Ethereum

Toncoin Price Drops 10% as Ethereum ETFs Take Center Stage

Toncoin price has decoupled from broader cryptocurrency market trends over the past week, dropping 11% as it fell below $7 on July 23. The on-chain analysis explores key bearish catalysts and how TON could evolve as the end of the month approaches.

Toncoin drops 11% amid market recovery

Toncoin (TON) is a Layer 1 blockchain protocol, whose technology stack is heavily tied to social media giant Telegram. TON Ecosystem has become one of the hottest crypto sectors this year, thanks to dominant market themes like trading bots, crypto artificial intelligence, and gaming.

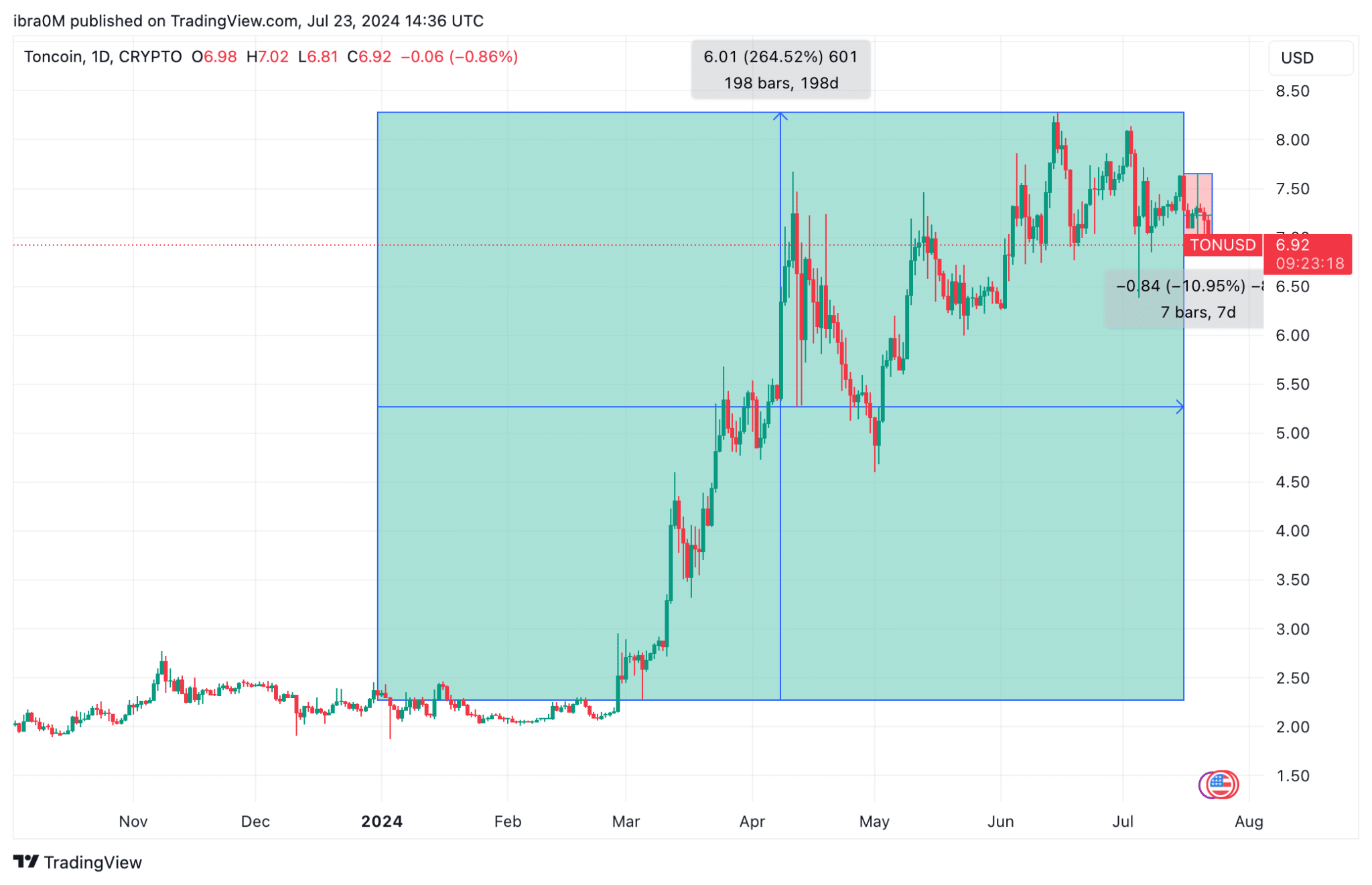

In 2024 so far, Toncoin has recorded remarkable Toncoin’s price rose more than 264% to a new all-time high of $8.28 on June 15, before breaking through the $8 barrier again on July 3. Toncoin quickly climbed to become one of the top 10 cryptocurrencies by market capitalization, according to data from CoinMarketCap.

However, as the launch of Ethereum ETFs drew closer, Toncoin struggled to gain traction last week.

On July 16, the price of Toncoin surged to $7.35. But at the time of writing, on July 23, the price of TON has fallen below $7, reflecting an 11% decline over the last 7 trading days. In comparison, Ethereum and Bitcoin have seen gains of over 5% during this period, while the overall market cap of altcoins has also increased by a similar margin.

Toncoin price dropped 11% during a market rally, sparking concern among short-term bullish traders. Currently, the dominant speculative narrative is that crypto investors have shifted their attention away from the Toncoin ecosystem, following news of the imminent launch of Ethereum ETFs.

Demand for TON could decline further in the coming days, increasing the risk of a further decline as investors channel their capital into Ethereum-hosted projects to benefit from expected ETF inflows.

TON Price Prediction: Is $6 Support Under Threat?

Toncoin price has seen significant volatility over the past few months, with notable price movements reflecting changing market sentiments. According to the latest data, TON is trading at $6.92, down slightly by 0.86% on the day. The key question for traders and investors is whether the $6 support level can hold.

From a technical perspective, the chart highlights a substantial increase in the price of TON, with an increase of 264.52% over 198 days, demonstrating strong bullish momentum at the start of the year.

However, the recent price action suggests a period of consolidation and a potential downside risk. The immediate support level lies at $6.81, which is crucial to maintain the current bullish structure.

Key resistance levels are seen at $7.02 and $8.50, marking the upper limits of recent price ranges. A break above these levels could signal further bullish momentum, potentially targeting higher levels.

Conversely, if the price breaks below the immediate support at $6.81, the next critical support level is at $6.00, which would be an important psychological and technical level for traders to watch.

In summary, although Toncoin has seen remarkable growth, the $6 support level is indeed under threat if the bearish pressure continues.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinion of The Crypto Basic. Readers are encouraged to conduct thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Advertisement-