Ethereum

Ethereum Price Targets $4,000 This Week as Network Usage Surges 56%

Ethereum price consolidated in the tight $3,550-$3,400 range over the weekend. However, spikes in on-chain activity suggest that investors are now bracing for a major shift in market dynamics in the coming week.

Ethereum Price Volatility Rises as ETF Launch Nears

ETHthe second-largest cryptocurrency, has been subject to intense market volatility over the past week. Prolonged delays surrounding the official launch of the Newly Approved ETH Spot ETFs has triggered anxiety not only among Ethereum holders, but also among investors in global cryptocurrency markets.

However, the latest filings by Bloomberg show that companies like Blackrock and VanEck have moved the needle in terms of final adjustments to their Ethereum ETF applications.

On June 21, Bloomberg analyst Eric Balchunas revealed that the institutional fund’s sponsors had submitted their final S-1 filings to the U.S. Securities and Exchange Commission (SEC).

This brings the candidates closer to final approval before the official listing date is announced, a move that could spark a massive market reaction in the coming week.

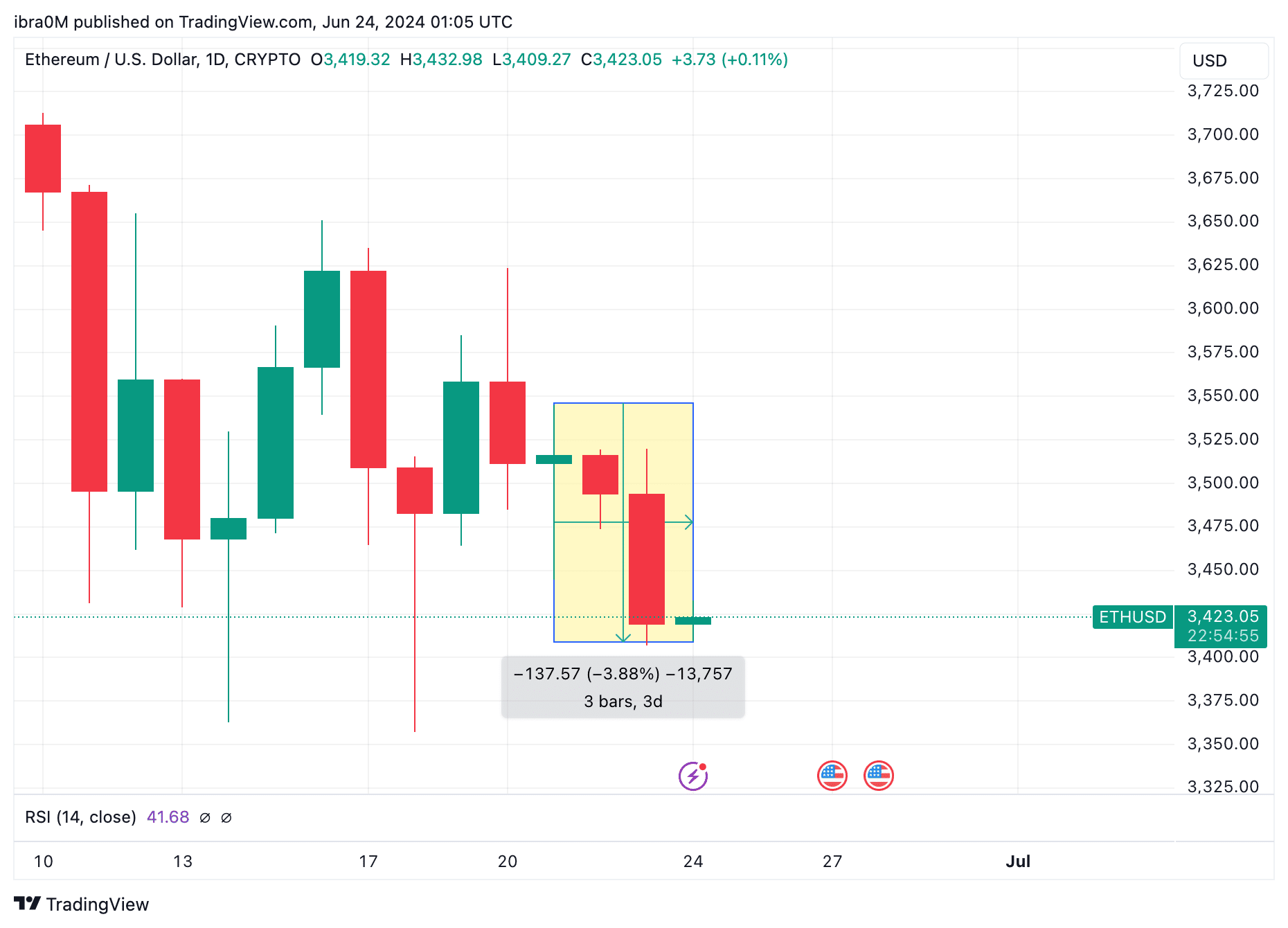

The chart above shows that the price of ETH fell 4% from its daily high of $3,544 on Friday, June 21, before opening trading around $3,419 on Monday, June 24.

This reflects the general trend in the cryptocurrency market, as investors appear reluctant to build large positions, instead adopting a neutral stance while waiting for the SEC’s next update on filings.

Ethereum network activity increases by 56% in 7 days

In terms of price reaction, Ethereum markets were largely unresponsive to the news surrounding the S1 filings on Friday. However, looking beyond the price charts, there is a significant shift in Ethereum network usage, a move that signals that investors are preparing for major trading activity in the week ahead.

IntoTheBlock’s Daily Active Addresses chart below tracks the total number of unique ETH wallets involved in confirmed transactions on a given trading day. This provides real-time information on changes in the level of network activity and user participation.

As the snapshot above shows, 515,610 ETH wallets made valid transactions a week ago, on June 17. The network utilization metric moved in a tight 5% range until Friday, June 21, when news of the S-1 filing broke.

Ethereum has since seen a massive 56% increase in network activity, reaching 806,500 active ETH addresses as of the close of June 23.

When there is a significant increase in the number of addresses transacting on a network, it indicates that a large number of investors are active and may be reacting or preparing for a major event. In essence, it is only a matter of time before this 56% increase in network activity is reflected in Ethereum’s price action.

Ethereum Price Prediction: Possible Break of $4,000?

Ethereum price consolidated in the $3,550-$3,400 range over the weekend. The spikes in on-chain activity suggest that investors are preparing for a significant shift in market dynamics in the coming week.

According to data from IntoTheBlock, the current Ethereum price of $3,429.04 is at a critical point. The support level around $3,334, represented by the lower boundary of the Bollinger Bands, seems to be holding, while resistance looms near $3,575, the upper boundary.

The market is on edge, awaiting SEC updates on Ethereum spot ETFs. A positive update could trigger a bullish breakout, pushing Ethereum price towards the $4,000 mark.

With strong support from institutional investors like Blackrock and VanEck, the potential for a sharp price rally is high. As investors await the SEC’s decision, increased network activity, marked by a 56% increase in daily active addresses, suggests a willingness to capitalize on any positive developments.

Upcoming ETF news could be the catalyst needed for a breakout. As network activity continues to spike, indicating increased investor interest, there is a strong chance that Ethereum will reach new highs above $4,000 in the near term.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinion of The Crypto Basic. Readers are encouraged to conduct thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Advertisement-