Ethereum

Here’s the $700M Signal That Pushes ETH to $4,000

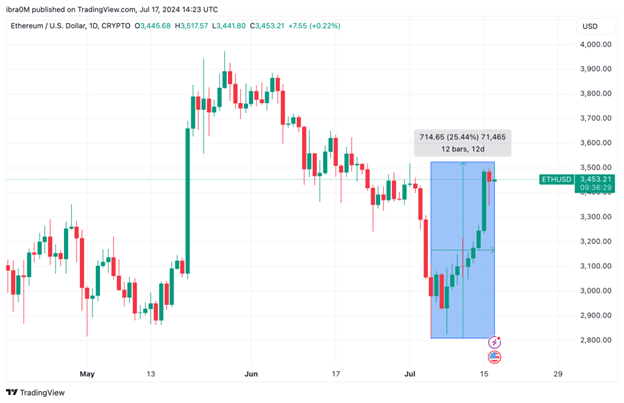

Ethereum price hit a high of $3,517 on Wednesday, July 17, 2024, marking a 25% rebound over the last 12 trading days; on-chain data shows that increased staking on the ETH 2.0 network could be a key bullish catalyst.

Ethereum Price Surges 25% Ahead of ETF Launch on July 23

The anticipation surrounding the potential launch of a Ethereum ETF July 23 was a major factor behind Ethereum’s recent price surge.

Further bolstered by dovish macroeconomic cues from recent nonfarm payrolls and consumer price index (CPI) data, market sentiment around ETH has turned overwhelmingly positive, with investors eagerly awaiting increased institutional participation and Fed rate cuts in the second half of 2024.

The chart above shows how the price of ETH fell to a 100-day low of $2,815, during the market crash on July 5. But since the dovish NFP data, bullish traders went on a buying spree over the weekend, pushing the price of Ethereum back above the $3,000 level.

However, on Monday, July 15, the impending launch of the Ethereum ETF on July 23 made headlines. The bullish headwinds caused by the anticipated ETF inflows have kicked Ethereum’s price rally into high gear this week.

At the time of writing, on July 17, the price of Ethereum had broken above the $3,517 area, up 25% from the all-time lows recorded on July 5. With the Ethereum ETF launch date still nearly a week away, speculators are betting on a further rise towards the $4,000 range.

Ethereum ETH 2.0 stakers deposited $700 million in 7 days

Another key catalyst that has driven Ethereum’s price action over the past few days is the surge in staking deposits accumulated by ETH investors. Ever since Bloomberg analysts highlighted July 23 as a possible launch date, investors have been increasing the wave of deposits into ETH 2.0 Beacon Chain staking contracts.

The chart below tracks official data from the Ethereum blockchain network, showing daily changes in the number of ETH coins deposited into ETH 2.0 Beacon Chain contracts. Increases in staking often occur during periods when investors consider the effective yield more profitable than other alternatives, or when they are increasingly confident in the project’s growth trajectory.

As of July 10, investors have staked a total of 32,919,270 ETH into the Ethereum 2.0 staking contract. But following the back-to-back dovish NFP and CPI macroeconomic reports, as well as the announced ETH ETF launch data, Ethereum investors have responded by increasing their staking deposits.

At the time of writing, the total staked funds have reached 33,124,709 ETH, which reflects an increase of 205,439 ETH over the last seven days. An increase in staking during a market uptrend is interpreted as a bullish signal for a number of reasons.

First, this indicates that despite Ethereum’s price rallying to monthly highs, the majority of investors are looking to put more funds on the line and wait for future gains rather than selling now. This decrease in selling pressure could encourage undecided new entrants to invest in the ETH rally in the days ahead.

Additionally, when the newly staked 205,439 ETH is valued at current prices, it means that investors have effectively removed over $711 million in liquidity from the market supply in the short term.

Essentially, if investors continue to reduce selling pressure by adding more to the $700 Ethereum 2.0 staking deposits, the ETH price should further advance towards $4,000 as demand increases ahead of the ETF launch date scheduled for July 23.

In summary, the combination of increased anticipation for an Ethereum ETF and the substantial increase in ETH 2.0 staking deposits is pushing Ethereum price to new highs.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinion of The Crypto Basic. Readers are encouraged to conduct thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Advertisement-