Altcoins

Long-Term Investors Accumulate $7.4 Billion in Bitcoin as Weak Hands Fell Off

As weak hands dump Bitcoin, forcing a retest of the $65,000 threshold, data shows that investors with longer-term outlooks are accumulating BTC.

Bitcoin fell more than 4% today, triggering a general market crash. Specifically, the leading cryptocurrency fell from its daily high of $68,284 to $65,894, with altcoins bearing the brunt. At press time, Bitcoin has stabilized around $66,150, reversing all of the gains it made over the past week.

Bitcoin Selling Pressure Examined

It’s worth noting that this latest wave of bearish sentiment came as the U.S. government moved $2 billion worth of Bitcoin to a new wallet on Monday night. The move coincided with Bitcoin’s temporary recovery in value to $70,000.

Following the massive movement of Bitcoin announcementThe asset quickly dropped to around $66,000. Although it briefly recovered, it has since hit a lower target today.

The US government’s decision to sell $2 billion worth of bitcoin has sparked fears of a sell-off, with many criticizing the potential sales. The move comes on the heels of the German government’s dumping of nearly 3 billion dollars in Bitcoin this month.

Bitcoin has shown resilience and recovered all losses caused by German selling, but it now faces another major bearish factor.

Long-term holders buy $7.4 billion worth of BTC

On the other hand, investors with a longer-term outlook are adding more BTC tokens to their portfolios. Ali Martinez, a prominent market observer REMARK the trend and drew attention to it in a recent article on X.

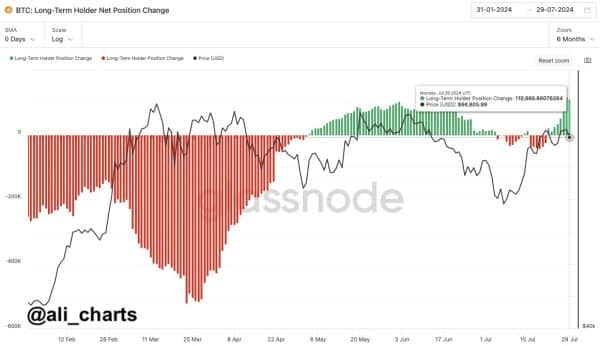

Citing statistics from analytics platform Glassnode, Martinez revealed that long-term holders are in full accumulation mode as they added over 100,000 BTC to their wallets this month.

The report notably notes that on Monday, long-term holders’ positions changed positively by 110,666 BTC. At a price of $66,805 per Bitcoin yesterday, this change equates to an astonishing $7,393,042,130 (roughly $7.4 billion) accumulated.

This mirrors a similar event in May, when Bitcoin whales has accumulated over 47,000 BTC valued at $2.8 billion in one day.

It is worth noting that Martinez’s chart indicates that long-term Bitcoin holders have continued to top up their wallets since May, although a slight negative trend emerged earlier this month.

Prior to the sustained bullish trend in bitcoin buying, this group of investors saw their holdings depreciate for an extended period between February and April, taking advantage of the rise in bitcoin’s price during that period. Now, they are reversing the trend amid bitcoin’s falling price.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinion of The Crypto Basic. Readers are encouraged to conduct thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Advertisement-