Altcoins

Here Are Four Key Reasons Why Bitcoin, Shiba Inu, and XRP Are Down Today

The cryptocurrency market crash that impacted assets like Bitcoin, Shiba Inu, and XRP is attributable to four main factors.

The cryptocurrency market has been hit hard recently, with Bitcoin (BTC) and other major digital assets are seeing significant declines. With BTC down 1.65% this morning, the leading cryptocurrency has collapsed 6.11% from its July 22 high of $68,000.

Altcoins have suffered similar declines. XRP is on track to retrace yesterday’s 3.46% gain, down over 1.5% today. XRP’s saving grace has been support at $0.60Meanwhile, Shiba Inu (SHIB) is down 10% from its July 22 peak of $0.00001832 and down 2.74% this morning due to its higher volatility.

It is worth noting that four key factors have contributed to this slowdown, raising concerns among investors and market analysts. Here is a more detailed look at what is happening.

Bitstamp and Kraken Distribute Bitcoin to Mt. Gox Creditors

The defunct Mt. Gox exchange, which collapsed in 2014 after losing 850,000 bitcoins due to a major security breach, has finally began to repay its creditors.

This long-awaited repayment involves the distribution of 142,000 BTC and 143,000 BCH. Mt. Gox is to distribute the tokens to creditors via centralized exchanges. Exchanges Bitstamp and Kraken are already facilitating the distribution, with Bitstamp having a 60-day window and Kraken up to 90 days to make the payments.

Bitstamp a engaged to speed up the distribution, aiming to complete it well before the 60-day deadline. Similarly, Kraken is also starting to release funds. The large volume of Bitcoin entering the market has led to increased selling pressure, contributing to the current market downturn.

Kraken has started distributing Gox coins pic.twitter.com/cOxXQaC5p0

— punch (@Punch0x1) July 23, 2024

Concerns have emerged that many creditors may choose to immediately liquidate their holdings. However, data shows that most Kraken users have held on to their tokens, but this has not alleviated concerns.

US Stock Market Crash

Another event contributing to the market’s fall is the performance of US stocks. Recently, the US stock market experimented a major crash, wiping out more than $1.1 trillion in value.

This loss impacted traditional financial markets, and then spilled over into the cryptocurrency scene. Historically, there has been a notable correlation between the performance of traditional markets and that of cryptocurrencies.

When the stock market suffers, risk assets like Bitcoin often follow suit, with investors liquidating their holdings to cover their losses or seek safer investments. This situation has also contributed to the decline of XRP and Shiba Inu.

S&P 500 and NASDAQ down

Amid the stock market crash, both the S&P 500 and NASDAQ indices have experimented their worst performance in two years. Market data confirms that the S&P 500 collapsed by 2.3% yesterday.

This decline further exacerbated negative market sentiment. As leading indicators of economic health, the performance of the S&P 500 and NASDAQ indices often leads to broader declines in various asset classes, including cryptocurrencies.

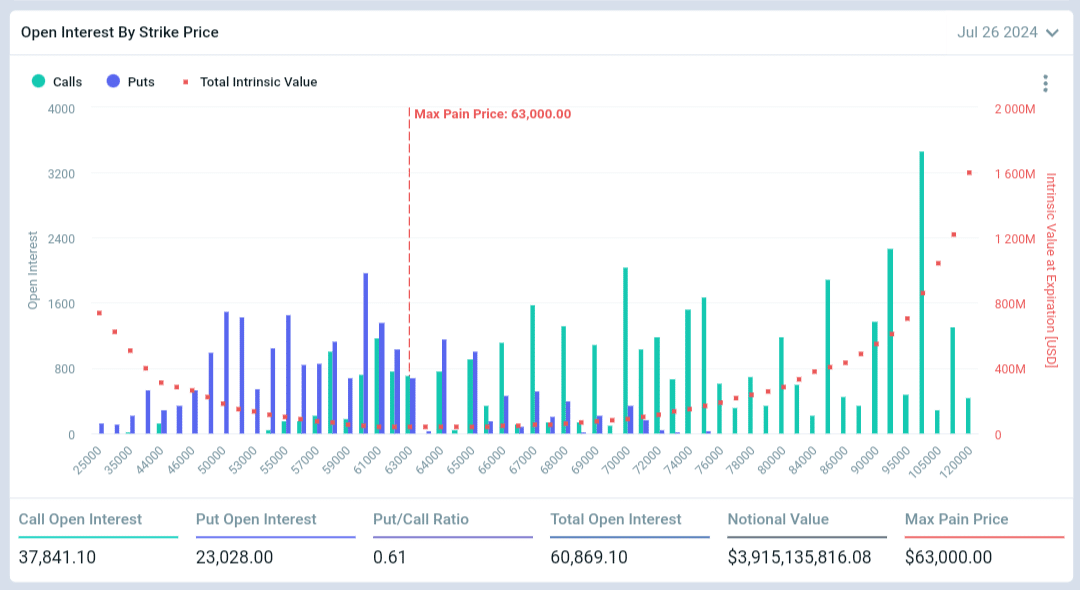

$4 Billion Bitcoin Options Expiry

Another major factor affecting the cryptocurrency market is the imminent expiration of Bitcoin options worth nearly $4 billion. Data from Deribit confirms that Bitcoin has a total open interest of 60,869 options with a national value of $3.9 billion around tomorrow, July 26. The maximum price for these options is $63,000.

The potential expiration of this large volume of options contracts has contributed to market instability, as traders will be forced to either sell their positions or roll them over depending on the expiration.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinion of The Crypto Basic. Readers are encouraged to conduct thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Advertisement-