Ethereum

Ethereum Foundation Wallet Transfers $290 Million in ETH After 7 Years of Inactivity

A wallet linked to the Ethereum Foundation wakes up after 7 years of dormancy, moving 92,500 ETH worth $290 million to a new address.

A major Ethereum whale recently woke up after seven years of inactivity, moving 92,500 ETH worth $290 million. According to Chinese journalist Colin Wu, the transfer took place on July 25 at 23:39 UTC+8 from address 0x0d…ecf4 to a new address 0xe4…328C.

0x0d…ecf4 transferred approximately 92,500 ETH worth $290 million to the new address 0xe4…328C at 23:39 UTC+8 on July 25. The funds originated from the transfer from address 0xe9…1e94 marked by Arkham, which may be the Ethereum Foundation, on May 9, 2017. https://t.co/2964kDcDK0

— Wu Blockchain (@WuBlockchain) July 26, 2024

Notably, the blockchain monitoring platform Lookonchain confirmed this report, with both disclosures linking the sending address to the Ethereum Foundation.

The fund transfer came from address 0xe9…1e94, also identified by Arkham as possibly being linked to the Ethereum Foundation. The recipient address, which recently woke up, recorded its first transaction on December 21, 2017. In that transaction, the address received 92,401 ETH worth $75.11 million at the time. A subsequent transaction saw it receive an additional 99,189 ETH worth $80,630,000.

This brought the cumulative amount of funds received to 92,499 ETH. Calculating the profit from the 92,499 ETH transfer reveals a substantial gain, with the current value being approximately $283.5 million, which translates to a profit of over $215 million.

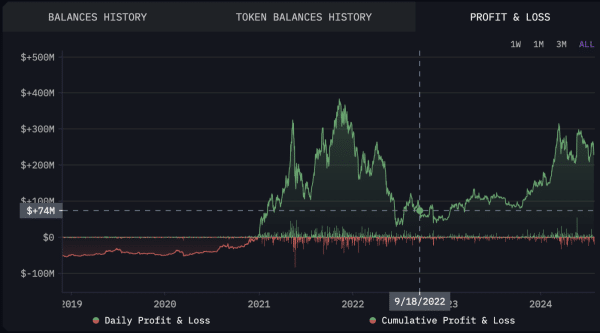

Fluctuations in profit and loss trends

Looking at the profit and loss (PnL) trends for address 0x0d…ecf4, we observe periods of significant fluctuations. From 2019 to 2020, the cumulative PnL remained relatively stable with minor fluctuations. However, by the end of 2020, a notable upward trend was observed, indicating significant gains.

2021 marked the first peak in cumulative PnL, followed by a correction. Another peak occurred in 2022, reflecting market volatility. Late 2022 and early 2023 showed a recovery and stabilization, with moderate gains.

In 2023-2024, we observe a substantial increase in cumulative PnL, reaching new highs before experiencing a slight correction in mid-2024, when the address decides to withdraw.

Distribution of assets and related transfers

To contextualize this whale activity, it is essential to examine the distribution of ETH holdings. data According to IntoTheBlock, as of July 8, 2024, there were 122.34 million addresses holding ETH, with only five addresses holding more than 1 million ETH.

The whale’s recent transfer of 92,401 ETH likely puts it in the 10,000 to 100,000 ETH category, which only includes 1,010 addresses. This substantial transfer has reduced the number of holders in this range.

Additionally, recent activity from Ethereum Foundation wallets adds context. On July 17, two wallets linked to the Foundation and the ICO transferred 3,631 ETH worth $12.5 million to Kraken. One wallet unloaded 2,631 ETH ($9.01 million) and had previously deposited 17,886 ETH ($65 million) since June 8.

Another wallet transferred 1,000 ETH ($3.46 million) to Kraken, from an ICO participant who received 100,000 ETH during Ethereum’s genesis in 2015. Despite these transactions, the ICO participant still holds 49,000 ETH valued at $171 million across four wallets.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinion of The Crypto Basic. Readers are encouraged to conduct thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Advertisement-