Ethereum

Ethereum ETFs Generate $1 Billion in First Day of Trading: Will ETH Price React?

Ethereum price consolidated above the $3,400 territory on July 24 as the newly launched ETF saw $1 billion in inflows on its first day of U.S. trading, with technical indicators highlighting how ETH could react.

Ethereum Holds $3,400 Support Despite Selling Pressure From New

On July 23, 2024, Ethereum ETFs have started trading officially listed on regulated derivatives markets and exchanges in the United States. Ahead of this historic event, many speculative traders took a cautious stance on ETH, fearing that investors looking to sell into the euphoria could trigger massive declines.

However, after the first day of Ethereum ETF trading, the daily ETH/USD price chart is showing mixed signals.

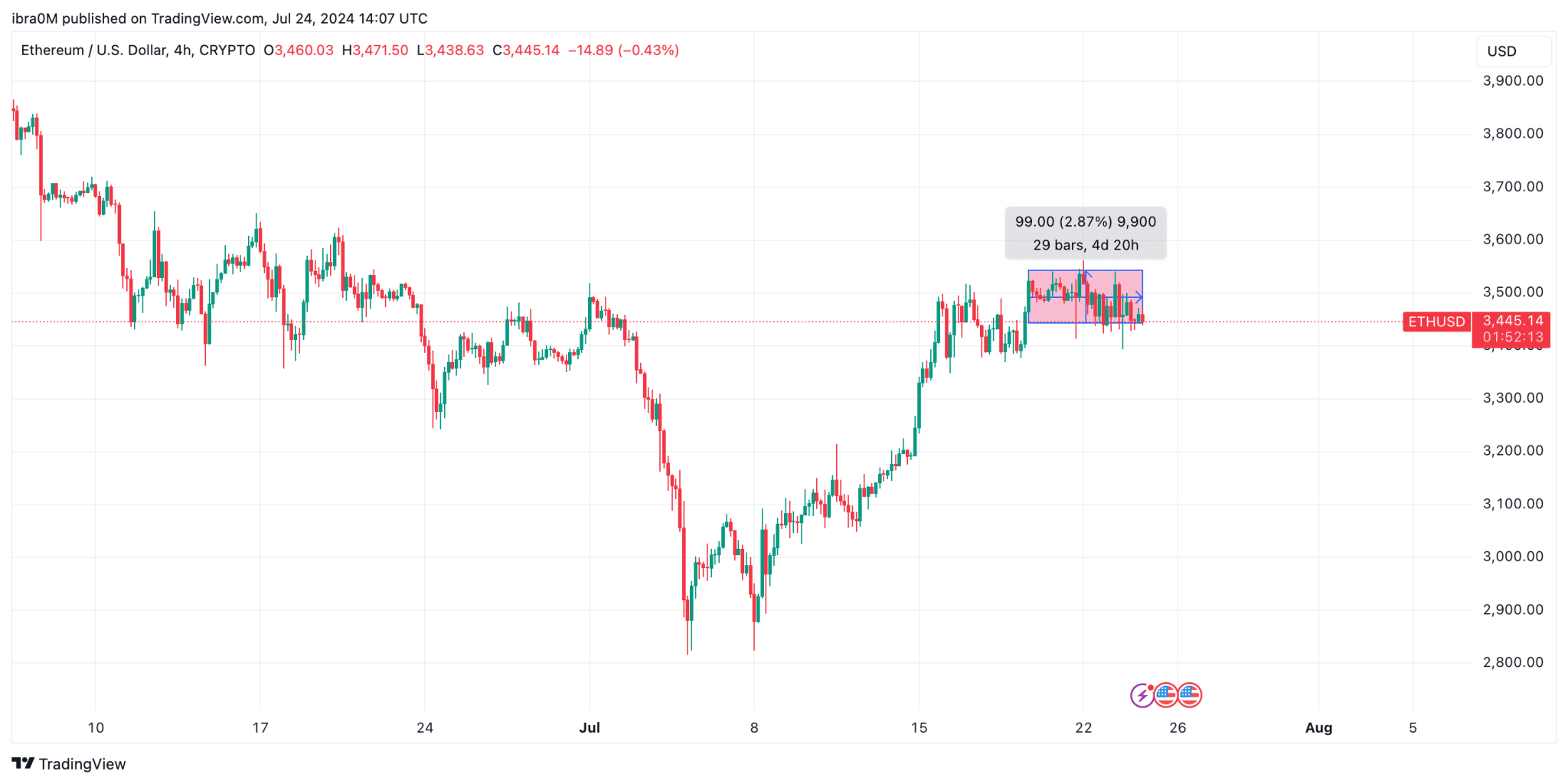

At the time of writing, July 24, the Ethereum price is hovering above the $3,445 area. However, a closer look at the chart shows that since Friday, July 19, ETH has been consolidating within the narrow 3% channel between $3,420 and $3,580.

Such tight consolidation often indicates a counteraction to the bearish and bullish catalysts active in ETH markets. While swing traders sold after the hype surrounding the approval of their ETFs for trading, inflows from new institutional players continued to support prices and prevent a major decline.

Ethereum ETF Raises $1 Billion in First Day of Trading

On the first day of trading, Ether ETF volumes surpassed $1 billion, with $106.78 million in net inflows.

By comparison, Bitcoin ETFs saw $4.5 billion in trading volume on their first day and a net inflow of $600 million.

On the first day of trading, Ethereum exchange-traded funds (ETFs) saw remarkable activity, with volumes surpassing $1 billion and net inflows of $106.78 million. This is equivalent to 20% of the Bitcoin ETFs’ first trading volume of $4.5 billion and net inflows of $600 million.

BlackRock’s iShares Ethereum Trust ETF led the way with $266.5 million in inflows, followed by Bitwise’s Ethereum ETF with $204 million.

Despite the significant activity, the trading volume of Ethereum ETFs was about 20% of that of Bitcoin ETFs on the day of their launch. Market experts expected lower volume for Ethereum ETFs due to the lack of a staking mechanism.

This strong first day of performance explains why Ethereum price managed to avoid a break below the $3,400 level on July 24, amid the news-selling frenzy that followed over the past 24 hours.

Ethereum Price Prediction: $3,600 Target Now in Sight

After defending $3,400 amid intense market activity on July 24, Ethereum price now appears poised to break above $3,600.

Ethereum price is currently trading around $3,436.89, with bears posting a strong resistance level at $3,519.04. The bullish momentum indicates a potential rally towards $3,600, fueled by support provided by the 0.618 Fibonacci retracement level at $3,312.75.

However, if the price fails to break through this resistance, it could find support at $3,312.75. Below that, another support lies at $2,747.64. The Choppiness Index (CHOP) at 48.10 suggests that the market is in a neutral state, indicating a possible consolidation before any significant move.

Traders should watch for a decisive move above $3,519.04, which could pave the way for a climb towards $3,600. Conversely, a break below the $3,312.75 support could trigger a decline towards the $2,747.64 level.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinion of The Crypto Basic. Readers are encouraged to conduct thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Advertisement-