Ethereum

XRP Price Rally Halts at $0.63 Amid Ethereum ETF Outflows

XRP price stumbled to the $0.61 resistance on Thursday, July 25 amid bearish headwinds from Ethereum ETFs, market data analysis shows how bull traders are fighting to extend the rally towards the $0.65 territory.

XRP’s 17% rally halted by $133M Ethereum ETF outflows

The cryptocurrency market has been in a steady uptrend since July 5. Among several bullish catalysts, the Ethereum ETF Both Joe Biden’s launch and withdrawal from the 2024 US election have highlighted potential positive changes in the cryptocurrency regulatory landscape.

As expected, Ripple (XRP), one of the most contentious crypto entities during the Biden administration, has garnered considerable demand. Crypto-native investors are predicting that Biden’s departure will increase the probability of victory for Donald Trump, a candidate perceived to have a friendlier stance on crypto.

In fact, the price of XRP has seen a 17% increase since Biden’s announcement, outperforming the price of XRP. BitcoinETH and all other crypto assets in top 10 valuation rankings.

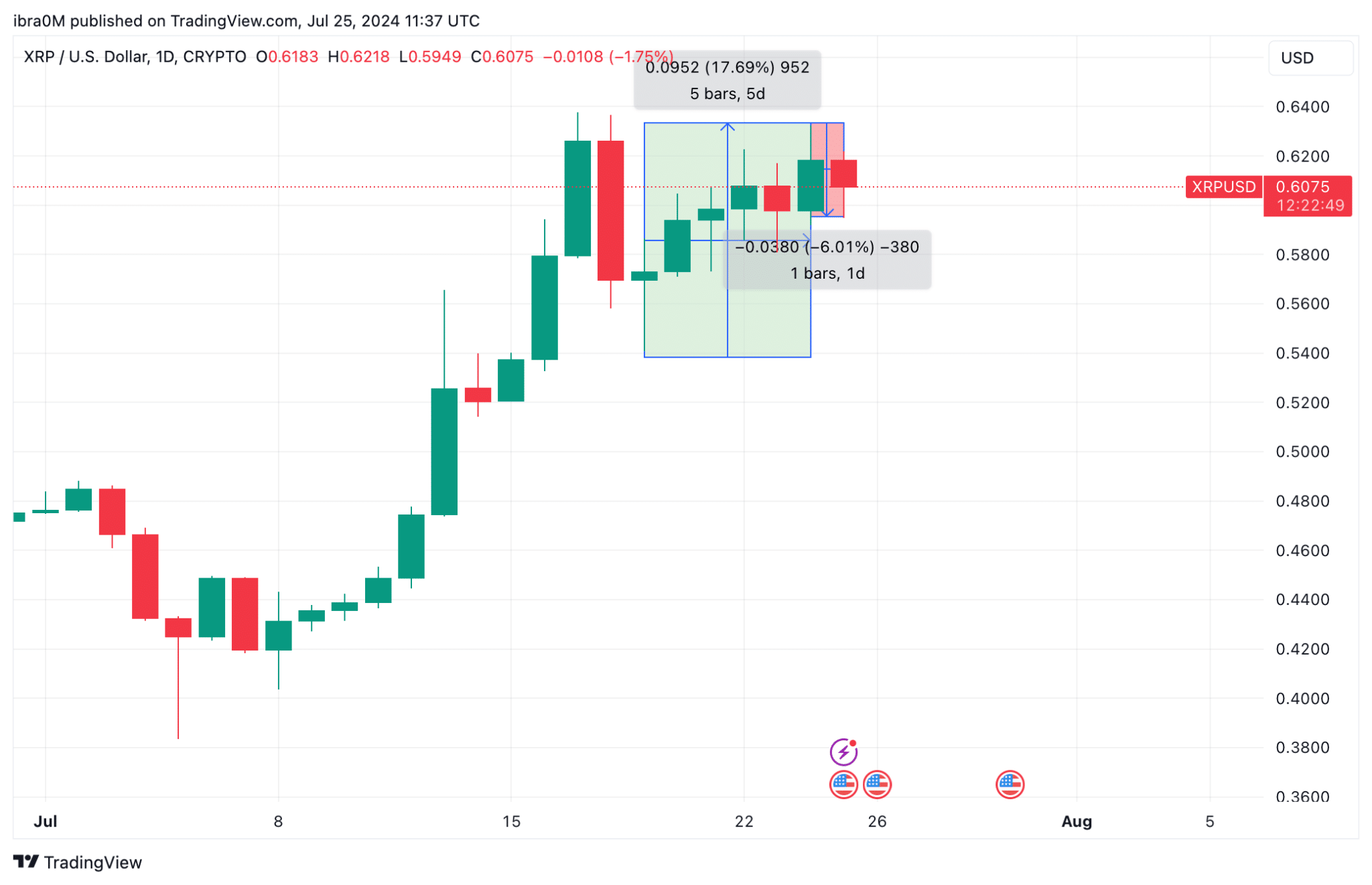

The chart above shows how the XRP price increased by 17.69% from $0.54 on July 19 to reach a weekly high of $0.63 on July 23. This remarkable price performance sparks speculation that the XRP price could reclaim the $0.65 resistance territory in the weekly time frame.

However, recent bearish events surrounding Ethereum ETFs threaten to spill over to the rest of the altcoin market, putting XRP’s price rally at risk.

First, Ethereum ETFs were officially launched on Tuesday, July 23, after nearly 2 months of regulatory delays.

Many crypto traders chose to sell amid the market euphoria, locking in some of the unrealized profits they had accumulated since the bull run began three weeks ago, following the release of dovish NFP and CPI data on July 5.

On the first day of trading, Ethereum ETFs attracted a whopping $1 billion in trading volume and $107 million in inflows. This helped offset the bearish headwinds caused by the selling frenzy on the July 23 news. But things took a turn for the worse on July 24.

However, market sentiment shifted on July 24 due to massive outflows from Ethereum ETFs. On Wednesday, Ethereum ETFs saw net outflows of over $130 million.

The largest outflows of the day were from Grayscale Ethereum Trust, which reached $32 million, making it the only Ethereum ETF to record a net negative result over the two trading days so far. On the other hand, Fidelity’s FETH led the inflows, accumulating just over $74.46 million.

The bearish aftershocks have spread across altcoin markets. XRP price has now fallen 6% from its weekly peak, as it has fallen below $0.60 at the time of writing on July 25.

It now remains to be seen whether XRP bulls will hold on to their 17% unrealized gains or succumb to the mounting bearish pressure.

XRP Price Prediction: Bulls to Fiercely Defend $0.59 Support

XRP is currently trading at $0.6185, seeing slight upward momentum with a 0.03% increase in the last 24 hours. The price action has shown significant consolidation around the $0.60 mark, which is a critical support level for the bulls. The Fibonacci retracement levels indicate that $0.59 is a key support level that the bulls will need to defend to avoid further decline.

The chart shows a recent one-day decline of 6.01%, reflecting a brief period of selling pressure. However, the presence of a notable gain of 17.69% over a five-day period suggests that there is an underlying bullish sentiment in the market.

If the price breaks below the $0.59 support, it could potentially test lower support levels around $0.55 and $0.50, as indicated by the Fibonacci retracement zones.

On the upside, key resistance levels are located at $0.62 and $0.65. A break above these levels could open the way for further gains, with the next major resistance area being located around $0.70. The Accumulation/Distribution Line (ADL) is currently at 1,517.40, indicating moderate buying pressure, which supports the possibility of holding the current price level or pushing it higher.

The market is showing mixed signals, leaning towards a neutral stance but with a slight bullish bias due to recent price gains and moderate buying pressure.

In summary, XRP’s immediate support at $0.59 is crucial for the bulls’ defense. A break below this level could lead to a further decline, while holding above this level and breaking the $0.62 and $0.65 resistance levels could indicate a continuation of the uptrend.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinion of The Crypto Basic. Readers are encouraged to conduct thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Advertisement-