Altcoins

Maximize your profits in the 2024 boom

Bitcoin’s recent performance has sparked discussion among analysts who believe a significant price rise could follow its next halving event. This prediction is promising for the broader crypto market, potentially triggering a domino effect that benefits various digital currencies. As anticipation grows, a new wave of enthusiasm is emerging around altcoins, which are expected to rise in the coming year, highlighting the potential for wise investments that can yield substantial profits during the predicted 2024 boom.

BlastUP emerges as a game changer by raising over $2.5 million in a few weeks

BlastUP is a unique launch platform based on Blast, a legendary layer 2 blockchain that made headlines with its dizzying debut. BlastUP is following in Blast’s footsteps, having raised over $2.5 million in just a few weeks.

BlastUP’s impact could be huge, as its innovative solutions for launching DApps with a full suite of Web3 and AI tools are going to be a hit for startups. It provides a comprehensive set of tools and a reward system for everyone who joins the platform.

The pre-sale of BlastUP tokens is underway, and investing in them at this stage could be like buying Ethereum for a few dollars in 2017. The price at the fifth stage is set at $0.055, while the price at the quotation will be $0.1. . It’s the perfect time to buy BlastUP tokens at the best price with a 45.% reduction.

>> Experience a True Game Changer: Buy BlastUP Tokens at 45.% OFF NOW <

BlastUP token holders have access to many advantages from priority token sales to exclusive loyalty rewards in IDOs. They can also earn interest by staking BlastUP tokens and benefit from the seed staking feature, which provides free tokens from supported projects.

BlastUP is not just another crypto project, it has a solid foundation to build a large following. This launchpad aims to lower the barriers to entry for blockchain startups, ensuring they have everything they need to succeed from the start.

BlastUP’s detailed roadmap extends to 2026 and includes the introduction of an AI IDO filter, AI Startup Team Tools and the Community market. BlastUP is about to become the next big thing in the crypto space, so you you better hurry and jump on the bandwagon before it’s too late.

>> Ready to take off? Buy BlastUP tokens now and catapult your investments <

Avalanche dynamics with long-term growth prospects

The recent uptrend, with a one-month price increase of 34.97%, shows strong short-term momentum for Avalanche. If it holds above the nearest resistance at $66.32, we could see a push towards the second resistance level at $71.66. However, the proximity of the current price of $51.98 to the 10-day moving average of $55.61 suggests that the price could either consolidate around this area or potentially move back to find support. In the short term, the support level at $33.98 is crucial to avoid further decline, and staying above the 100-day moving average of $40.43 is key to maintaining confidence.

In the long term, Avalanche saw exceptional six-month growth, soaring 483.42%. While the all-time high of $151.22 indicates significant prior market approval, current levels well below that high suggest room for growth. However, investors should remain vigilant for a possible correction after such rapid increases. Prices near the $33.98 and $26.97 support levels could generate buying interest on a dip, but breaking through them could indicate a deeper retracement. It is critical for long-term stability that Avalanche establishes new bases of support at higher price levels, using positive price data as a springboard for future appreciation.

Polkadot’s 117% surge suggests bullish trend

Polkadot posted a significant rise of 117.33% over the past six months, suggesting strong market interest. With the current price at $8.78 and a recent monthly increase of 13.58%, the trend could continue to push prices towards the nearest resistance level at $9.26. If the positive momentum continues, it is possible to see a further rise towards the second resistance at $10.25. However, considering the all-time high of $56.22, the current price suggests that there is room for growth, but reaching new highs could be a long process influenced by market dynamics and sentiment.

In a more conservative scenario, it is worth noting that the closest support level lies at $6.91, not far from the current price. Any negative change in market conditions could cause a fall to this point. Deeper setbacks could even test the second support level at $5.55. The long-term outlook remains uncertain as the market has yet to return to its all-time high. The 10-day and 100-day simple moving averages at $9.96 and $8.03, respectively, illustrate the possibility of volatility. If the short-term average drops below the long-term average, it could suggest a cooling-off period ahead.

Price fluctuations of optimism: growth versus risks

Looking back, optimism fell 17.74% last month, which might worry some. But let’s not forget that it is up 157.33% over the last six months. Even with the current price at $3.34, not far from the nearest resistance at $4.32, growth remains possible. If it breaks above $4.32 and heads towards the second resistance at $4.95, the momentum could turn very positive. The all-time high of $4.86501702 indicates room for growth, but getting there again will require strong interest and broader market support. Keep an eye on the $3.66 and $3.50 averages as they could suggest the direction the price is heading.

On the other hand, if the current sentiment changes, the price could slide towards the nearest support at $2.95 or even the second support level at $2.20. Since prices fluctuate, short-term declines should not be ignored. Considering the all-time high, the current price of $3.34 may seem low; however, recent declines suggest potential risks. The unpredictable nature of the market means it’s best to take a balanced outlook. Optimism could either return to its former glory or overcome market hurdles, with each scenario influenced by trader confidence and external factors.

Jupiter Price Surge Signals Bullish Trends

Looking at Jupiter’s (JUP) impressive one-month price rise of 133.68% and an even more remarkable six-month rise of 3,836.67%, there is an aura of optimism around the coin. The current price of JUP is $1.18. If the momentum continues, surpassing the nearest resistance level at $0.68 and aiming for the second resistance level at $0.81, the room for growth looks promising. Investors can view these targets as steps toward higher valuations. Driven by positive sentiment, if JUP maintains its current trajectory, prices could fight for new highs.

However, given the volatile nature of the cryptocurrency market, the risks should not be underestimated. If market sentiment moderates, JUP could see downward pressure, with immediate support found at $0.42 and lower at $0.30. Should selling signals such as the 10-day SMA at $1.21 gain traction, a reversal could be on the horizon. Long-term sustainability depends on several factors beyond simple technical indicators. The combination of current performance and market dynamics suggests the need for a vigilant and balanced approach in anticipation of potential fluctuations in JUP.

Conclusion

In conclusion, while the booming crypto market presents a variety of promising coins, BlastUP stands out as the pinnacle of potential within the Blast ecosystem. The $2.5 million raised in a few weeks echoes the market’s confidence in its innovative approach to DApp launches, complemented by Web3 and AI tools. BlastUP’s comprehensive benefits and robust roadmap point to a bright future. Other altcoins retain their appeal with respective growth prospects, but it is BlastUP’s strategic positioning and concept within the proliferating Blast landscape that positions it as the frontrunner for the 2024 boom. Investors looking for Dynamic opportunities might consider BlastUP as one of the top candidates to maximize their profits.

Site: https://blastup.io/

Twitter: https://twitter.com/Blastup_io

Discord: https://discord.gg/5Kc3nDhqVW

Telegram: https://t.me/blastup_io

Altcoins

On-chain data confirms whales are preparing for altcoin surge with increased buy orders

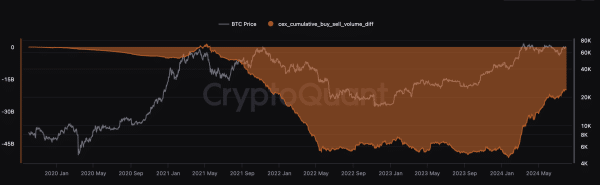

Ki Young Ju, CEO of analytics platform CryptoQuant, believes whales are preparing for an upcoming surge in altcoins.

In a recent revelation about X, Ju underlines that the volume of limit buy orders for altcoins, excluding Bitcoin and Ethereum, is increasing. This pattern suggests the formation of substantial buy walls, highlighting significant buying pressure from large-scale investors.

Ju’s chart identifies two main phases in limit order volume for altcoins: the limit sell phase and the limit buy phase. The limit sell phase saw a notable increase in cumulative sell orders in 2022, demonstrating strong selling pressure from whales and other market participants. This phase coincided with a period of falling altcoin prices due to unfavorable market conditions.

Then, the limit buying phase began, marked by a significant increase in cumulative buy orders. This indicates a period of strategic accumulation where whales establish substantial buy walls.

According to Ju, the increase in buying volume suggests confidence in the future conditions of the altcoin market. This buying pressure creates strong support levels, indicating that whales are preparing for a positive change in the market.

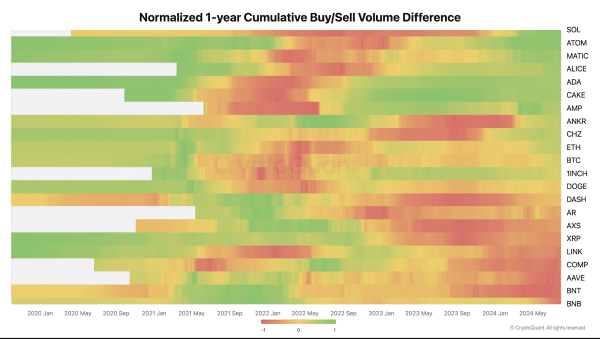

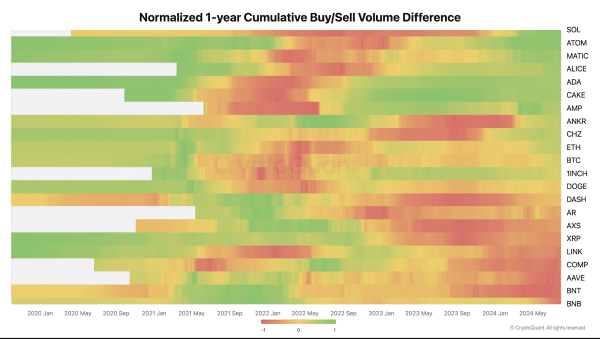

Buying pressure on specific altcoins

Ju also provided a heatmap of the 1-year normalized cumulative buy/sell volume difference for various altcoins, showing the buying and selling pressure over time. Solana (SOL) has seen alternating strong buying and selling phases, with recent activity showing increased buying interest. Cosmos (ATOM) and Polygon (MATIC) have also shown increased buying pressure despite mixed activity trends.

Cardano (ADA) and PancakeSwap (CAKE) have shown balanced buying and selling phases, with recent trends proving increased buying pressure. Coins like AMP and ANKR have also demonstrated increased buying activity. The heatmap reveals that most altcoins are seeing increased buying pressure as whales and large investors accumulate altcoins in anticipation of a rally.

Meanwhile, coins experiencing selling pressure, as indicated by the predominantly red areas on the heatmap, include DOGE, DASH, AXS, XRP, COMP, and AAVE, BNT.

Bitcoin whales are also buying

It is important to note that while whales are accumulating altcoins, Bitcoin whales are also active. Crypto Basic note an increase in buyer activity on Binance, which aligns with an increase in the buy/sell ratio of takers and whale movements. Analyst Ali Martinez highlighted the ratio fluctuations from below 0.8 to above 1.7 between July 27 and 31. Ratios above 1.0 indicate aggressive buying, often preceding price rallies.

From July 27 to July 28, the ratio remained mostly above 1.0, corresponding to the rise in Bitcoin price from around $66,500 to over $67,000. A spike to around 1.5 led to a sharp increase in price to around $68,500. However, on July 30 and 31, the ratio fell below 1.0 several times, corresponding to a drop in price to around $66,000, before a final spike to 1.7 indicated another slight increase in price.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinion of The Crypto Basic. Readers are encouraged to conduct thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Advertisement-

Altcoins

How to buy a car with cryptocurrency

The automotive and cryptocurrency industries have been merging for the past few years. As digital currencies become more prevalent in everyday activities, it is increasingly likely that they will be integrated into everyday transactions, such as when buying a car. The article unpacks the dynamic relationship between cryptocurrency and car buying today, explaining how digital currencies can be used to buy a vehicle today. It includes elements such as some of the benefits and challenges of buying a car using cryptocurrency and what lies ahead in the future.

Understanding Cryptocurrency Payments in the Automotive Industry

Cryptocurrency is not just a digital asset; it represents a revolutionary approach to decentralized financial transactions. The automotive industry, known for its adaptability, has begun to accept cryptocurrencies as a legitimate form of payment in various markets. For example, luxury car dealerships and online platforms offering car auctions in new york increasingly allow buyers to purchase cars using cryptocurrencies.

There are several factors that determine how much cryptocurrency you need to buy a car. Among them, the most influential will be the current value of the cryptocurrency you want to use at that moment. Unlike traditional currencies, cryptocurrencies can be very volatile. Their value can change drastically in an instant, which affects the amount needed at the time of purchase.

Benefits of Buying Cars with Cryptocurrency

Buying cars with cryptocurrencies offers several advantages:

– Reduced transaction fees: Cryptocurrencies can reduce the fees involved in large financial transactions typical of car purchases.

– Enhanced Privacy: Buyers who value their privacy can benefit from anonymity through blockchain-based transactions.

– Speed and convenience: transactions are faster than those carried out by banks, especially when the operation has an international scope.

Challenges and considerations

Although the benefits are compelling, several challenges must be considered:

– Volatility: At one moment, the price of any cryptocurrency can collapse, or the next minute it can skyrocket, and the price needed to buy a car can double or triple from one day to the next.

– Limited acceptance: Not all dealers accept cryptocurrency, which in turn may limit its use for making purchases.

– Tax implications: This may create different tax implications on purchases via cryptocurrency, depending on your jurisdiction.

Practical steps to buy a car with cryptocurrency

If you want to use cryptocurrency to buy a car, follow these steps:

- Ensure Acceptance: Check if the dealer or auction accepts the use of cryptocurrency.

- Check the conversion rate: You need to know how much your cryptocurrency is currently trading at compared to the price of the car in fiat currency.

- Secure your funds Make sure your digital wallet is secure and funded.

- Know the terms: Be informed and be clear about return policies as well as any additional fees incurred.

- Complete the transaction: Continue the payment via the digital wallet.

Future prospects

There is a good chance that many car dealerships will start accepting digital currencies, especially when blockchain technology pushes the boundaries and cryptocurrencies become stable. This trend is expected to be propelled forward due to the increasing demand for transparency, security, and efficiency in transactions.

Conclusion

The potential for cryptocurrencies to have a real impact on the car buying process is enormous. Of course, there are a few issues that emerge when considering the current market, including volatility and limited acceptance. However, the benefits of using digital currency to execute such transactions can easily outweigh the drawbacks for many buyers. As both sectors continue to grow, buying cars with cryptocurrencies shows a promising future and therefore creates a more connected and developed technological automotive market.

This means that buying a car, whether in cryptocurrency or in another form, is not just about following technological trends; it is rather about enjoying greater freedom and efficiency in financial transactions. Indeed, the closer the digital and automotive worlds become, the more buyers should expect simpler, much safer and also very innovative ways of purchasing.

Disclaimer: This press release article is provided by the client. The client is solely responsible for the content, quality, accuracy, products, advertising or other materials on this page. Readers should conduct their own research before taking any action related to the material available on this page. Crypto Basic is not responsible for the accuracy of the information or for any damage or loss caused or alleged to be caused by the use of or reliance on any content, goods or services mentioned in this press release article.

Please note that The Crypto Basic does not endorse or support any content or products on this page. We strongly advise readers to conduct their own research before acting on the information presented here and to take full responsibility for their decisions. This article should not be considered investment advice.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinion of The Crypto Basic. Readers are encouraged to conduct thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Advertisement-

Altcoins

Introducing Bit-Chess. The World’s First Fully Decentralized Chess Platform

Bit-Chess announces the pre-sale of the world’s first fully decentralized chess platform, combining the classic strategy game with the innovative world of cryptocurrencies. This platform will change the way millions of people interact with chess online, providing a digital space where players can enjoy their favorite game, compete in global tournaments, and earn rewards through play-to-win mechanics.

Bit-Chess is an entry point for both experienced players and newcomers to the crypto space. It provides tools and guides to help even inexperienced users get started with cryptocurrencies by creating in-game wallets upon first login. It is the first chess game to use Web3 technology, and all participants can earn money while playing.

During the presale, 500 of the 2,000 special NFTs will be available, with the rest distributed through tournaments and auctions. Unless NFT holders agree otherwise, the team will manage 1,500 NFTs, preserving their rarity with a cap of 2,000 pieces. More information about the NFT marketplace will be released after the token’s official launch.

The platform aims to become the world’s leading online chess center, offering:

Play to win features.

Global tournaments with cash or NFT prizes.

Player versus player challenges

Special NFTs and more

Bit-Chess invites players from all over the world to join its unique ecosystem, where playing chess is more than just entertainment: it’s an opportunity to earn and learn in the world of crypto.

For more information and to participate in the presale, Visit the Bit-Chess website.

Disclaimer: This press release article is provided by the client. The client is solely responsible for the content, quality, accuracy, products, advertising or other materials on this page. Readers should conduct their own research before taking any action related to the material available on this page. The Crypto Basic is not responsible for the accuracy of the information or for any damage or loss caused or alleged to be caused by the use of or reliance on any content, goods or services mentioned in this press release article.

Please note that The Crypto Basic does not endorse or support any content or products on this page. We strongly advise readers to conduct their own research before acting on the information presented here and to take full responsibility for their decisions. This article should not be considered investment advice.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinion of The Crypto Basic. Readers are encouraged to conduct thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Advertisement-

Altcoins

Here’s the price of XRP if it handles 10% of SWIFT transactions

Popular community figure Amélie predicts a massive increase in the price of XRP if its underlying network, XRPL, is used to process 10% of all SWIFT transactions.

In a recent article on X, Amélie took on SWIFT (Society for Worldwide Interbank Financial Telecommunication), suggesting that XRP is a better alternative for cross-border settlements.

Ripple claims Swift is not fast enough

In a recent post on X, the community personality called attention to a Ripple ad claiming that “Swift isn’t fast enough.” The remark was a subtle criticism of Ripple’s transaction processing speeds for the global financial messaging giant.

Interestingly, Ripple has recommended financial institutions to adopt its solution to instantly transfer value across borders.

Amelie compared the processing speed of SWIFT and XRP transactions. According to community figures, cross-border transactions on SWIFT typically take between three and five business days. Conversely, Amelie claimed that XRP transactions can be completed in four seconds.

After the analysis, Amélie echoed Ripple’s sentiments, pointing out that SWIFT is not fast enough compared to XRP.

XRP to Surpass $1,000 if it handles 10% of SWIFT transactions

Therefore, enthusiasts have speculated that all SWIFT transactions will eventually be processed through the XRP Ledger (XRPL), the underlying blockchain of the XRP token.

Interestingly, she suggested that the price of XRP could surpass $1,000 per token if 10% of all SWIFT network transactions were processed through XRPL. However, Amelie did not provide details on how XRP could reach this milestone.

SWIFT VS XRP:

SWIFT: 3 to 5 business days

XRP: Cross-border payments in 4 seconds

SWIFT IS NOT FAST ENOUGH!

I think all Swift transactions will soon be processed via #XRPL 💵💱💴

10% of SWIFT network = $1,000+ per XRP! pic.twitter.com/Jt6mumQHfb

— 𝓐𝓶𝓮𝓵𝓲𝓮 (@_Crypto_Barbie) July 20, 2024

Can XRP replace SWIFT?

Several cryptocurrency enthusiasts have compared XRP to SWIFT in recent years. In particular, the famous crypto asset manager Grayscale characterized XRP as an alternative to SWIFT. Notably, some users have taken this comparison further by projecting that XRP could eventually replace SWIFT because of its inefficiencies, including slow transaction processing.

The potential replacement of XRP with an established system like SWIFT would require more than just community support. Factors such as the final resolution of the SEC lawsuit, increased institutional adoption of XRP, and large-scale commercial partnerships leveraging Ripple’s payment solution could play a critical role in XRP’s potential replacement or integration with SWIFT.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinion of The Crypto Basic. Readers are encouraged to conduct thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Advertisement-

-

News1 year ago

News1 year agoBitcoin (BTC) price recovery faces test on non-farm payrolls

-

Bitcoin12 months ago

Bitcoin12 months ago1 Top Cryptocurrency That Could Surge Over 4,300%, According to This Wall Street Firm

-

Altcoins12 months ago

Altcoins12 months agoOn-chain data confirms whales are preparing for altcoin surge with increased buy orders

-

Bitcoin12 months ago

Bitcoin12 months agoThe US government may start accumulating Bitcoin, but how and why?

-

News1 year ago

News1 year agoNew ByBit Listings for 2024: 10 Potential Listings

-

News1 year ago

News1 year ago11 Best Crypto TikTok Accounts & Influencers in 2024

-

Altcoins1 year ago

Altcoins1 year agoMarket giants have taken action!

-

News1 year ago

News1 year ago11 Best Shitcoins to Buy in 2024: The Full List

-

Ethereum1 year ago

Ethereum1 year agoTop Meme Coins by Market Capitalization in 2024

-

News1 year ago

News1 year ago1.08 Trillion SHIBs Dumped on Major Crypto Exchange, What’s Going On?

-

News1 year ago

News1 year ago19 Best Crypto Games to Play in 2024

-

Altcoins1 year ago

Altcoins1 year agoAltcoin Recommended by Crypto Expert for Today’s Portfolio