Ethereum

Ethereum Price Faces $1 Billion Supply Shock as SEC Greenlights ETH Spot ETFs

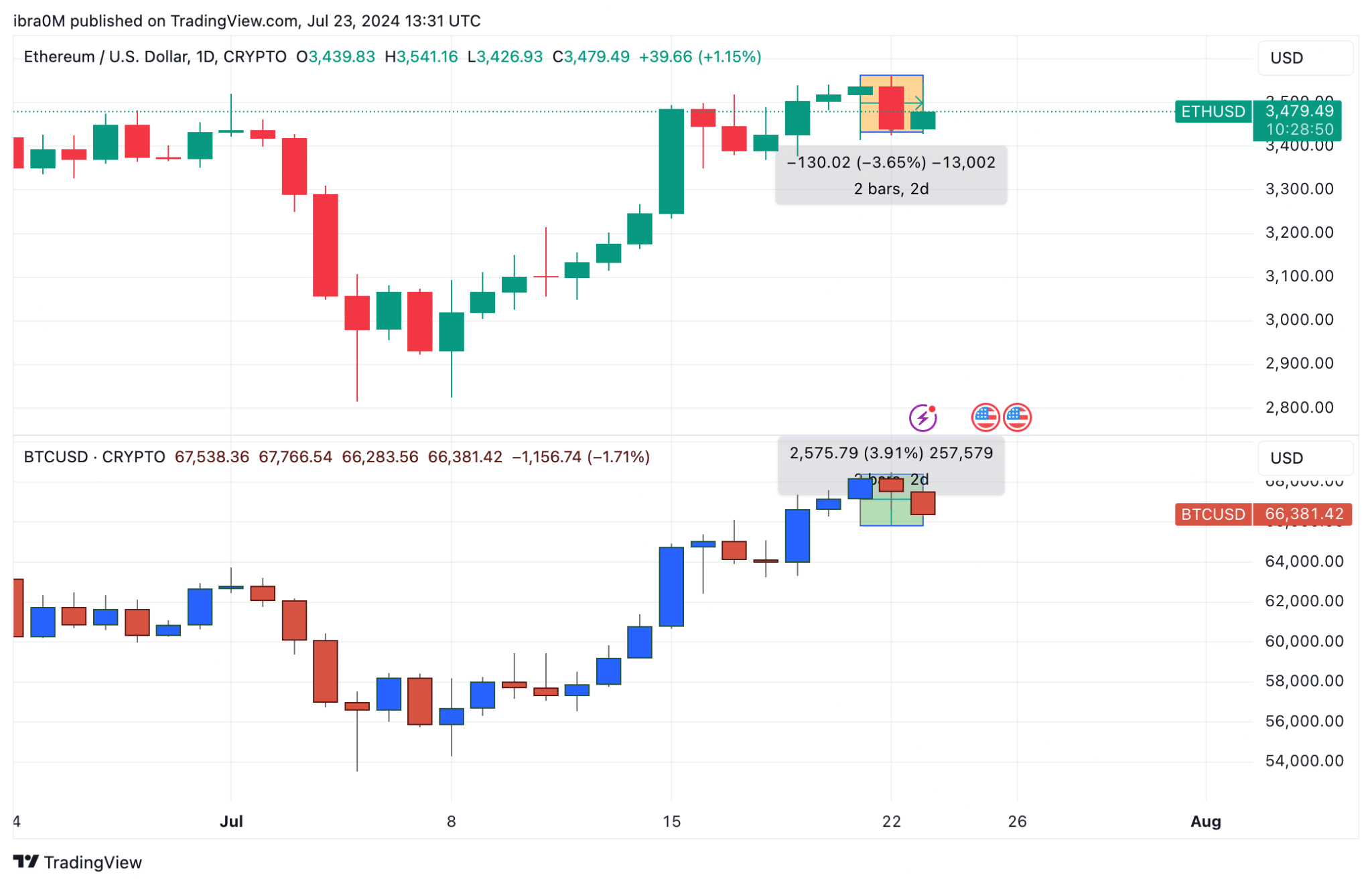

Ethereum price has been consolidating within the narrow channel of $3,400 to $3,550 over the past four trading days, with bullish traders adopting a cautious outlook ahead of the launch of ETH spot ETFs on July 23.

Ethereum Price Drops as Bitcoin Rallyes

On July 22, the Chicago Mercantile Exchange (CME), a trading platform dedicated to institutional traders in the United States, announced that it had received the green light from regulators to list Ethereum ETFs under the microscope from Tuesday, July 23, 2024.

Notably, Bitcoin ETFs have raised over $50 billion BTC Holdings within 6 months of launch, sparking optimistic projections that Ethereum ETFs could also receive a healthy fraction of these flows in the coming weeks.

Interestingly, as it prepares for this positive historical event, Ethereum price is showing early bearish signals. The chart above shows how Ethereum price has stalled below the $3,550 resistance over the past 48 hours, while Bitcoin price has increased by another 4%, reaching a new 30-day high of $68,747.

This suggests that while the rest of the cryptocurrency market is booming, ETH traders are taking a more cautious outlook in an effort to avoid a bull trap from the potential news sell-off cycle.

This is a short-term trading strategy in which investors quickly sell an asset shortly after a positive event, to take advantage of the market’s euphoria. It appears that Ethereum traders are preparing for this event ahead of the ETF’s launch on July 23.

ETH Market Supply Increased by $1 Billion in July 2024

The media buzz surrounding this news has had a significant impact on the global cryptocurrency market movements over the past few days. But interestingly, on-chain data has shown signals that Ethereum may experience some selling pressure following the event.

The CryptoQuant chart below tracks the number of coins that investors currently hold in wallets and trading platforms hosted by cryptocurrency exchanges. This provides insight into short-term supply trends in the Ethereum market.

Looking at the chart above, we see that Ethereum investors held a total of 16.6 million ETH in exchange wallets as of the close of June 30. But as the Ethereum ETF launch date approached, investors began moving more coins to exchanges, a move that typically occurs before a major profit-taking frenzy.

At the time of writing, July 23, there are now over 16.9 million ETH coins in circulation on exchanges. This shows that investors have deposited over 330,000 ETH since the beginning of July.

If we take into account current prices, this means that the supply in the Ethereum market has increased by more than $1 billion this month. Such a significant increase in the market supply of an asset could lead to an accelerated decline in prices if traders go on a selling spree in the coming days.

Ethereum Price Prediction: Bulls Must Defend $3,400 Support

Ethereum price experienced a slight pullback on July 23 after testing resistance around the $3,600 level. This slight pullback is crucial as Ethereum bulls aim to defend the critical support at $3,400.

The Bollinger Bands indicator reveals that Ethereum is trading within the upper half of the bands, suggesting continued bullish momentum if support holds. The middle band, currently at $3,252.96, acts as an immediate support level, while the lower band at $2,845.59 offers a more substantial floor if the price declines further.

The Relative Strength Index (RSI) is at 55.01, slightly above the neutral level of 50. This position indicates that Ethereum is neither overbought nor oversold, giving bulls room to push prices higher. However, the slight downward tilt in the RSI suggests caution, as any further decline could signal a shift in momentum in favor of the bears.

The key resistance levels to watch are $3,600 and the upper Bollinger Band at $3,660.34. Breaking above these levels could open the way towards $3,800 and beyond. On the downside, defending the $3,400 support is essential to sustain the bullish sentiment. A drop below this level could see Ethereum retest the $3,252.96 support and possibly the $2,845.59 level if bearish momentum intensifies.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinion of The Crypto Basic. Readers are encouraged to conduct thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Advertisement-