News

Here’s Why The Shiba Inu Is Down Today As Liquidations Surpass $2 Million

Factors such as continued selling pressure around Bitcoin have contributed to the Shiba Inu’s decline today, with liquidations surpassing $2 million, heading towards a four-month high.

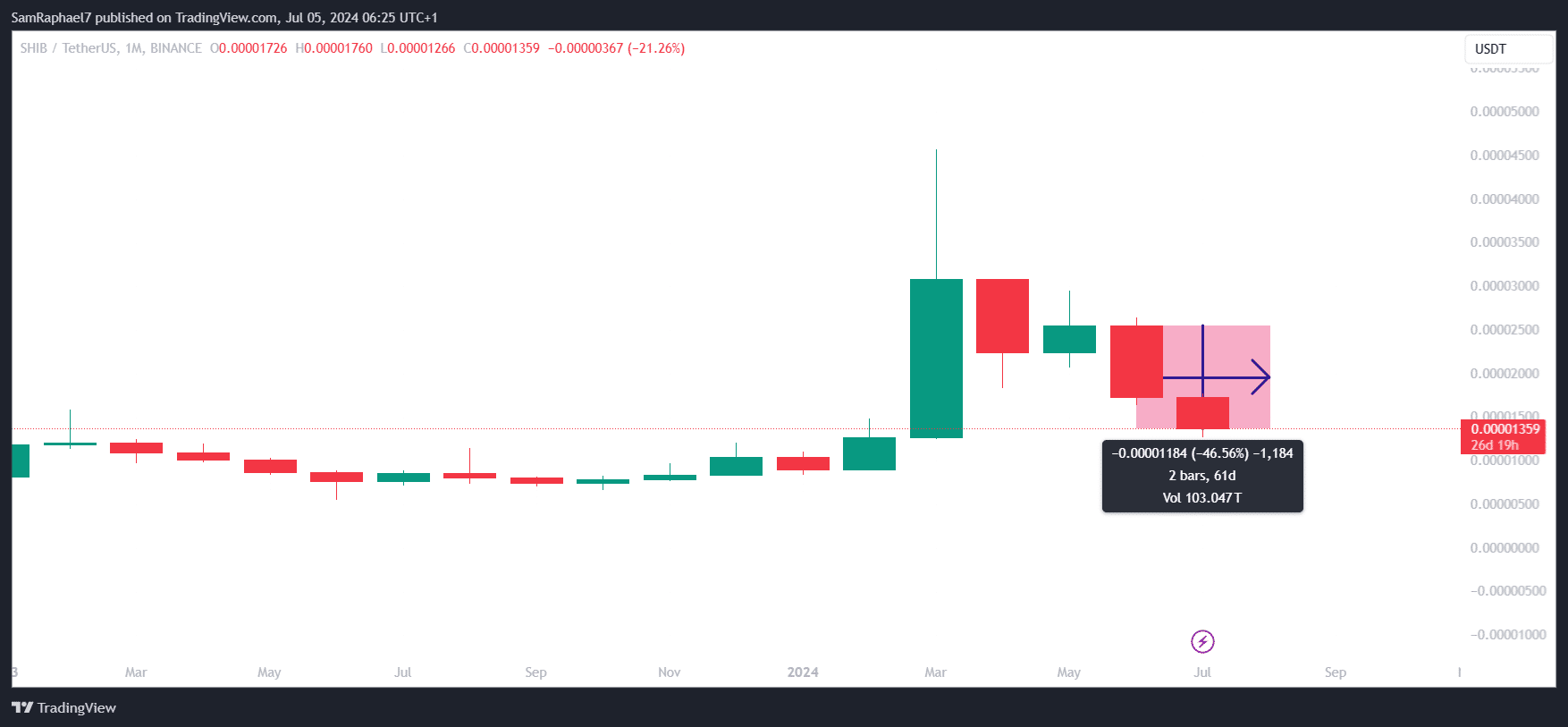

In particular, the cryptocurrency market has slipped into another round of declines. This time, prices have fallen to shocking levels, triggering long liquidations across the board. Shiba Inu Dog is one of the biggest victims of this sell-off, now down more than 21% this month. Magnified, SHIB has fallen 46% since June 1.

This bearish situation positions the Shiba Inu as one of the biggest losers in the overall market crash. For context, this steeper decline is due to its increased volatility. Currently trading at $0.00001359, SHIB has now given up multiple support levels amid a 7.11% decline this morning. These levels include the $0.000015 and $0.000014 thresholds.

Shiba Inu Long Traders Bear Losses

Most investors who were long Shiba Inu were pinning their hopes on the defense that these thresholds could mount. After this breach, most of these long positions faced liquidations. Data from Coinglass he confirms That SHIB Liquidations reached $1.616 million this morning alone.

Specifically, about $1.54 million, which represents over 95% of the total liquidations, are attributable to long positions. Although the day is far from over, the $1.54 million long liquidation figure is the highest for SHIB in four months. The last time long investors lost this much money was on March 19, when long liquidations exceeded $2.77 million.

Market tracker Crypto Crunch has drawn public attention to a large liquidation that contributed to this figure. Interestingly, one market whale saw its long position worth $980.7K wiped out at 3 AM (UTC) today when SHIB fell to the lower limit of $0.000014.

┌🟥 #1000SHIB Liquidated Long – $980.7K @ $0.01

└Financing rate: 0.00%— CryptoCrunchApp (@CryptoCrunchApp) July 5, 2024

However, Shiba Inu liquidations are relatively small when compared to the broader market data. In the last 24 hours, SHIB has seen $2.31 million in liquidations. However, this represents only 0.3% of the total liquidations in the market, which totaled $679 million.

With $226.94 million, BTC represents the largest liquidated figure. Ethereum (ETH) is in second place, having seen $166.48 million worth of liquidations in the last 24 hours. The largest single liquidation also involved Ethereum, with one trader losing $18.48 million in a transaction on Binance.

Factors Behind the Market Crash

The market turbulence is largely attributable to the selling pressure surrounding Bitcoin, the leading crypto asset. Yesterday, The Crypto Basic brought to light a series of whale exchange deposits and sell-offs that contributed to this selling pressure. At the time, BTC had fallen 5% on the daily chart.

The report confirmed a series of test transactions by the Mt. Gox trustee in preparation for early July redemptions. In the latest update, the Mt. Gox trustee transferred 47,228 BTC worth $2.7 billion to a new wallet today. This typically signals an impending distribution, triggering widespread panic and exacerbating selling pressure.

BREAK

Mt Gox moves 47,228 BTC ($2.71 billion) from cold storage to new wallet. photo.twitter.com/3ZdSlC1IX2

— Arkham (@ArkhamIntel) July 5, 2024

The subsequent drop in Bitcoin price below $55,000 triggered the Shiba Inu crash. In addition to the contagion of BTC decline, SHIB is also facing shark and whale sell-offs. Santiment data indicates that wallets holding 10 million to 1 billion SHIB have gradually reduced their balances since June 1.

Disclaimer: This content is informational and should not be considered financial advice. The views expressed in this article may include the personal views of the author and do not reflect the views of The Crypto Basic. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Announcement-