon. The Artemis Crypto System, which will act as a platform for cryptocurrency transactions, will be launched in Phase 4. Buyers, sellers, service providers, and requesters will all benefit from seamless trading with this system. Customers will be able to purchase things, such as mobile phones using digital money, as well as sell products such as involved bicycles and get paid in cryptocurrency. Additionally, crypto money can be used to pay for administrations such as clinical consultations, legitimate care, and freelance work. Artemis Coin will act as the main currency of the ecosystem, with Bitcoin and other well-known cryptocurrencies from various blockchain networks backing it.

Artemis Coin has increased in price from 0.00055 to 0.00101 from 0.00094. Artemis may be attractive to individuals looking to recoup losses in Bitcoin, as predicted by cryptocurrency analysts. At this point, it seems to present an interesting presale opportunity.

>>> Visit the best cryptocurrency pre-sale to invest in now <<

The world of digital currency pre-sales is an exciting and exciting opportunity that could open the door to game-changing blockchain projects. Projects in this article, like Artemis Coin, offer the opportunity to shape the future of various industries and the potential for significant returns as the industry develops.

However, it is imperative to approach these investments with caution, thorough research, portfolio diversification, and awareness of the risks. You can explore the digital currency pre-sale scene with greater certainty and increase your chances of identifying and profiting from the most promising venture opportunities by following the advice and methods in this article.

>>> Join the best cryptocurrency pre-sale to invest in now <<

-

News1 year ago

News1 year agoBitcoin (BTC) price recovery faces test on non-farm payrolls

-

Bitcoin12 months ago

Bitcoin12 months ago1 Top Cryptocurrency That Could Surge Over 4,300%, According to This Wall Street Firm

-

Altcoins12 months ago

Altcoins12 months agoOn-chain data confirms whales are preparing for altcoin surge with increased buy orders

-

Bitcoin12 months ago

Bitcoin12 months agoThe US government may start accumulating Bitcoin, but how and why?

-

News1 year ago

News1 year agoNew ByBit Listings for 2024: 10 Potential Listings

-

News1 year ago

News1 year ago11 Best Crypto TikTok Accounts & Influencers in 2024

-

Altcoins1 year ago

Altcoins1 year agoMarket giants have taken action!

-

News1 year ago

News1 year ago11 Best Shitcoins to Buy in 2024: The Full List

-

Ethereum1 year ago

Ethereum1 year agoTop Meme Coins by Market Capitalization in 2024

-

News1 year ago

News1 year ago1.08 Trillion SHIBs Dumped on Major Crypto Exchange, What’s Going On?

-

News1 year ago

News1 year ago19 Best Crypto Games to Play in 2024

-

Altcoins1 year ago

Altcoins1 year agoAltcoin Recommended by Crypto Expert for Today’s Portfolio